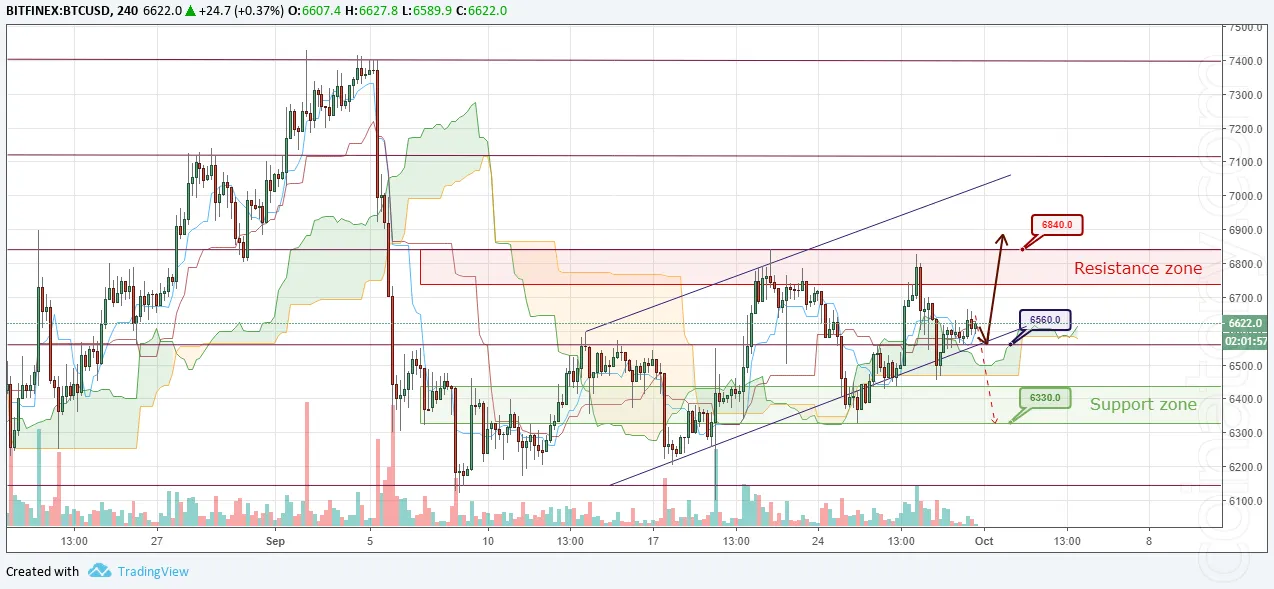

BTC/USD

BTC/USD is trading at $6,622 and continues to move within the borders of rising channel. The coin is traded above the Ichimoku Kinko Hyo Cloud, which indicates an upward trend. As we wrote before, the price went down to retest, but apparently did not find enough support from buyers there. Therefore, the retreat turned out to be very modest and the price continues to stand in the region of the resistance level of $6,560 and the lower boundary of the rising channel. This is not a very good development for bulls, but given that the market activity is declining on weekends, it is likely that we will still be able to see growth on Monday.

BTC/USD Forecast and analytics 01 October 2018

As part of the forecast for October 1, the development of further upward movement within the channel remains a priority. The potential goal of growth is also the renewal of the local maximum of $6,840. It is likely that we will be able to see further retests of the support level of $6,560 and the area of the lower channel border and after that, the upward movement.

Cancellation of the growth will be the withdrawal of the price below $6,560 and the consolidation of quotations below the lower boundary of the Cloud Ichimoku Kinko Hyo, with a potential target at $6,330.

ETH/USD

ETH/USD is trading at $234.44 and continues the upward movement within the channel. The coin is traded above the Ichimoku Kinko Hyo Cloud, which indicates an upward trend. After another retest of $220.50 on very good volumes, the coin grew and renewed the previous local maximum of $235.20. But the subsequent lateral movement and the lack of consolidation above the maximum of the candle penetration - somewhat disappointing and alarming.

ETH/USD Forecast and analytics 01 October 2018

As part of the forecast for October 1, the priority remains the expectation of further growth in prices within the rising channel, with the aim to update the highs at $250.00. Attempt of growth can be expected from the current positions and after a small rollback down and testing the lower boundary of the rising channel.

The abolition of this will be a drop and a breakdown of $220.50. In this case, it will be possibbility of descending movement with a target on the lower border of the support zone $202.30.

XRP/USD

XRP/USD is trading at $0.57659 and continues lateral movement within the established flat. The coin is traded above the Ichimoku Kinko Hyo Cloud, which indicates an upward trend. The price reached the upper boundary of the flat corridor and began a fairly confident downward movement. The level of $0.62800 is not broken, the corrective movement is not over.

XRP/USD Forecast and analytics 01 October 2018

As part of the forecast for October 1, we can expect the continuation of the lateral movement within the framework of the established flat and a price movement to the lower border of the $0.50000- $0.46500 corridor, and from there - the further development of lateral movement to the upper border of the flat at $0.62800.

The cancellation of the development of the lateral movement will be the growth and breakdown of the level of $0.62800. In this case, we can expect the price to rise to $0.70000.

XMR/USD

XMR/USD is trading at $116.000 and continues lateral movement within the rising channel. The price of the coin is below the Ichimoku Kinko Hyo Cloud borders, which indicates a downward trend. Fears about the possibility of a false breakdown of the channel border were justified, but the sellers attempting to press the support zone ended up forming Pin Bar. The signal is weak for purchases, because of the location of the pattern, but still points to the dominance of buyers who were able to keep the price from falling.

XMR/USD Forecast and analytics 01 October 2018

As part of the forecast for October 1, we can expect a second test of the lower limit of the upward daily channel, in the region of $112.800. So far, the development of the continuation of the upward movement in priority, so after the retest, we can expect a price increase with an intermediate goal to update the local highs at $122.000, and then gaining a foothold above $127.500.

The cancellation of the growth will be the breakdown of the price of the lower border of the ascending daily channel and its consolidation below the level of $108.000. In this case, we should expect a further decline in quotations in order to update local minimum at $104.200.

Posted from my blog with SteemPress : https://coinatory.com/2018/10/01/forecast-and-analytics-01-october-2018/