Bitcoin is plagued with problems, that may eventually cause its downfall.

Bitcoin was the first crypto currency, which made it king. This does not mean its the best, far from it.

Bitcoin was first created in 2008 and was largely ignored. In the time leading up to its massive explosion the creator disappeared. All progress since then has come from the community forking the chain, and that is very rarely done. There are many problems with the currency that need to be addressed, and some that could prove fatal.

The Problem of Bitcoin's Blockchain Structure

Bitcoin strives to be free and secure.

This freedom is achieved through decentralized blockchain. Every computer hoping to spend bitcoin must have the entire blockchain downloaded. This transaction then propagates throughout the network until it is included in a block. This new block is then downloaded to all of the computers hoping to use the network and the process continues.

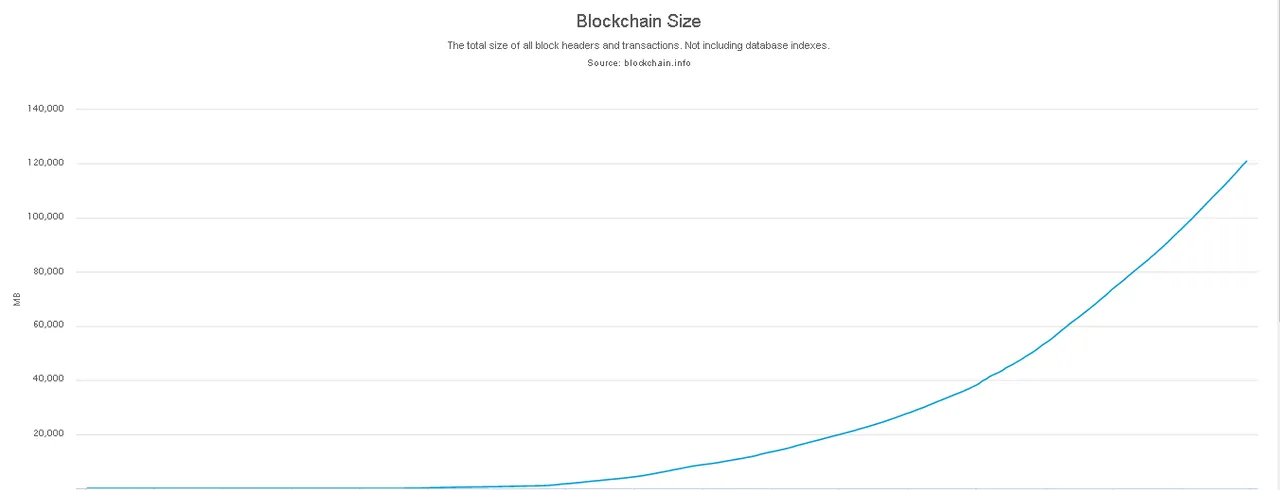

Blockchains of this type have two major problems: The transactions are hard capped, and the storage space required. The first is a problem of scalability. The network can not become more widespread and be considered the worldwide currency it strives to be when we have already up against the transaction limit. The only way to fix this without massive changes to bitcoin are increases in the maximum size of each block, which is still being heavily debated. A change in maximum block size would have a major effect on the second problem. The block size is already over 120 gigabytes. As the blockchain takes more time and resources to download, the more expensive it is to start mining and sending bitcoins. This leads to more and more centralization, the whole thing bitcoin was trying to avoid. [1]

Looking at this picture you can see the acceleration of the size of the blockchain.

Proof of Work

Bitcoin mining is the process in which bitcoin validates transactions. This runs with a process called Proof of Work, where computers race to find a singular hash which “solves” the block and allows it to propagate throughout a network. This race includes a massive amount of computers, which in turn causes a massive waste in humanities resources. [2]

The first mining was done with cpu’s. It was found that it was far less efficient than GPUs, and that multiple GPUs could easily operate on a single computer. This system can change algorithms easily when another becomes more profitable, so they are still commonly used today. (Although not for bitcoin mining) Next came the Field Programmable Gate Array, which consumed far less power than a GPU, but was just as fast and more expensive. Both of these were soon replaced by the Application Specific Integrated Circuit, known as ASIC. These ASICs were several orders of magnitude faster than GPU’s, but still consumed far less power. Unlike GPU’s these are produced by relatively few different companies. This leaves the entire network open to attacks by either the companies, or hackers if some way is found to attack the miners themselves. [3]

Then comes the problems of the amount of power Proof of Work consumes. The total hashpower of the bitcoin network is about 5.1 terahashes a second. The latest antminer (the most popular brand of ASIC) is rated at 0.098 J/GHs. This is the most efficient miner on the market. Crunching the numbers gives us 490 terawatts minimum. We all know that few people have the best miner, and using the older antminer s7 as a gauge gives us even worse results. (It is fair since it is still in production and was released only a year and a half ago.) This ASIC has an efficiency of 0.25 W/GH/s. This gives us an estimate of 1200 terawatts of power. The problems with this are twofold. This is both a major source of centralization and pollution of the environment. [4][5]

Bitcoin mining is becoming very centralized in China, in part because of extremely cheap electricity (about $0.08 usd kwh vs $0.12 on average in the US). This electricity is even cheaper in bulk. China controls 60% of the world’s hashrate, with about 80% of the daily transaction volume. [6][7]

The effect on the environment. On average each Kilowatt hour of energy causes 1.2 pounds (0.55 kg) of CO2 to be released. This is about 12.5 million pounds (587 thousand kg) of CO2, per year. Professionals say this go up by ten times by 2020. This doesn’t even factor in the impact of making, storing, and cooling mining hardware. There is over 10,000 metric tonnes of bitcoin mining hardware. That is enough material to build a new Eiffel tower. All of these resources are wasted to humanity, just because social change is too hard. The only value of bitcoin comes from the thought of it having value. [8][9][10]

Bitcoin was created for a few reasons, but because of the way they are carried out they can only exist naturally for so long. It has served its purpose and spawned a whole host of new currencies that cost humanity less resources to use.