A judicious look at crypto-assets should lead us to neither crypto-condemnation nor crypto-euphoria. ~ Christine Lagarde, head of the International Monetary Fund (IMF)

Nearly a month ago (13th March, 2018), Christine Lagarde, head of the International Monetary Fund (IMF) addressed the dark side of the crypto world through her blog post. She stated that the peril of crypto-assets is a potentially major new vehicle for money laundering and the financing of terrorism.

However, we can fight fire with fire, by focusing on policies that ensure financial integrity and protect consumers in the crypto world just as we have for the traditional financial sector. Indeed, the same innovations that power crypto-assets can also help us regulate them.

She looked at the volatility of crypto-assets as well, which has prompted an intense debate about whether they are a bubble, just another fad, or a revolution equivalent to the advent of the internet that will disrupt the financial sector and eventually replace fiat currencies.

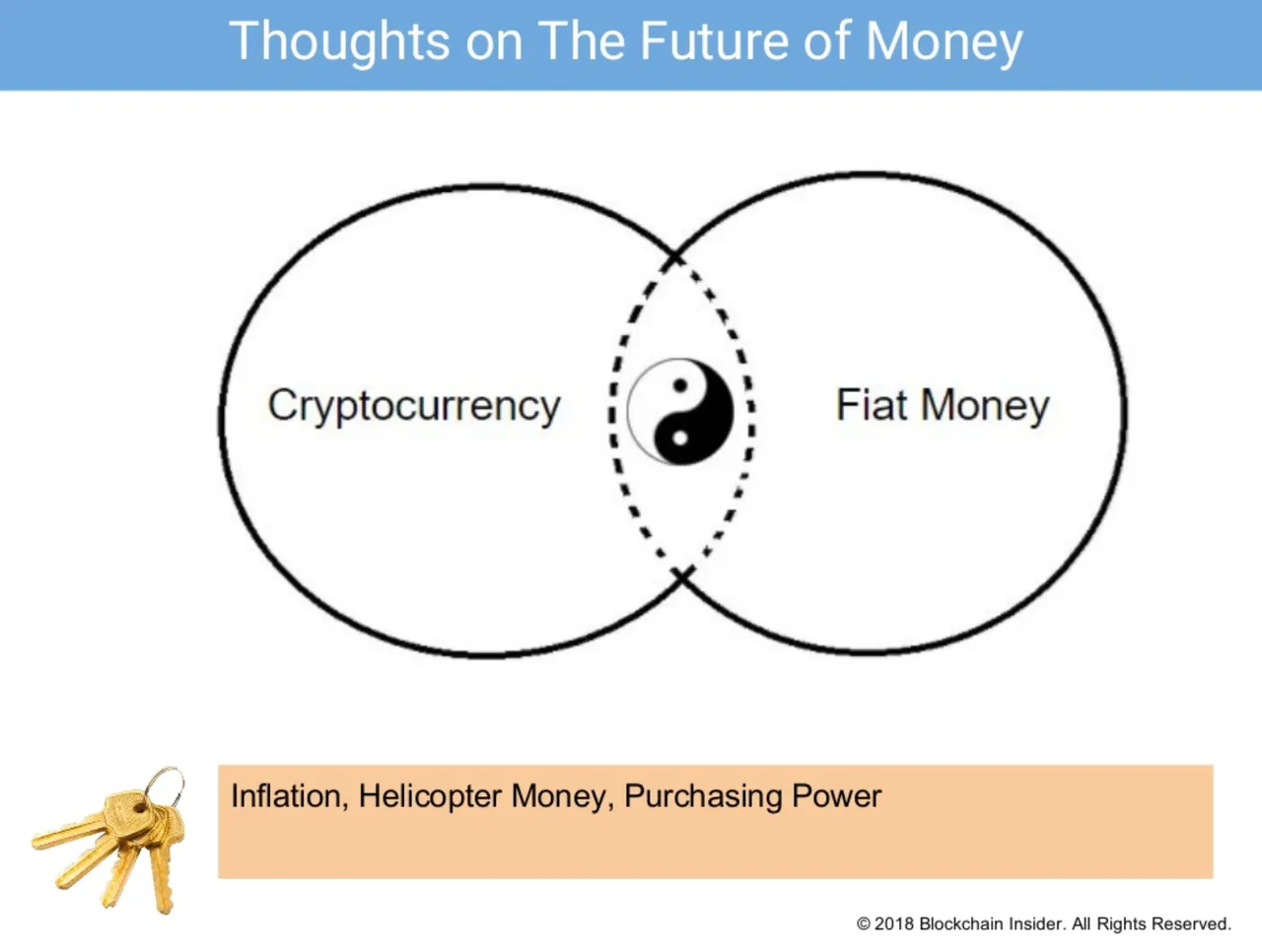

The truth is obviously somewhere in between these extremes.

A month later (16th April, 2018), she examined the promise crypto-assets offered, as the potential benefits are already starting to take shape. These include but not limited to fast and inexpensive financial transactions, and secure storage of important records.

There is hope that decentralized applications spurred by crypto-assets will lead to a diversification of the financial landscape, a better balance between centralized and de-centralized service providers, and a financial ecosystem that is more efficient and potentially more robust in resisting threats.

An even handed approach to crypto-assets is the key.

And yes, in the book Blockchain Insider I see that the best approach is to strike a balance by having the best of both worlds.

Understanding the risks that crypto-assets may pose to financial stability is vital if we are to distinguish between real threats and needless fears. That is why we need an even-handed regulatory agenda, one that protects against risks without discouraging innovation.

A clear-eyed approach can help us harness the gains and avoid the pitfalls of the new crypto-assets landscape.