With Bitcoin approaching 10K USD mark I would like to share with you very insightful thoughts by Vijay Boyapati about Brief history of Bitcoin’s monetization.

While there are no a priori rules about the path a monetary good will take as it is monetized, a curious pattern has emerged during the relatively brief history of Bitcoin’s monetization.

Bitcoin’s price appears to follow a fractal pattern of increasing magnitude, where each iteration of the fractal matches the classic shape of a Gartner hype cycle.

In his article on the Speculative Adoption Theory, Michael Casey posits that the expanding Gartner hype cycles represent phases of a standard S-curve of adoption followed by many transformative technologies as they become commonly used in society.

Each Gartner hype cycle begins with a burst of enthusiasm for the new technology and the price is bid up by the market participants who are “reachable” in that iteration.

The earliest buyers in a Gartner hype cycle typically have a strong conviction about the transformative nature of the technology they are investing in.

Eventually the market reaches a crescendo of enthusiasm as the participants who can be reached in the cycle are exhausted and the buying is dominated by speculators more interested in quick profits than the underlying technology.

Following the peak of the hype cycle, prices rapidly drop and the speculative fervor is replaced by despair, public derision and a sense that the technology was not transformative at all.

Eventually the price bottoms and forms a plateau where the original investors who had strong conviction are joined by a new cohort who were able to withstand the pain of the crash and who appreciated the importance of the technology.

The plateau persists for a prolonged period of time and forms, as Casey calls it, a “stable, boring low”. During the plateau, public interest in the technology will dwindle but it will continue to be developed and the collection of strong believers will slowly grow.

A new base is then set for the next iteration of the hype cycle as external observers recognize the technology is not going away and that investing in it may not be as risky as it seemed during the crash phase of the cycle.

The next iteration of the hype cycle will bring in a much larger set of adopters and be far greater in magnitude.

Very few people participating in an iteration of the Gartner hype cycle will correctly anticipate how high prices will go in that cycle. Prices usually reach levels that would seem absurd to most investors at the earliest stages of the cycle.

When the cycle ends, a popular cause it typically attributed to the crash by the media. While the stated cause may be a precipitating event, it is not the fundamental reason for the cycle to end. Hype cycles end because of an exhaustion of participants reachable in the cycle.

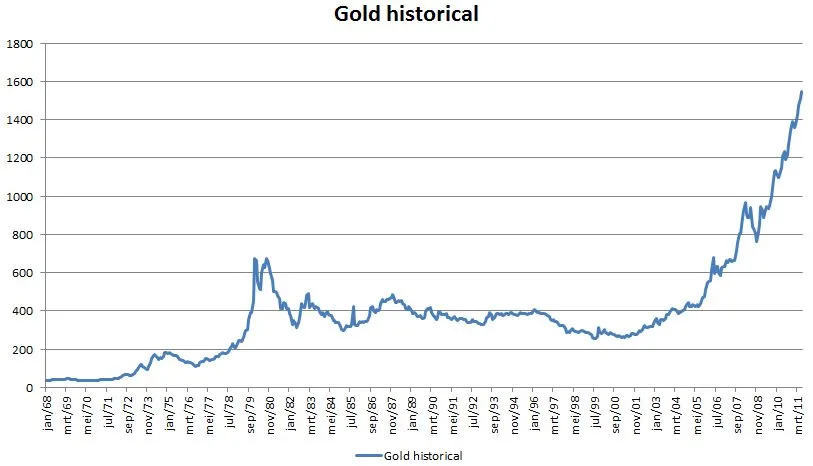

It is telling that gold followed the classic pattern of a Gartner hype cycle from the late 70s to the early 2000s. One might speculate that the hype cycle is an inherent social dynamic to the process of monetization.

Additional source:

Speculative Bitcoin Adoption/Price Theory: https://medium.com/@mcasey0827/speculative-bitcoin-adoption-price-theory-2eed48ecf7da