134 billion was the corporate tax revenue in 2019.

3.9% of the 3.46 trillion dollars of tax revenue for the federal government.

21.4 trillion dollars was GDP in 2019.

Corporate taxes were .6% of GDP that year.

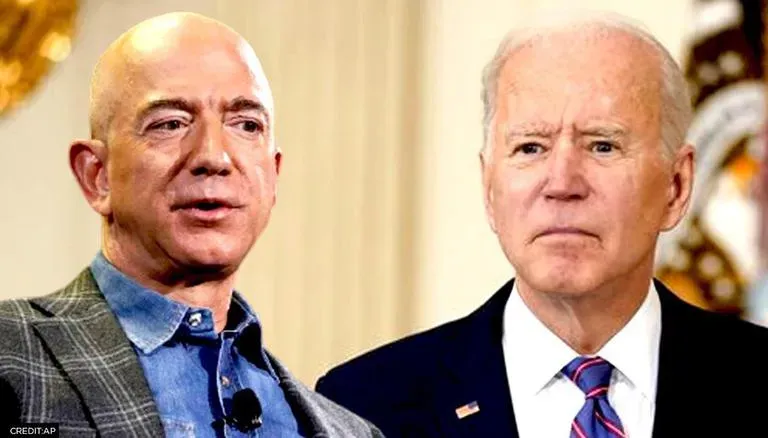

Joe Biden recently got into a small feud with Jeff Bezos, where Biden said if people want to correct inflation, they should look at raising corporate tax rates.

Jeff Bezos responded by saying he’s open to the conversation of raising corporate rates to fund programs or reduce the deficit, but said the idea it’s a factor with inflation is just false information.

https://twitter.com/JeffBezos/status/1525309091970699265?s=20&t=M65ceTEC0V-Baq7ohK63uw

- JeffBezos

To be clear, there is an argument for raising corporate tax rates.

In 2015, corporate tax revenue was 284 billion dollars.

8.7% of the total tax revenue that year.

This was due to a change in corporate tax rates under Donald Trump, as well as a change to policy for deductions.

Which some people could argue they should have been higher and some lower, but the best way to look at this would be a comparison to other countries.

21% is the current US corporate tax rate.

35% was that rate in 2015.

The global average for corporate tax rates is 23.5%.

Meaning the US under the tax cuts is actually closer to the global average now over 2015, when America’s corporate tax rate was 49% above the global average.

Also, corporate taxes are relatively low in progressive nations.

All counties with single payer and some form of universal college, but all of them have for decades had lower corporate tax rates over the United States.

In 2019, in the second to last year of Donald Trump, the deficit 984 billion.

In 2015, in the second to last year of Barack Obama, the deficit was 439 billion.

If corporate tax rates held to 8.7% of revenue, the federal government would have raised 301 billion that year off of corporate taxes and the deficit would have been a little over 800 billion, versus slightly under a trillion.

This does make a case the tax cuts weren’t a good idea, but at the same time, I feel Joe Biden and the left are pretty delusional on corporate tax hikes and what that gets people.

If the federal government were to increase corporate taxes 500%, that’d not provide even a third of the revenue needed for single payer, which has a projected cost of 3.5-4 trillion yearly in the most basic version.

It also really doesn’t do anything for inflation.

If federal corporate tax rates were as high as they were in 2015, there’d only be an additional 200 billion in revenue, which is too small to the deficit/GDP to actually impact the value of the dollar much.

Writing this, there might be a value to raise rates to reduce the deficit, but the idea raising corporate taxes changes the value of the dollar is just a lie.