With news from South Korea confirming the government's positive position on cryptographic currency trading, the market remains volatile.

If it does not recover in the next few days, negative news can provoke the sale of the bulls, which will lead to a long liquidation.

However, if the bulls succeed in defending the critical support levels, we could see a strong setback and the money sitting on the sidelines will rush into the markets, giving a new boost to the upside.

We believe that we should see a strong movement up or down within the next 3-5 days. Let's see how we can capitalize on this.

BTC / USD

The price of bitcoin fell yesterday, January 30, resulting in a sharp fall. Currently, he is finding support just below the critical level of $ 9,920.02.

Yesterday, January 30, it was the first close below the December 22 lows of $ 10,704.99. This shows that sellers are gaining ground at lower levels.

If the bears build on their advantage and break below the $ 9,300 level, we should see a drop to $ 8,000. If the BTC / USD pair makes a new minimum, we will not buy.

However, if the bulls regroup and buy aggressively, pushing prices above the downline, this will indicate a probable investment. That's why we suggest buying at a close above $ 12,200 with an initial stop loss of $ 9,600. We expect the rebound to face strong resistance at levels of $ 14,000.

Although this trade does not offer a good ratio of risk to reward, we suggest taking it because the goal is to buy as close to the fund as possible. We should close the position quickly if it does not rise to more than $ 12,200.

Since the chances of a whipsaw are high, please keep the size of the assignment at 50 percent of normal.

ETH / USD

Ethereum continues to be strong, as it continues to operate above the bullish trend line and above both moving averages. We are withholding 50 percent of our original purchase made at the $ 1,000 levels with stops at balance points.

We remain bullish in the ETH / USD pair because it continues to form a high level in the charts. This shows that bulls are eager to buy at the lows, so do not drop prices.

However, the upward movement faces the reserve of benefits at higher levels. As a result, the 20-day EMA has turned flat, indicating short-term consolidation. The 50-day SMA continues to rise indicating the uptrend.

Our bullish view will be invalidated if the cryptocurrency falls below the uptrend line and 50-day SMA.

BCH / USD

Bitcoin Cash has fallen around 64 percent since its peak of $ 4,139,0893, which was reached on December 20, 2017.

$ 1,364.9657 is an important support level on the negative side. If the BCH / USD pair breaks below this value, we anticipate a drop to the levels of $ 1,150, which is the next important support.

If this level is maintained, the bulls will try to exit the 20-day EMA and the downline. In case they are successful, we can expect the cryptocurrency to remain within a limited range between $ 1,364.9657 and $ 2,072.6853.

XRP / USD

Ripple is still under pressure. It can not be established at any level of support. Currently, he is receiving support at the psychological level of $ 1.

If this level breaks down, we can expect a fall to the lower end of the range of $ 0.87. If we find a strong purchase at this support level, we can consider the possibility of starting long positions.

Until then, we did not find any purchase settings in the XRP / USD pair, so we do not recommend any operation on it.

XLM / USD

Stellar has broken the immediate support of the trend line and the price is trading below 20 EMA days.

Your next support is in the 50-day SMA and below it in the $ 0.41 levels.

On the positive side, it is likely that the pair XLM / USD will face the resistance in the trend line and the recent swing at levels of $ 0.634.

Starting long positions only above the levels of $ 0.65 could be a good move in this case.

LTC / USD

Litecoin broke below the critical support of $ 175, which completes the bearish pattern of the descending triangle. It is likely that the bassists lower the price to $ 140,001 and then to $ 85 dollars.

On the other hand, the bulls will try to quickly recover the $ 175 levels. The LTC / USD pair will become positive only after crossing the descending trend line. It would be a good idea to wait for the trend to change before suggesting any trade.

XEM / USD

NEM has gone down after failing to break the moving averages. He is currently trying to keep support in the bearish trend line 1. If this support breaks, we could see a fall to $ 0.60.

The XEM / USD pair will show signs of bottoming once it leaves the bearish trend line 2 and stays above $ 1.1.

It seems reasonable to wait for a reliable purchase configuration to be formed before starting any long position in the.

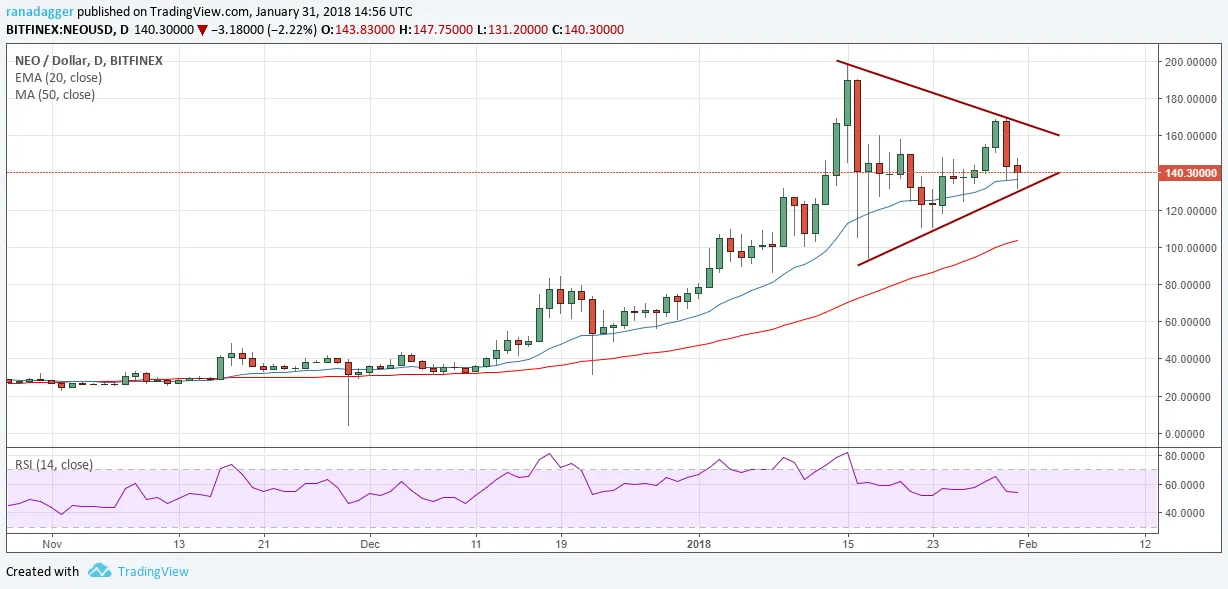

NEO / USD

NEO has had a strong uptrend since December 2017. During the recent correction, it has not given much ground, which makes it a relative performance. It is ticking both the 20-day EMA and the 50-day SMA, which is a bullish signal.

It has formed a symmetrical triangle, which is a continuation pattern. A break in this pattern could resume the uptrend and bring the pair NEO / USD to the highs and then to its target of $ 275.

In this way long positions can be started at $ 170 and the stop loss can be maintained at $ 130.

Our bullish view will be invalidated if the cryptocurrency breaks from the triangle, which can push it into the support zone of $ 85 to $ 100.

EOS / USD

EOS is on an upward trend since November 2017. The price has rebounded from the trend line four times. Currently, the price has fallen back to the trend line.

The 50-day SMA is also placed at the same level, and we expect the bulls to defend the $ 10.5 levels.

However, any retracement of the trend line will face resistance at $ 14 levels. We wait a few more days of consolidation before a break. Long positions could start if the EOS / USD pair holds the trend line for the next few days.

In case the cryptocurrency breaks below the trend line, our bullish view will be invalidated.

Source cointelegraph