You need to make a tough decision today, and postponing it any longer only hastens the inevitable.

Both in Europe and in the U.S., the middle-class wealth is eroding, leaving hundreds of millions wondering why they work for 45 years and have barely enough to sustain a short retirement.

Wages in the western world are not about to suddenly or magically double – that’s a guarantee, so your commitment to take action and change your circumstances must occur.

Currently, the USD is the global reserve currency, but that’s a side effect of a system gone wrong. While the 2nd world war allowed the middle-class to prosper, while Europe was rebuilding itself, the power is shifting today – Asia is much stronger fundamentally than the U.S.

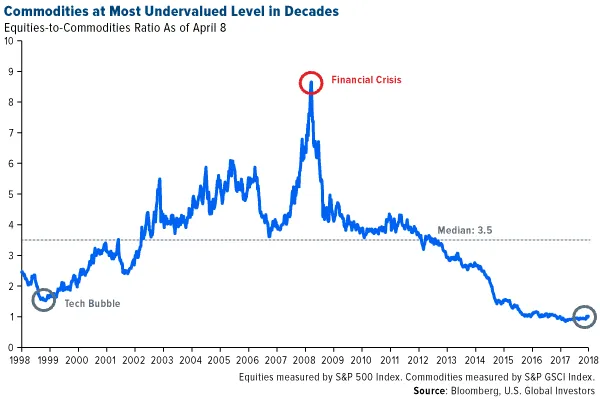

Courtesy: U.S. Global Investors

Now is the time to add commodities to the portfolio.

I am currently reading, _“The Most Important Thing,” _by the legendary investor, Howard Marks. In each chapter, he births a new concept as the most important for investors.

More chapters are devoted to the topic of risk than to any other strategy. The emphasis is on permanent loss of capital. Many times we position ourselves in a company, but the bottom is not yet set. Howard Marks doesn’t see this as risky at all. He views it as natural.

Instead, he fears that either the company is not fundamentally sound, so its future is uncertain, or that he overpaid. Not buying at the exact bottom doesn’t bother him at all.

Apart from this, his only other concern is with black-swan events. Since he cannot prepare for them, the only way to offset the risk is by investing with cash-rich companies and talented management teams.

Some of the best mining shares are absolutely cheap right now, but there’s even a bonus to that. You see, the primary producers are in a crisis mode.

Take a look:

Courtesy: U.S. Global Investors

Barrick Gold, the world’s largest producer, needs to start making acquisitions immediately.

In the next three to seven years, as Portfolio Wealth Global sees it, the USD system, in its current structure, will cease to exist.

Our team isn’t predicting hyperinflation, nor are we forecasting a catastrophe, but we are definitely going to see a worldwide concentrated political effort to move around the key chess pieces.

Gold is a key influence in this game, so countries have begun repatriating it. Turkey is the latest example, but this all comes at a time when gold production is weak, and oil prices are on the rise.

Nothing correlates to the price of gold and silver more than oil prices.

Courtesy: U.S. Global Investors

Notice how February of 2016, which marked the bottom for prices at $26 per barrel, also marked the bottom for mining stocks.

Also, notice how oil leveling off mid-way through 2016 marked the top for mining shares prices.

Now, oil is nearing a pivotal breakout moment again.

This is important for two reasons:

Gold and Silver Juniors – Timing is nearly perfect. An oil bull market will draw institutional money into mining because precious metals prices will rise, making projects more valuable.

Electric Vehicles – Higher oil prices make an even stronger case for them. I expect cobalt to made global headlines soon.

The most important decision you can make is to become a skilled investor because your curiosity level will become dominating in character. You’ll associate with higher-quality individuals, become privy to early-stage opportunities, and find ways to leapfrog the American Nightmare, which replaced the Dream.

Life today is more complex and requires each of us to accumulate assets towards our future. We live longer, so we must be able to save, build a capital reserve, and grow it wisely.

The USD won’t save America. The global financial institutions aren’t using it because they want to, but because they have no other alternatives, as of now.

Cryptocurrencies are changing that, though, and I expect G20 meetings to revolve around a new monetary system in the years ahead.

Do not wait any longer. Raise your game. Become a serious investor who reads books, networks with smart people, and comes up with ways to capitalize on relationships.