Hello everyone,

In this post, I would like to share top 15 cryptocurrencies’ volatility (risk) ratios. The method that I employed is very similar to stock market’s capital asset pricing model (CAPM), where it measures systematic risk (beta) of each stock compared to the general market’s movement. Beta equal to 1 means the stock generally moves with the market; beta less than 1 means the stock is less reactive than the market; beta greater than 1 means more reactive than the market.

For example, if a stock has a beta of 2, then it translates to: when the market increases/decreases by 1 the stock increases/decreases by 2. So, the beta of capital asset pricing model tells you how volatile (risky) it is compared to the general market.

In an efficient market, a coin or stock with high volatility may have a high expected return, however, it follows with a high risk (uncertainty). Thus, high volatility=high risk; low volatility= low risk (assuming the market is efficient).

I wish to achieve the same goal but using top 15 cryptocurrencies only. The regression model employed is:

R = a + beta*market

- R represents the 15 cryptocurrencies’ rate of return for each day, which is found by, (close-open)/open.

- Market represents the average rates of return of the 15 cryptocurrencies’ rate of return.

- Beta (volatility ratio) of each cryptocurrency is the variable we wish to know.

- a is the intercept which represents the average difference of each cryptocurrency compared to the market; for example, a negative intercept would mean the coin in question, on average, had a smaller return compared to the market.

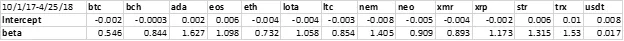

The following are the results:

**USDT’s rate of return (R) was found using USDT’s market capitalization.

As one can see, the most volatile cryptocurrency on this list is cardano (ADA) and the least volatile is bitcoin (BTC), not including USDT for obvious reasons.

It is also useful to note the intercepts. In an efficient market, the intercepts should be 0. If an intercept is negative, it indicates that the coin is under-valued; if an intercept is positive, it indicates that the coin is over-valued. However, since there are likely many other variables at play, don't take the intercepts too seriously.

So, how can this help you? Using the result, you can strategize accordingly. Say, we now know that btc is the least volatile coin, so, it would be wise to hold on to btc when the market is falling; conversely, we now know that the most volatile coin is ADA, so, it would be wise to hold on to ADA when the market is doing well. I am sure all of you guys knew this optimizing strategy already, so I just wished to provide you guys with something more substantial facts and numbers to work with.

Thanks.