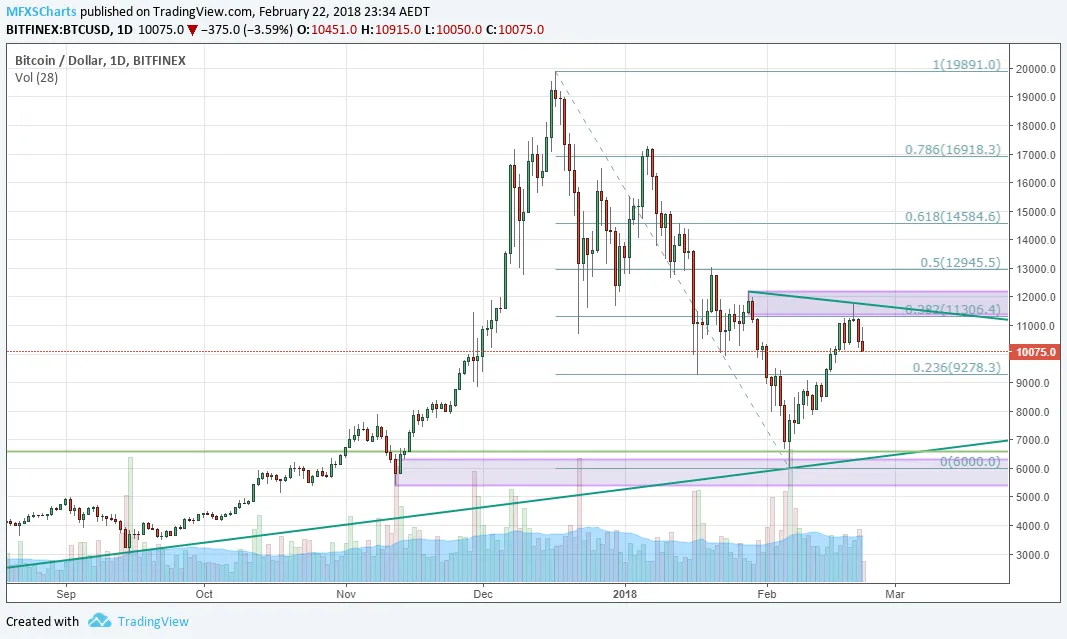

Update: 10K is now gone and focus is lower towards 9000

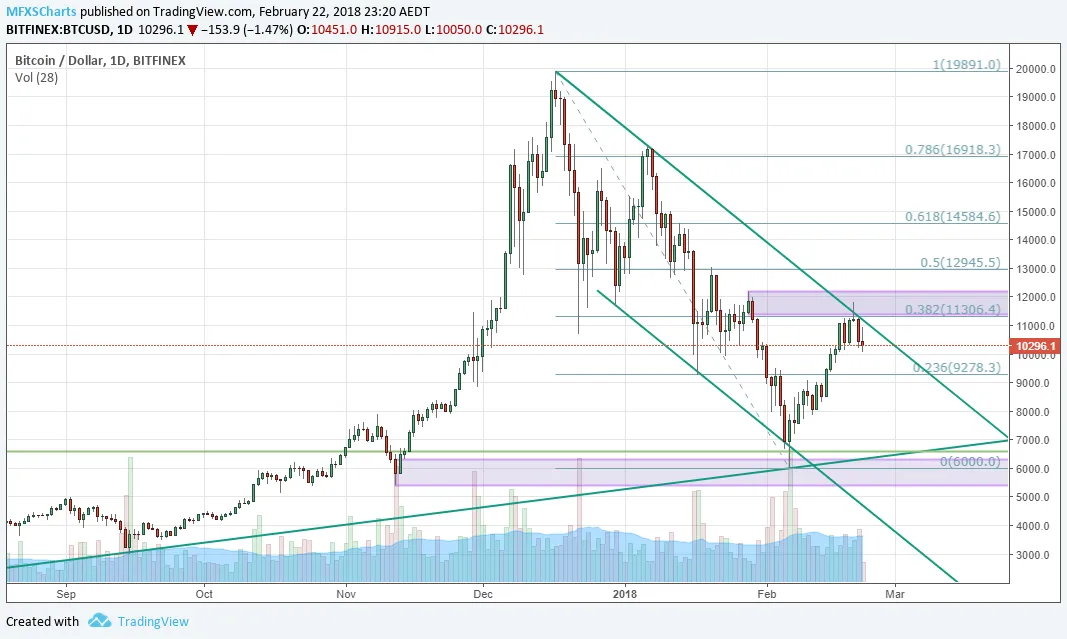

BTCUSD finished Wednesday down substantially after failing to close above the channel top on Tuesday. Pair caught a bid in Asian trade on Thursday, trading as high as 10915, but the strength was short lived, with sellers driving the pair lower towards 10000 in the London session:

Though we now have a confirmed Head and Shoulders topping pattern on the hourly, zone support still holds for the moment and this could well be a false break - these topping patterns are very reliable on daily charts, but much less so on lower time frames. I've also noticed taller patterns like this one seem to fall short more often:

Even so, pressure clearly remains on the downside for the moment and though I'd like to see pair bounce here, there's every chance we correct lower towards 9000. On the bright side, we now have a clear Inverse Head and Shoulders reversal pattern on the daily, so I expect pair to find significant buying interest above 9000 if we do correct lower. If you remember back to a couple of weeks ago, this reversal started with a smaller Inverse Head and Shoulders and has now developed into a much larger one - this is a very good sign IMO: