A $190m deal has been struck to mine Bitcoin in Australia in an old coal power plant. The deal will include a power purchase agreement for 5 years at $0.11 AUD per kilowatt hour.

Intercontinental Exchange (ICE), owner of the NYSE, is looking to launch a Bitcoin swap contract that can be used by market makers at Banks to manage risk. This follows Goldman Sach’ recent launch of a Bitcoin trading desk.

Bitcoin has scaled. You can now buy a coffee instantly with only a 0.0000092 USD fee (1 sat). You also get the full immutability and decentralised trust of Bitcoin backing it. #lightning

Facebook has assembled a blockchain team as part of a firm wide restructuring. This follows Mark Zuckerberg’s intention earlier this year to study cryptocurrencies as a part of his pledge to “fix” Facebook in 2018.

Microsoft have launched their own blockchain as a service product. The tool called Azure blockchain workbench will help with creating blockchain applications,

Oracle have announced they will be releasing their own blockchain as a service product this month. This follows recent BaaS products from Amazon and Microsoft.

China’s second largest manufacturer of Bitcoin mining hardware is preparing a $1bn IPO.

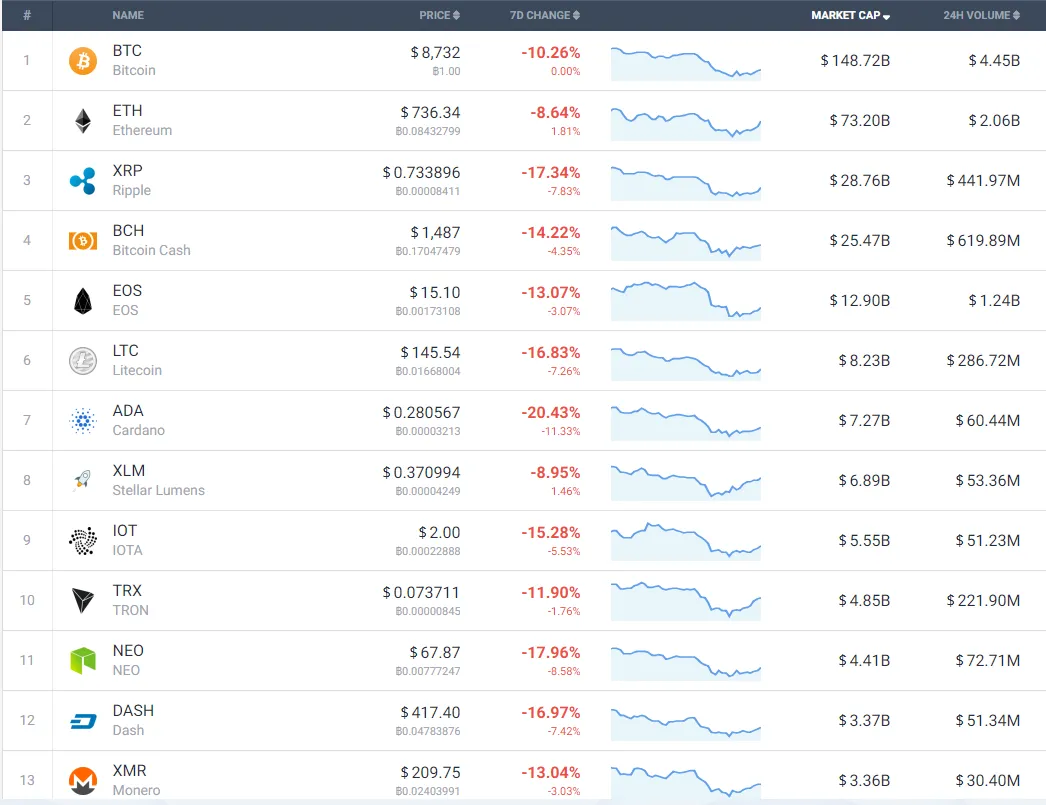

Galaxy Digital and Bloomberg have partnered to launch the Bloomberg Galaxy Crypto Index (BGCI), which tracks the performance of the 10 most liquid cryptocurrencies and rebalances monthly. Providing a benchmark for institutional asset managers. It will be interesting to see whether index inclusion results in outperformance like it does with traditional asset classes like equities.

Nvidea’s revenue from sales of GPU’s to cryptocurrency miners reached $289m last year.