Development of the BTC ECHO model portfolio Conservative KW46

BTC-ECHO's sample portfolio Conservative defies the sell-off: While Bitcoin, Ethereum and XRP have suffered losses of up to 21 percent since the beginning of November, only half of the sample portfolio is up.

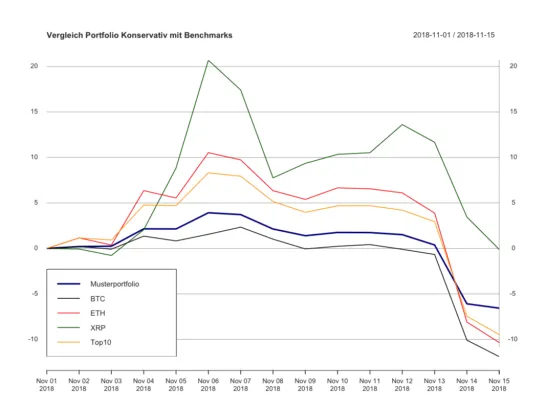

As I explained recently, I want to track the progress of our sample conservative portfolio from the cryptocompass weekly. We compare the performance of this portfolio with those of Bitcoin, Ethereum, XRP and a benchmark portfolio composed of the top 10 weightings proportional to market capitalization.

Conservative means that the portfolio is relatively low risk. It's made up of older cryptocurrencies like Bitcoin or Ethereum. In addition, a stable coin or cash position is established. Without going into too much detail, the Conservative portfolio consists of the following positions (ranked from the strongest to the weakest): Tether, another stable coin or cash position, Omnilayer Protocol, Counterparty, Ethereum, Bitcoin, Dash, Siacoin , Monero and Ripple.

The November 14th sale could hardly ignore the crypto affine. After a week to month-long sideways trend, the Bitcoin price collapsed - and with Bitcoin the entire crypto market. XRP, which had a plus of 20 percent in between, fell back to the course of early November. The maximum drawdown for XRP is thus 21 percent. A loss that otherwise only Ethereum suffered with 20 percent. Bitcoin and the comparison portfolio, which consists of the top ten, are only slightly better: the drawdown here is 14 percent and 18 percent, respectively.

Musterportfolio Conservative since October only minus 7 percent

And my sample portfolio? With a drawdown of just ten percent, it performed twice as well as the benchmarks. Compared to the beginning of the month, it has lost only seven percent:

The key figures confirm the impression:

[table id = 3 /]

The short-term Bull Run made sure that XRP still has a positive average daily return. However, for Ripples cryptocurrency the other comparison values are significantly worse than the sample portfolio. The risk, ie the recorded fluctuations, is significantly higher for XRP than for all benchmark values and the value at risk also shows that the model portfolio would have been a safer investment than XRP.