The top 4 ways whales can increase the market cap of Steem are included near the end of this post. You can jump down to them if you like, but they'll make much more sense to you if you read this post from top to bottom to understand the framework behind these recommendations.

The value of Steem is not going to increase over time unless whales start paying attention to the metrics that drive real long term business value.

Do you think I'm unrealistically pessimistic and don't have any basis for making this claim?

You don't need to take my word for it, just look at this chart from coinmarketcap.com:

The big growth in market capitalization that happened in early July was not sustained.

I would argue we can only expect the market cap to hold at the current level or decline in the near future if our community continues to act as though currency speculation alone is enough to make this platform and currency increase in value.

As the chief architect behind potentially the most successful local currency in the USA and as a professional online marketing consultant, I have an important perspective on how to create real value for Steemit that isn't based on speculation.

Start up cryptocurrencies have the advantage over local currencies that people will invest in them purely for speculation purposes. Local currencies on the other hand have to succeed entirely on their ability to add value to users without serving as a speculative investment tool.

The currency system I'm involved with has, "$101,781.15 worth of currency in circulation with $975,603.85 worth of transaction volume over the last year," and this was all accomplished with zero speculation and only about 70 people using the currency.

It is because of my experience with a highly successful local currency that didn't depend on speculation that I can help shine a light on the path for Steem growth that is also not dependent on speculation.

Furthermore, while Steem appears to be a very profitable speculative investment for those who took a position in Steem Power or Steem prior to early July of 2017, depending on speculation to continue to drive up the price and market capitalization now is highly unwise.

Why isn't currency speculation enough for Steem to continue growing in value?

Steemit isn't just a currency, it is a social media platform and in order for the currency to succeed the social media platform needs to succeed as well. You might say the early and rapid growth of Steemit as a social media platform has been outstanding, so there isn't anything to worry about on that front.

I disagree.

Steemit is losing credibility with social media users.

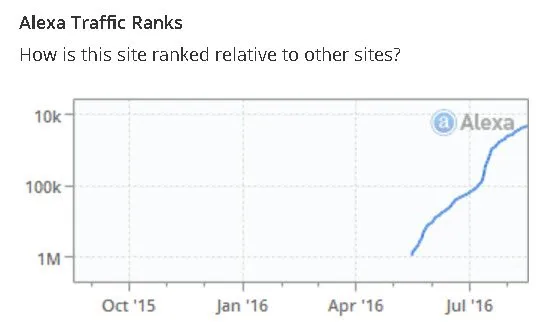

What proof do I have for this claim? Well, let's look at the traffic growth curve...

The first thing you notice when you look at this chart is the very steep growth in traffic, but look a little closer.

The top of the curve is leveling off and Steemit is almost not growing anymore.

So what are the biggest problems that are causing the platform to stop growing?

##The first problem for growth is lack of retention. The vast majority of users are joining this platform to make money, but only a tiny fraction of people will ever see more than a few bucks here. ##

I see some people arguing that as the site grows more people will be able to make money, that's true in raw numbers, but it isn't true as a percentage of users.

Again, you don't need to take my word for it, just look at what the WHITEPAPER has to say about people's ability to make money on Steemit:

"Taking popularity as a rough measure of value, then the value of each individual item is given by Zipf’s Law. That is, if we have a million items, then the most popular 100 will contribute a third of the total value, the next 10,000 another third, and the remaining 989,900 the final third. The value of the collection of n items is proportional to log(n).

The impact of this voting and payout distribution is to offer large bounties for good content while still rewarding smaller players for their long-tail contribution.

The economic effect of this is similar to a lottery where people over-estimate their probability of getting votes and thus do more work than the expected value of their reward..."

Let me break the math down for you if you have not already.

1.01% of authors will capture 2/3rds of all the money to be made on Steemit, while the remaining 98.99% of authors will have to split the last 1/3rd.

If you just realized you are one of the 98.99% of minnows who will see nothing but a few dollars from your efforts here, then I imagine you can easily understand why Steemit has a retention problem. If you are one of the lucky whales I hope your power hasn't zapped you of the empathy that is needed to understand why minnows are jumping in the pond and right back out at a rapid pace.

You might think I'm going to argue that the way to solve this problem is to change something about how the payout works so that more people can make money, but you'd be wrong.

The payout structure is great the way it is right now because it gives a strong incentive for big players to get involved and promote the platform to their followers.

If we changed the reward structure to spread out the money to many more users, then it would be much harder to attract the big players because they wouldn't make much per post.

So what needs to change to improve retention when 98.99% of users are never going to see any serious money from Steemit rewards?##

The big players need to bring their followers onto the platform by focusing on the following things instead of making money:

1) Steemit has a better user experience because people are more respectful.

When was the last time you saw a civil conversation on a Facebook post involving people with widely different perspectives? The Steemit community is doing a great job of policing itself which is proving to generate an environment that is much more pleasant than the social media experiences that most users expect.

2) Users have 100% control over their feed.

I can't tell you how many times I've heard people complain that Facebook is messing with the content showing up in their feed. With Steemit there isn't some complicated algorithm making it hard for you to see the content you want to see. If you follow some one, you see all their content. It is very simple and it is much more in line with what most users I know seem to actually want.

3) There is no annoying advertising.

Do I even need to bother and explain why this is an obvious perk?

4) Users can support the writers, artists, journalists, non-profits, media outlets, and politicians that they care about just by up voting their content.

This is especially important as it relates to popular music artists, authors, etc. because the more these content produces can get paid posting here, the less need they will feel to charge for their content. This in turn means their fans get more and more content they love without having to crack their wallets.

Focusing on the above benefits will help with retention, which indirectly helps with the second biggest problem for Steemit, which is sustaining demand for Steem Power!

The biggest driver for increasing Steem's market capitalization is demand for Steem Power. This is true for two reasons.

You have to buy Steem to power up, which pushes up the price of Steem.

Powering up locks up Steem for at least two years, reducing the short term supply of Steem. When supply is reduced, it also pushes up the price.

By improving retention, we increase the number of people on the platform and Steem Power becomes a more valuable asset for entities to acquire in order to sell products and services to Steemit users.

If the only benefit one gets from holding Steem Power is the ability to get more Steem, then a quick and sharp reduction in the desire to speculate on Steem as a currency could tank the platform in black swan event. Ultimately Steem Power needs to be valuable because it gives entities exposure and sales, not because it gives them the ability to acquire currency for speculation purposes.

Furthermore, Steem Power is only useful as a way to sell products and services if Steemit has a large audience of people that are able and willing to spend money. The money being spent can be either USD, or SMD, it doesn't matter. Exposure just simply needs to drive sales.

In fact, demonstrating Steemit's ability to drive sales should be the top priority for every whale, because doing so will drive up the value of the Steem they are holding faster and more sustainably than speculation ever could!

There are a lot of people on Steemit.com for a platform that is only a few months old. The time to demonstrate that we are a great market to tap into is now, while there is still buzz associated with our launch and early rapid growth.

Because Steem Power needs to be seen as a tool for driving sales, whales should sometimes promote posts that sell products and services.

I've only seen one whale focusing on this issue, and that whale is @stellabelle. While she isn't the biggest whale in the bunch, she has the high reputation of anyone on the platform.

In particulare @stellabelle is encouraging minnows to sell products and services on Steemit. She is doing this because it is a much more functional way for minnows to earn Steem compared to fighting their way into the top 1.01% of users who are making money from posting content.

Take note of the fact that the whale with the highest reputation on the platform is focusing on getting people to sell products and services for Steem Dollars.

When the most trusted person in your community says you should do something, you should take them seriously.

Furthermore, you should follow their lead by finding other ways to contribute to the core concept that @stellabelle is advocating for here. That's exactly what I'm doing here with this post. I'm building on @stellabelle's idea of getting people to sell products and services for SMD by expanding the concept to include sales of any kind.

Here are my top 4 ways whales can increase market capitalization.

1) Tell us what you want to purchase with SMD via posts you put on Steemit.

Occasionally put up posts that explicitly focus on what you want to purchase, with some sort of unique angle that gets people to engage with and vote up your content. In addition create a list of things you want to purchase with SMD and link to it at the bottom of all your posts. Whenever you find something this way, make a post about it to help drive more sales to the person from whom you purchased. This will be especially helpful for getting minnows who purchase from you to want to stick around on the platform.

2) Encourage minnows to sell cool products and services for SMD and promote them when they do with your up votes.

This not only help Steemit drive sales generally, it also gives another reason for more minnows to participate and stay on the platform.

3) Offer your own products and services for sale on the platform in posts that will get attention.

When you generate sales from your posts tell our community about it in a follow up post to help show the success of Steemit as a place for generating sales.

4) Promote products, services and companies that are values aligned with Steemit via clever and unique posts that get attention.

When you succeed in getting a lot of attention through one of these kinds of posts, approach the company or companies that you showcased to get them excited about joining the platform and selling their products and services here. When you do get companies to join, encourage them to invest in Steem Power so they can up vote content from other users that is beneficial to their brand.

If you have other ideas for ways that whales can help with this, please leave them in the comments below.

When whales demonstrate that Steem Power drives sales, values aligned companies will start buying up Steem Power in large quantities, driving up the market cap for Steem.

Steem Power as a tool for driving sales becomes a unique financial instrument that both allows a company to purchase ownership in a social media platform and simultaneously gain market access to the users of the platform.

This is essentially like paying for ads on Facebook, and in addition to getting sales from your ads, you also get shares of Facebook at the same time.

Companies spend thousands of dollars a month on Facebook ads. Imagine what will happen to the value of Steem when companies realize they can make a balance sheet transfer to increase exposure for their company instead of incurring an expense.