Hello everybody, in this post I just wanted to share where I have drawn regular support and resistance areas and fibonacci retracement levels for BTC/USD on the Weekly chart only. I believe since the Weekly chart is the longest time-frame that makes sense to look at for cryptos since they are so new compared to stocks (where Monthly charts are looked at), these will be the strongest levels to watch when trying to figure out where Bitcoin price may go.

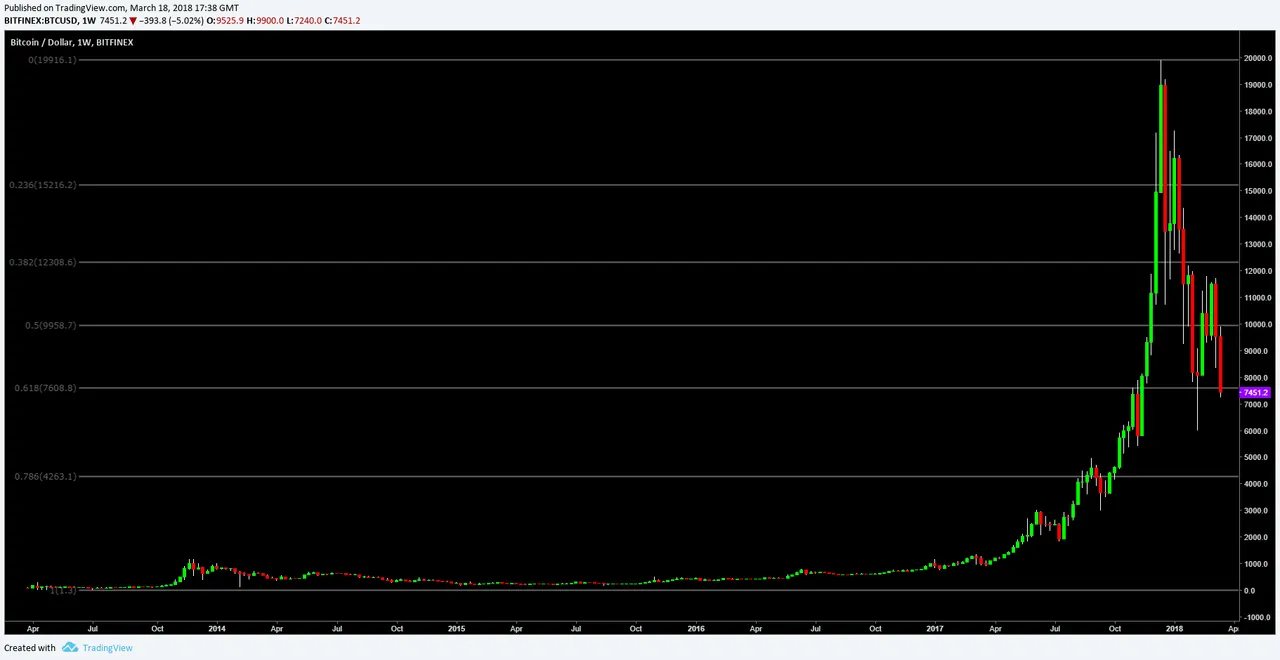

Below is the Weekly chart for BTC/USD on Bitfinex with my support and resistance lines drawn:

As you can see, we are currently at a Weekly support level around the $7,378 level. This support zone actually matches up very well with this 0.786 Fibonacci Retracement level:

I therefore believe that this is a very critical time for Bitcoin, because if price closes below them two support levels on the Weekly chart then, as you can see, the next support level is way down at $5,782.

Let's finally take a look at another possible Fibonacci Retracement Tool placement for BTC/USD and what this might tell us:

On this chart I have placed the Fibonacci Retracement tool's low at $0 and its high at the highest price bitcoin ever reached, near $20,000. Basically this shows us that if we close below $7,600 on the Weekly chart then we could very well expect Bitcoin to the $4,250 level. Of course, if it managed to come back up and close above $7,600 before the current Weekly candle closes in 6 hours then the 0.618 has held and it doesn't look as bad.

My overall thoughts:

If the Weekly closes below $7,381 then we can expect to see $5,781 by the end of next week. On the other hand, if price comes back up and closes above $7,616 then we can breathe a sigh of relief, for now anyway.

Thank you for reading and let me know what you think in the comments below, have a great day :)

Legal Disclaimer: This is just my analysis and not to be taken as professional financial advice. Do your own research beyond what you read in my blog posts and make your own decisions based on your beliefs about what to invest your money in.