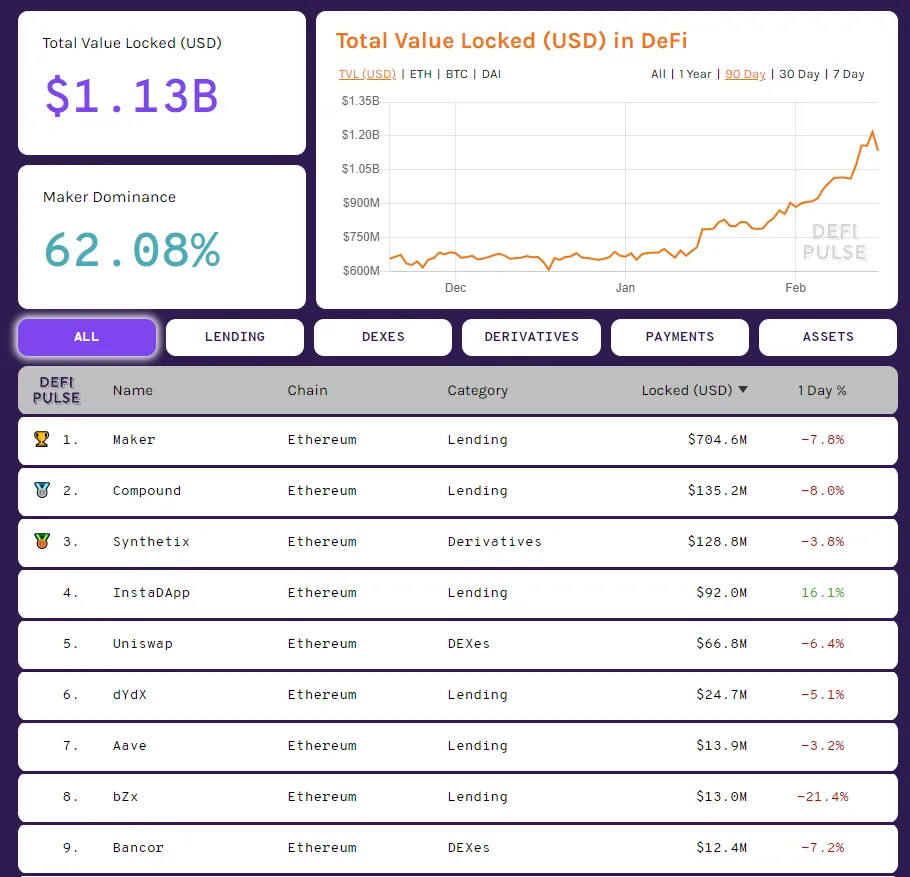

Defi which is decentralized finance is a term where you can take loans in crypto collateral and get another crypto (usually stable coins but not only). I think the first blockchain that had this option was actually BTS where you could borrow or lend coins for bitUSD CNY etc. Loads of people used/still use Bitshares to make loans not trade on the DEX but i will skip this topic for now.

Ethereum took the idea and built a huge ecosystem of loaning systems. To be clear crypto finances/DeFi also goes for places that are centralized but use crypto ie check Bitcoin Lending and Loans Offer List.

But lets get back to DeFi on Ethereum.

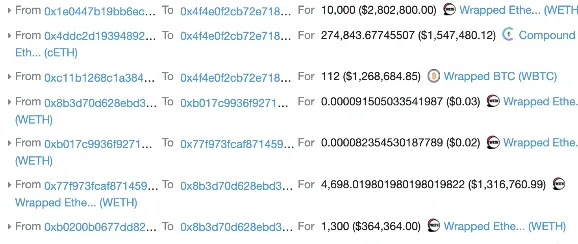

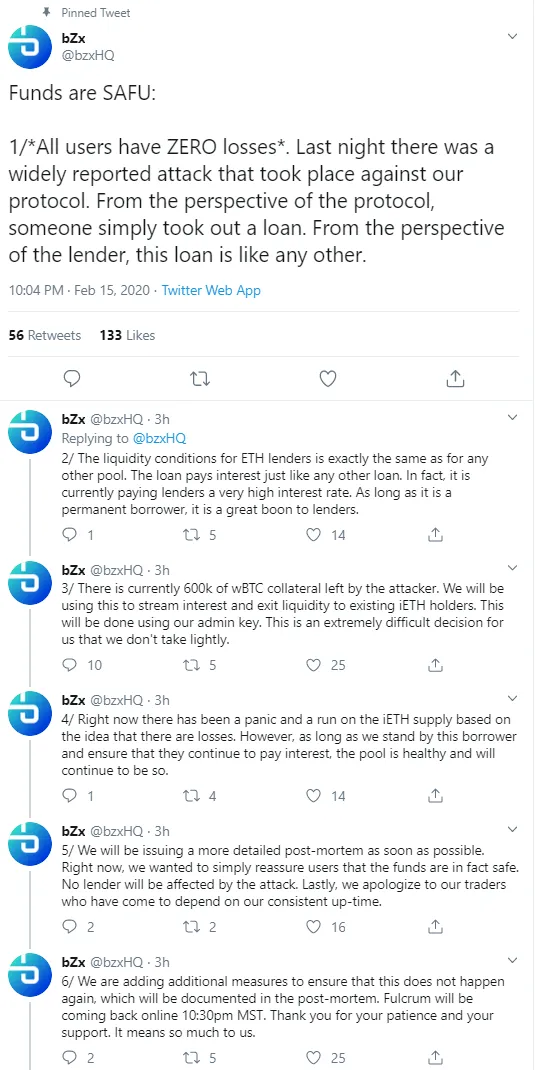

What thre guy did is probably (people still investigate) took a flash loan from dyDx exchange for 10,000 eth and then..

WBTC is 1:1 BTC on the Ethereum network. Keep in mind loan services are not superb liquid unlike exchanges.

The only tricky part he had to do it super fast aka with some coding contract as it had to be done in single transaction (!).

He paid $8.73 in transaction fees to get free 360k USD worth of Ethereum.

To be clear the didnt hack anything just exploited contract in a way as he noticed if the loan is taken and paid back in same transaction you dont need money as its flash loan not normal one.

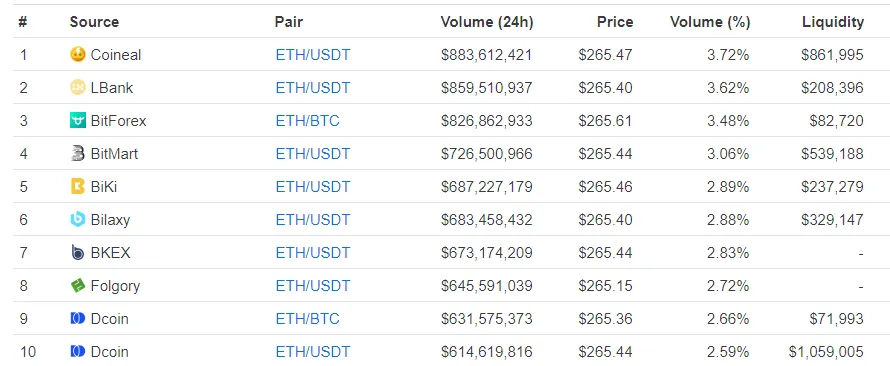

Ethereum Markets

Out of the top10 i suggest only BitForex to trade ETH coz ie Lbank i have account and only bots ride it, impossible to trade it manually. BitForex has loads of pairs, cheap fees and good options.

REAL WAYS TO MAKE PASSIVE INCOME FROM CRYPTOCURRENCY - DOWNLOAD FREE EBOOK NOW

Join My Official Discord Crypto/Steemit Group - https://discord.gg/Ma3VCxj

Follow, Resteem and VOTE UP @kingscrown creator of Bitcoin and Ethereum Loans with unique newsletter and hidden tips for subscribers! |

|

|---|