If a currency works as a backup of value, then it works very bad as a currency, because all the economic system becomes exploitable.

In every moment there is a certain amount of total currency circulating.

It is circulating, but in practice in every single moment, this currency is in the hands of determined persons and entities.

If there is no expectance of an increase of prices (inflation: devalutation of currency), there is no pressure to spend the currency, and this slows down money circulation, in other words this slows down sales, production, and occupation.

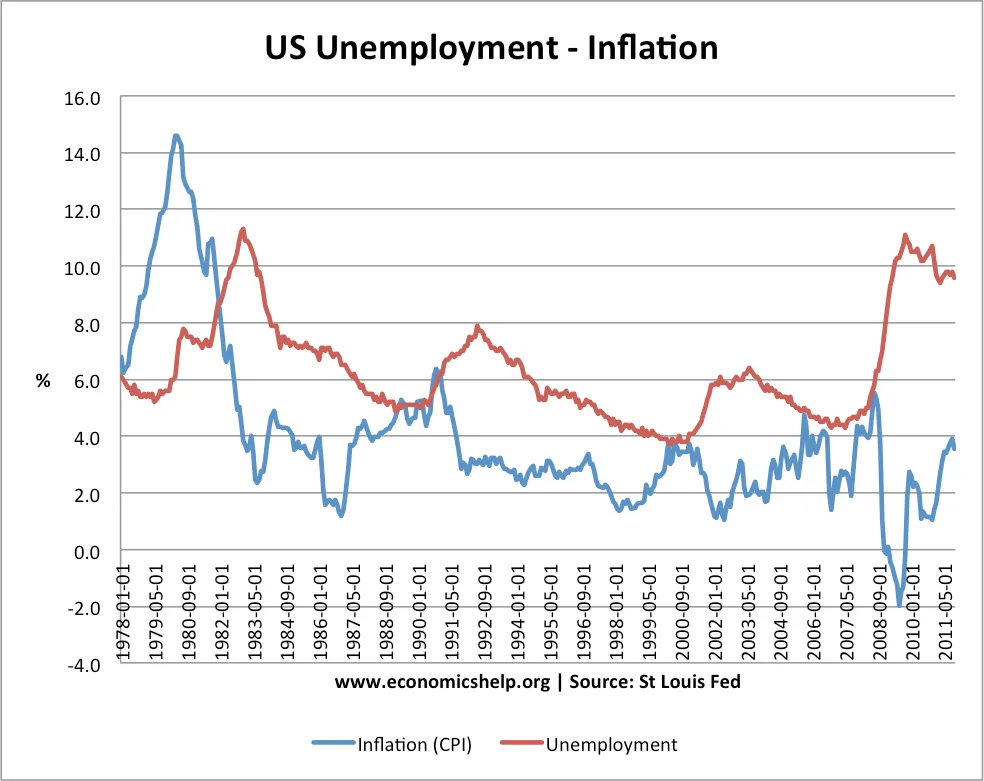

A reverse proportionality between inflation and employement has been often observed.

When most currency is owned by a few economic agents, this agents could setup a real scam:

The prices are linked with the amount of circulating money. (This correlation isn't linear: for example an increase of circulating money, not necessarily lends to an increase of prices, because it may lend to an increased production).

A decrease of circulating money, expecially in the case that circulating money is halved, will cause a significative decrease of prices, because not enough people has the money to buy at the original price.

For this reason, some "big players" of the economic game could just trick the game starting to save money, causing a reduction of the available money supply, wait for deflation, and then realize a big profit with their increased purchasing power.

This is not just a theoretical danger. This is what is going to happen in our economic system. For this to happen an explicit collusion by the economic agent isn't necessary: once the process is started, for every economic actor who has more money than he requires to live, the choice not to spend money may become the most profitable option.

How can we avoid that risk ?

Avoiding that the currency we use for our exchanges may be an useful backup of value.

The simpler way to achieve this is to continue printing enough money to mantain an inflation between 4% and 8%.

For a Central(ized) Bank this may be a very challenging matter.

European Central Bank doesn't have this problem, as the European Union has decided that the main target of the Euro is to have stable prices. In other words Euro is a useful reserve of value.

A useful setup for a legal scam provided by big economic players.

Steem is different.

Steem is the opposite.

Steem is designed to have a slightly amount of inflation, while Steem Power is designed to be a reserve of value.

And for this reason it is non trasferable.

If Steem Power was transferable, all the Steem system would be designed to collapse, because no one would use Steem as a currency, as Steem Power would be a better currency for the individual.

For a single individual is always better if the money he posses is a reserve of value. But for the society as a whole this is very bad.

Until every individual human soul will go beyond the momentary interests of their own temporal being, currencies won't be a store of value without allowing the speculators to exponentially increase their power over society.

A currency like Steem forces every individual to be productive, understanding that possessing money in his hands, is not a privilege, but a responsability.

Look at the whales.

Look at the dolphins.

They can't just sit and wait for their Steem Power to gain value.

They have to give value to Steemit, if they want their Steem Power to have value.

Should they just sit and wait for their Steem Power to get value, the value of their Steem Power would just decrease over time.