Dmitry Elin, co-founder and head of the partner network for crypto projects Biggico, shares his observations on the changing features of ICO projects' promotion over the past year with the readers of DeCenter.  I have been watching the ICO market since April 2017, that is, from the very beginning of its growth, and would like to share my observations on the changes in strategies and tools for marketing projects.

I have been watching the ICO market since April 2017, that is, from the very beginning of its growth, and would like to share my observations on the changes in strategies and tools for marketing projects.

Summer 2017. Hype

News about the records of funds raised at ICOs first quaked the internet, then the smoking lounges of cozy offices, then the restaurants, and even the restrooms. EOS more than $700 million! Tezos more than $232 million! FileCoin $205 million, Bancor more than $150 million, and Status more than $100 million . . . And such amounts were sometimes raised in just two to three hours.

This period was marked by the word “Hype.” It was especially related to ICOs and cryptocurrency in general. There were no rules. Everything happened for the first time and swiftly. As in the days of privatization, any methods were good, “grab and run,” blockchain will help you.

It seemed that it was a brave new world! Each IT entrepreneur thought for a moment "Maybe I can conduct an ICO too? At least a couple million bucks would be enough for me!" Many of them tried it in the fall of the same year. The world will soon find out about the stolen tokens, the villas and Maseratis bought on stolen funds, the crypto pyramids, and the dummy products.

<Marketing features of the period:

•Simple landings at Tilda.cc.

•All-star team and eminent advisors.

•PR is key. The main thing was to loudly declare about the super features of the product on blockchain.

•Optimistic Road Map, and a fantastic growth rate in the WP.

•The product did not exist at the MVP stage, or in any other form. There was often no product team, either.

•As a rule, there were no user accounts and investment tracking. Addresses of wallets were published directly on the front page of the landing and in the WP.

•The "must have" marketing channels for ICOs were BitcoinTalk, Facebook, Medium, and Telegram.

•Crypto news sites and ICO listings were breaking viewing records. The prices of advertising on these websites were growing even faster.

•Bounty programs were at the peak of popularity and efficiency.

•The CPM network of CoinTraffic was growing.

•The effectiveness of marketing costs was not measured at all or measured post factum.

*Autumn to Winter 2017. Market Formation

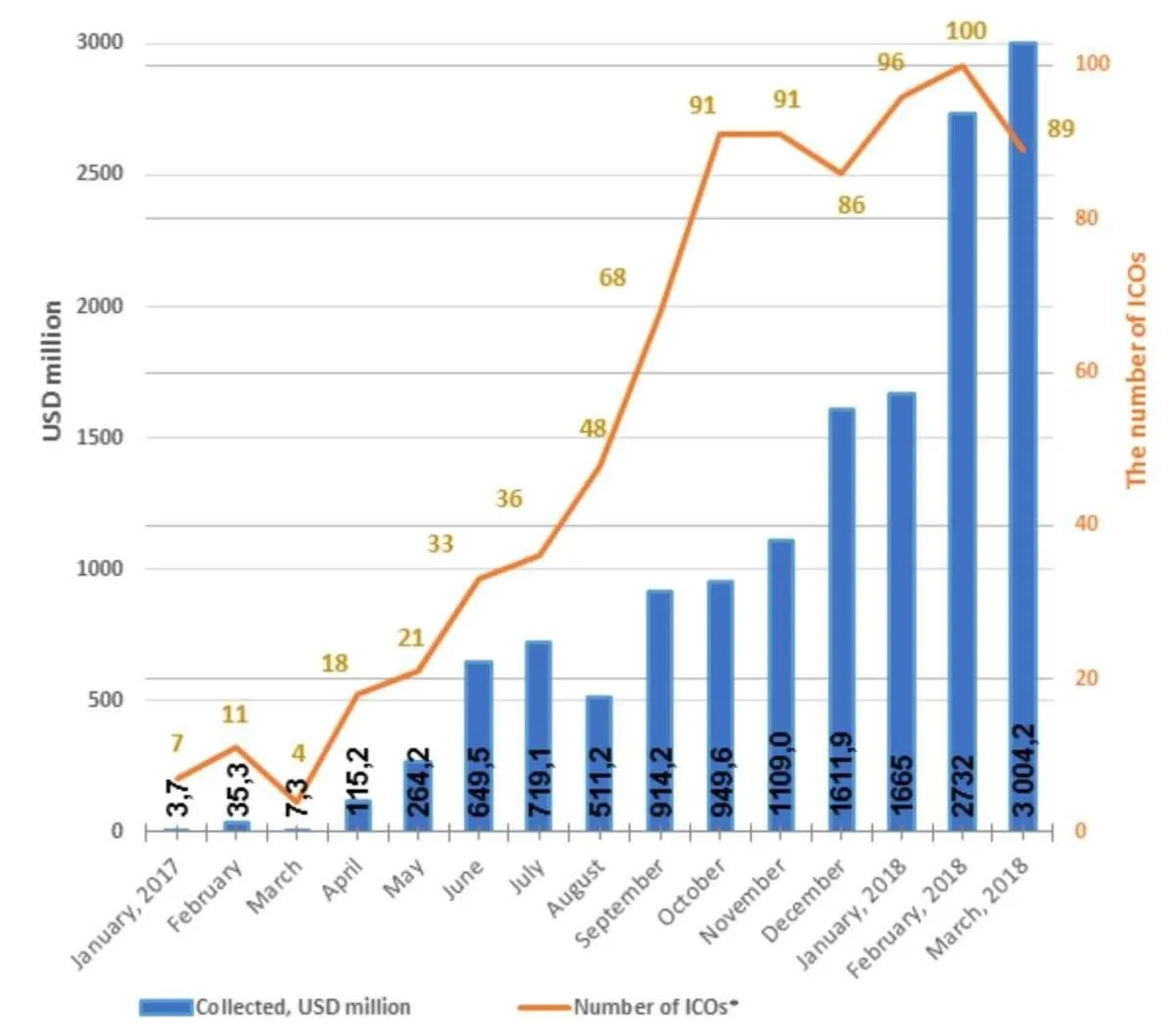

During this period, the number of ICOs increased multifold, but the percentage of successful ICOs and the average amounts raised were falling. The graph below shows how the number of ICO and funds raised was growing. The amounts already broke records by December.  Dynamics of fund attraction during ICOs. Source.

Dynamics of fund attraction during ICOs. Source.

In general, ICOs were becoming more "professional" and quality oriented. There were user accounts, purchases tracking, and ICO projects were starting to buy traffic on Facebook, Google, and Twitter.

At the same time, the average checks and average amounts raised were falling due to a sharp increase in the Bitcoin rate, hence the reluctance to invest in the cryptocurrency, since it is much more profitable to simply "hold" it and earn 40% per month as a result. And this was the right strategy for those who did not invest, despite the fact that there were successful ICO campaigns.

*Marketing features of the period:

•Attraction of large investors and funds through the Roadshows.

•Attraction of medium and small investors through advertising campaigns on Facebook, Google, Twitter, and so on. Aggressive remarketing.

•Further increases in the cost of placement on media platforms. The most effective ones were listings and calendars of ICOs.

•Bounty campaigns were becoming much less effective. But not exactly so!

•The landings became more sophisticated, as there were already user accounts. They allowed users to track investments through channels and legally protect themselves from the SEC.

•ICO agencies appeared that offered “turnkey ICO solutions.”

- Crackdown on ICO Ads

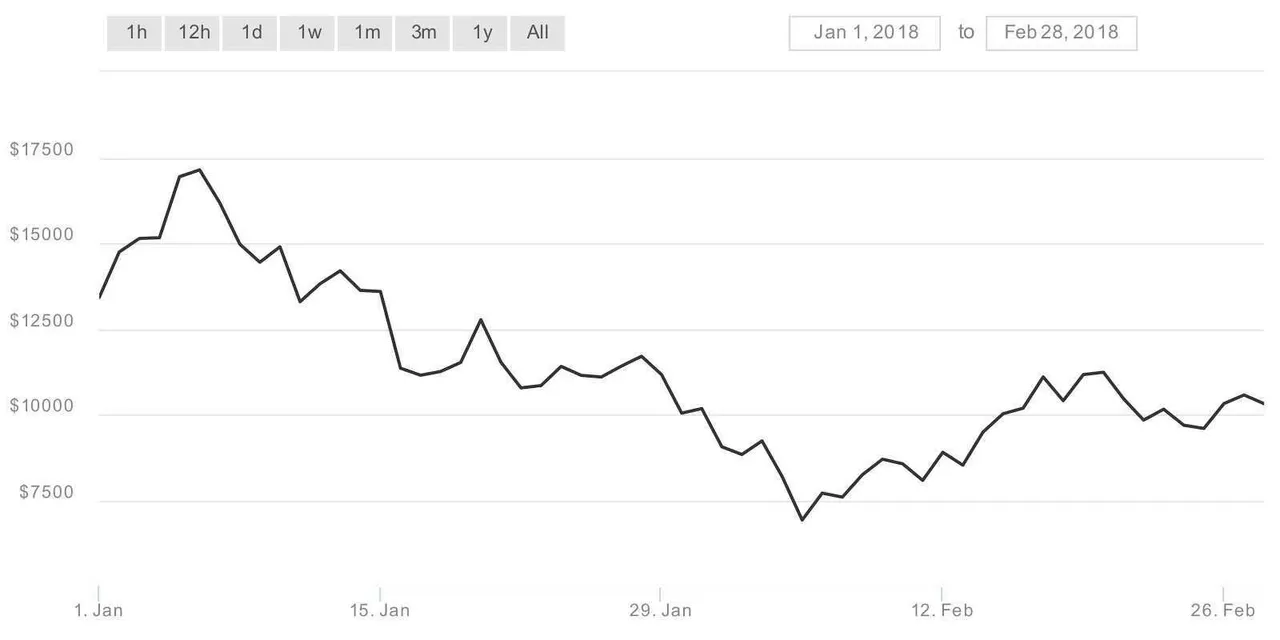

In February, the industry was in an almost shocked state after a long and smooth growth of rates by cryptocurrency standards. In just a month Bitcoin had lost $10,000 in price.