TL;DR: You will lose 0.42 BTC, if you invest 0.722 BTC to Genesis Mining today. The estimation is based on an idealized model

(continued from the previous post)

As of today, on the price list in Genesis Mining, the contract "Diamond" is marked "Max Profit". The price (or the upfront fee) is USD 1950.00, the hashrate is 15 TH/s (USD 0.13 per GH/s) and the maintenance fee is USD 0.00028 per GH/s and day (= USD 1533 per year). It is an Open-Ended contract, which runs the mining activity while it is profitable. Namely, it terminates when the Bitcoin mined per day becomes less than USD 4.2 (= 15 TH/s × USD 0.00028 per GH/s).

Here, we assume that the whole hashrate is 6,585,327 TH/s and the hashrate increase per year is four.

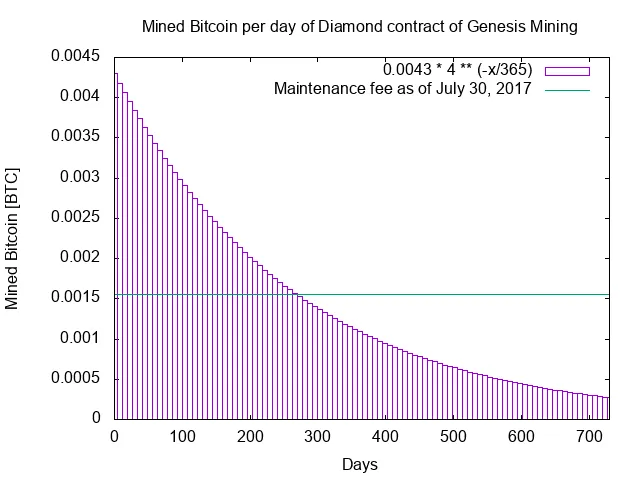

It should mine about 0.0043 BTC per day (≒ 15.0 TH/s / 6585327 TH/s × (12.5 BTC + α BTC) × 6 times/per hour × 24 hour).

(See the previous post)

Given k=4 and a0=0.0043, in a year the mined Bitcoin becomes about 0.8475 BTC and the accumulated maintenance fee becomes USD 1533.

Further, we assume the Bitcoin price is a constant (USD 2700, today's price).

On day 229, the maintenance fee is greater than the value of the mined Bitcoin, and the contract will be over.

The reward is about 0.302 BTC (0.658 BTC minus the accumulated maintenance fee USD 962).

In summary, if you buy the mining contract "Diamond" in Genesis Mining at the price USD 1950 (≒ 0.722 BTC) today, the estimated reward in an idealized model would be 0.302 BTC in total.

[1] https://www.genesis-mining.com/pricing