Margin trading is not exclusive to cryptocurrencies. BTCMEX is a blend of the best features of traditional finance and 21st Century innovations. The platform is currently providing Bitcoin Perpetual Contracts with up to 100x Leverage, a speed of 100,000 TPS, hundreds of APIs, diverse Order Types, and 24/7 localized live multilingual Customer Support.

This is an article from the official BTCMEX Help Center. Explore the Trading Guide.

Perpetual Contract: explained

Crypto Perpetual Contract: explained by BTCMEX

Perpetual Contract is a type of Futures Contract which doesn’t have an expiration date or settlement. It is an innovative cryptocurrency Futures market product. Unlike contracts on the traditional Spot Market, which are traded at a specific time at the specific price, in Futures, two parties will make a trade on the contract with a settlement on a future date and a specific price. Perpetual Contract is a type of Futures Contract that doesn’t have an expiration date or settlement. BTCMEX offers Bitcoin Perpetual Contracts, which allows traders to keep their positions open for as long as they want. Perpetuals are a type of Swap Contracts.

Let’s see how the contracts work on the Exchange. For example, you purchase a Perpetual Contract for the BTC/USD pair. If you Long (buy) and the Bitcoin price rises, you make a profit at the end of the contract, while you would suffer a loss if the price drops. On the contrary, if you Short (sell) and the BTC price falls in value, you would make a profit but would suffer a loss if the price rises.

What is Leverage?

In crypto Margin trading, Leverage is an important feature of the Perpetual Contract. On BTCMEX you can trade BTC/USD Perpetual Contracts with up to 100x Leverage. It allows traders to open positions and place orders that are significantly larger than their Initial Margin. Initial Margin is the percentage of the open position value held by a user at the beginning. High Leverage is one of the main profit-making instruments in cryptocurrencies Derivatives trading.

The money on a trader’s account is not exactly the money used to make trades. That money serves as collateral towards a loan an exchange is giving users to trade with. This allows traders to make much larger trades than they would with just their own money.

Here is an example, a trader goes Long USD 1000 worth of Bitcoin (BTC/USD currency pair). He does that using USD 200 of his own money, and USD 800 are borrowed from the exchange. If a trader goes Long (buys) and the price of BTC to USD rises and after closing his position his position value went up from USD 1000 to USD 2000. He would pay back the exchange’s USD 800 and walk away with USD 1200. He put 200 dollars and made 1000 dollars profit using Leverage. If he hadn’t used margin trading, his total position would have been USD 400, with only USD 200 profit.

Liquidation on BTCMEX

But what happens if the trader experiences loss? When the trader loses nearly all of his Initial Margin (the percentage of the open position value held by the trader at the beginning) his position is automatically closed. This process is called Liquidation. The trader whose position is liquidated loses his entire Margin.

Since users are trading with the exchange’s money, if the price drops (for long positions) or goes up (for short positions) too much, the exchange can potentially lose money. To guard against loss the platform sets a typical margin requirement, which is calculated on the BTC price — Maintenance Margin.

Following the example above — going Long USD 1000 worth of Bitcoin with 5x Leverage (USD 200 is the initial margin, USD 800 — the exchange’s margin) — if the exchange’s minimum margin requirement is 0,5% (USD 5 of position value), and the price drops by 19,5% (USD 195 of position value). The position value is now touching the minimum margin requirement (USD 800+5). This trader will automatically be liquidated. Liquidation is an automatic closing of the position due to a significant Margin loss.

The price at which Liquidation occurs always depends on the Leverage chosen, the Initial Margin value, and the Maintenance Margin value. The Liquidation Price will always be at a price better than the Bankruptcy Price, the price at which a trader would have lost all his Initial Margin.

Fair trading: Dual-Price Mechanism

BTCMEX uses a Dual-Price Mechanism — an important measure to prevent market manipulations. To protect users from volume inflations and price fluctuations, which can cause unreasonable Liquidations on the platform, the Mark Price is used to trigger the Liquidation. The Last Traded Price (internal price) can’t trigger the Liquidation on the Exchange. BTCMEX is using the Mark Price instead, which derives from the Index Price (average market price) and is calculated equally from three exchanges Kraken, Coinbase, and Bitstamp (33.33% each). This means BTCMEX can’t influence the Liquidation internally.

Risk management: Insurance Fund and ADL

To provide the best cryptocurrency trading experience BTCMEX uses an Insurance Fund — a mechanism that protects the users’ profits from an ADL (Auto-Deleveraging system) or any other type of loss covering system used by the exchange. The Insurance Fund serves to lower the risk posed by traders who have negative account balances when they are liquidated in a leveraged trade. If there’s no Insurance Fund, the loss covering payment would always be necessary during negative balance Liquidations.

The Insurance Fund is a balance on the exchange, filled by the Remaining Margin of a position liquidated at a price better than the Bankruptcy Price, and used to cover the loss from a position closed at a price worse than the Bankruptcy Price and prevent an ADL.

The Liquidation Execution Price is the Last Traded Price at the moment the position is closed. The difference between the Execution Price and the Bankruptcy Price is the amount of a margin taken from or given to the Insurance Fund.

The Auto-Deleveraging system is only used when the Insurance Fund is insufficient to cover the possible contract loss after the Liquidation. ADL is a crypto exchange feature that automatically deleverages opposing traders’ positions by profit and Leverage priority. Unlike in a Socialized Loss system, which spreads the loss amount among all profitable traders on the exchange.

The traders with the highest ranking will be selecting for deleveraging first. When an ADL is triggered, the system matches one or several profiting positions with the liquidated order at the Bankruptcy Price.

What is Funding?

When trading cryptocurrency Perpetual Contracts, every user needs to be aware of Funding — periodic interest payments exchanged between the buyer and the seller. If the rate is positive, then longs will pay and shorts will receive the rate, and in the opposite way if the rate is negative. On BTCMEX Funding occurs every 8 hours at 04:00, 12:00, and 20:00 Beijing time. The traders will only pay or receive Funding if they hold a position at one of these times. If the position is closed prior to the exchange, Funding will not be paid or received. BTCMEX does not charge any fees on Funding. It is a direct peer-to-peer Exchange.

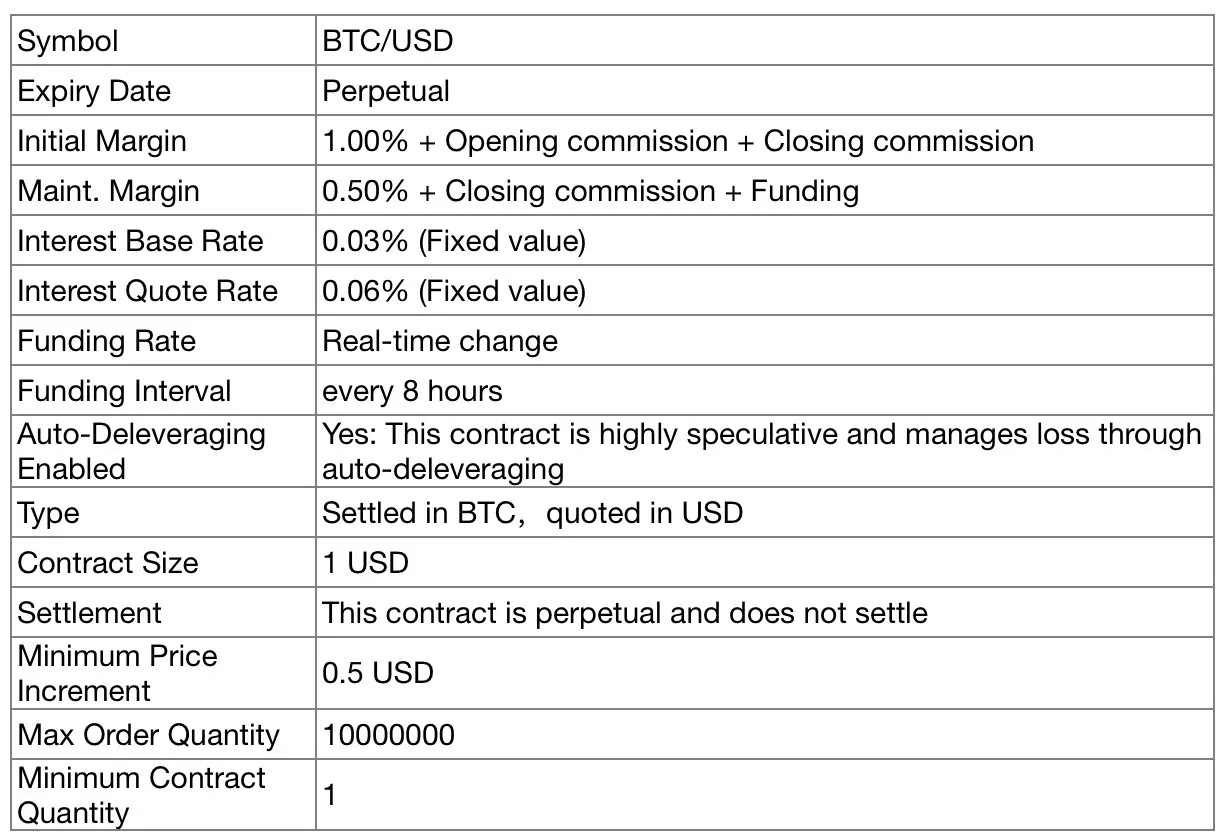

Contract Details

Market Order VS Limit Order

Traders use orders — an instruction to buy or sell — to open or close a position on the exchange.

A variety of order types are available when trading digital assets on an exchange. Some guarantee execution, others guarantee price. Each type of order is a tool that serves to achieve a certain goal. Both Market Orders and Limit Orders are currently available on BTCMEX. The platform is designed to bring diversity in cryptocurrency trading.

A Market Order is a buy or sell order that is executed immediately at the market price and filled at the best available price from the Order Book. Market orders are used when certainty of execution is a priority over the price of execution, and its goal is to have the order filled quickly. In the cryptocurrency Derivatives market, the price paid or received may be quite different from the last price quoted before the order was entered due to high volatility.

A Limit Order is an order used to buy or sell at a specified price or better. The main purpose of these is to control the price of the trade, which does not guarantee instant execution. To place the Buy Limit Order, the target price must be set lower than the Last Trader Price, or it will be filled as a Market Order. The opposite applies to the Sell Limit Order, where the target price must be set higher than the Last Traded Price. The Last Traded Price is the internal price index of a cryptocurrency on the exchange. Limit Orders ensure that the order is not filled at a price less favorable than the set target price.

Conditional Orders on BTCMEX

The crypto market is fast and flexible, so should be the exchange. There are tools suitable for both beginners and professional quantitative traders available on BTCMEX. In traditional finance, Take Profit and Stop Loss orders are used as exit trading strategies to secure the profit or prevent further loss. They are successfully applied for crypto derivatives trading on the exchanges today.

Take Profit Order is an automatic order to close the position at a pre-set price with an acceptable profit. The Take Profit exit strategy is designed to cash-out immediately and protect your trading from the future price fluctuations and secure your profit.

Stop Loss Order is an automatic order to close the position at a certain pre-set price better than the Liquidation Price to prevent further loss. The main purpose of the Stop Loss feature is to avoid Liquidation, during which a trader loses his entire margin.

These settings can be selected while placing Conditional Orders on BTCMEX. A Conditional Order is a buy or sell order that is executed at a trigger price pre-set by a trader. The common use of the Conditional Orders is to take profit, limit loss or enter the market at a desired price. Conditional Orders and be applied to both Market and Limit Orders.

Conditional Market Orders are triggered by a specific pre-set price and executed immediately. A trader can choose the Last Traded Price, Mark Price or Index Price to be a trigger for the order, but it’s always executed at the Last Traded price.

Conditional Limit Orders are triggered by a pre-set price (Last Traded, Mark or Index), on which a Limit Order is placed. A Take Profit Order is filled if a trader sets a trigger price better than the price of the position. A Stop Loss Order is filled if a trigger price is worse than the price of the position.

Positions closed with the Conditional orders can be filled fully or partially. Traders have three Time in Force options for Limit Orders: Good till Cancelled (GTC), Immediate or Cancel (IOC), and Fill or Kill (FOK).

Good till Cancelled (GTC): The order is active until filled or cancelled by a trader.

Immediate or Cancel (IOC): Any portion of the order that can not be filled immediately at the order price or better is cancelled.

Fill or Kill (FOK): The entire order must be filled immediately at the order price or better, or it will be cancelled.

All these features make a Bitcoin Perpetual Contract one of the most innovative types of products on the crypto derivatives market. Born in Europe and covering the whole world, BTCMEX is providing Bitcoin Perpetual Contracts with up to 100x Leverage, speed of 100,000 TPS, hundreds of APIs, and 24/7 localized multilingual Customer Support. Website can be accessed globally and available on your PC and mobile, on IOS and Android, providing a wide range of free videos, seminars, articles, charts, and education materials.