Hi everyone, I hope this post finds all of you well. After 5 consecutive posts of Litecoin, I’ve decided that’s enough of that. I’m getting bored of the same news. However before I embark on another ICO, wanted to take a small hiatus and share two fascinating articles that I read over the last few days. Two countries with their own perspective on cryptccurrencies.

Wall Street Journal article – Switzerland wants to be the Cryptocurrency Capital of the world

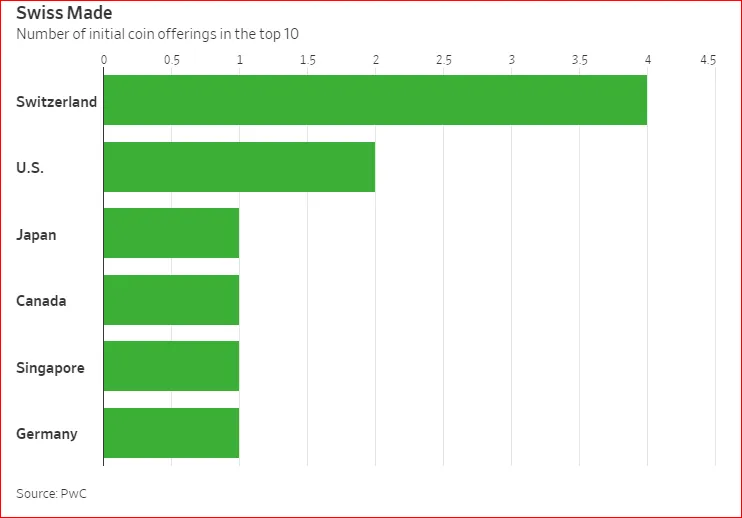

• This article came out over the weekend, April 28, 2018. My first initial glance at it was …surprise. I didn’t realize that Switzerland was such a hotbed of blockchain technology, but I was immediately floored by the data and statistics to back all of that up.

• According to the article there are 100 blockchain/ICO startups in Swiss right now

• Four of the largest ICO in 2017 were Swiss based…What???? Yes. (Tezos - $238M, Bancor- $156M, The DAO - $142M, and Status - $95M.

• What was also interesting from the article was that the Swiss Banks are dwindling while ICOs are increasing

• The Swiss regulators are on board with Cryptocurrency as well and are open to working for startup firms that are employing cryptocurrency.Venezuela’s ICO = Petro, where Venezuela is offering India a 30% discount on Venezuelan Oil if it uses Petro.

• This article was generated on Business-Standard, however, I’m struggling with determining if this article is legit or not.

• Petro, Venezuela’s Petro is real, and would be considered the first sovereign ICO backed by oil.

• However, many of the issues about Petro is what’s wrong with the Venezuelan Fiat currency, VEB (Bolivar).

• I think Petro is a non-starter, mainly because it’s the government’s last stand as its currency is deteriorating.

Petro is not decentralized (rather centralized by the government...which goes against the premise of ICOs.

• However, what it does say is that governments see some legitimacy of the ICO space.

Key Takeaways:

• Not much to say this week.

• I think the recovery on ICO has been great! However are they poised for some correction? Maybe.

• Bitcoin is back at 9,300, Ethereum is back at $680, and Litecoin is back at $150.

• For those that are worried and did by back 1 month, ago….might be time to trim some of that profit and take some chips off the table. So that you’re not regretting if a sell off occurs again….because it will.

• I would say take 10-15% of your profit and shift it to cash for now. And hold on to it for another rainy day….

• I’m looking to trim Bitcoin at $10K, Ethereum at $700 and Litcoin at $170. Not sell all of it but take some of my profit and move it to cash for now.

Follow Me @epan35

Reply (with a good comment) and Upvote and I'll return the favor! I need Feedback!