Hi Everyone,

I have been writing quite a few posts regarding the application of economics to many aspects of the Steem platform. I have provided a broad analytical overview of the platform. I have investigated voting. I have looked at the effect of bid-bots on the platform. I have discussed if the ‘Trending page’ should be the front page of Steemit and busy.org. Today, I want to discuss the rewards pool (sometimes referred to as the reward pool) and the economic implications of its existence.

What is the rewards pool?

The rewards pool is created from the increase in the supply of Steem minus interest on Steem Power (15% of the increase in supply) and minus payment to witnesses (10% of the increase in supply). Therefore, 75% of newly created Steem goes into the rewards pool. This 75% is available for distribution to content creators and curators of content.

What is the increase in the supply?

Steem is a blockchain. A blockchain is a chain of blocks containing data. The blocks on the Steem blockchain contains every activity that takes place on the Steem platform. This includes transactions, upvotes, downvotes, posts, and comments. Every 3 seconds a new block is added to the blockchain. The increase in supply of Steem is linked to the number of blocks in the blockchain. As the number of blocks increases, the percentage increase in the supply of Steem decreases. The percentage increase in the supply of Steem falls until it reaches 0.95% at block 220,750,000; this will take approximately 20 years.

At block 7,000,000, the annual increase in the supply of Steem was 9.5%. The increase in supply drops by 0.01% every 250,000 blocks. At the time of writing this post, the blockchain is at block 24,765,114 and the supply of Steem is 272,844,439. The annual increase in supply is therefore 8.79% (9.5 - (24,765,114– 7,000,000) / (250,000*100) ≈ 8.79%). The daily increase in supply of Steem is approximately 65,702 (272,844,439 × 8.79%/365). Of this 65,702 Steem, 9,855 Steem goes to witnesses, 6,570 Steem is paid as interest on holding Steem Power, and 49,275 Steem goes to the rewards pool. The decreasing percentage increase in the supply of Steem keeps the size of the rewards pool, in Steem, relatively constant. As the price of Steem increases, the value of the rewards pool increases.

How is the rewards pool distributed?

The rewards pool is distributed using votes. Upvotes distribute rewards to posts and downvotes remove rewards from posts and returns them to the rewards pool. Steem uses stake-based voting. The value of votes are based on the size of an account’s stake. The votes from an account with a larger stake are worth more than the votes from an account with a smaller stake.

How is the rewards pool expected to operate?

The creation of the rewards pool dilutes the stake of those invested in Steem. Those invested in Steem are funding the rewards pool through the dilution of their stake. Increasing the supply of Steem creates downward pressure on the price of Steem. The rewards pool attracts content creators and innovators to the Steem platform. These content creators provide content and the innovators provide extra utility; this adds value to the platform. The content and innovation attracts attention and attention attracts investors. Investors want to buy Steem and this puts pressure on the price of Steem to increase. Those invested in Steem expect the upward pressure to exceed the downward pressure and therefore the price of Steem will increase.

The strengths and weaknesses of the rewards pool

The rewards pool is one of the defining features of Steem. The existence of the rewards pool is what makes Steem unique from any other social media platform. The rewards pool is an interesting approach to distributing rewards to contributors to the Steem platform. How does the strengths of this approach compare to the weaknesses?

Strengths of the rewards pool

I have identified the following key strengths of the rewards pool; this list is not exhaustive.

- Does not require direct payment from own stake.

- Consistently increasing rewards pool ensures constant flow of activity on the platform.

- Provides a great source of funding for projects.

- Provides a voice for the voiceless.

- Builds a strong sense of community.

Does not require direct payment from own stake

This, in my opinion, is the greatest strength of the rewards pool. The creation of the rewards pool does not give the account holder the option not to pay content creators, innovators and witnesses. Instead, it gives the account holder the option to decide which content creators, innovators, and witnesses to pay. The absence of the rewards pool would most likely require account holders to make direct payment for posts. Very few account holders would be willing to offer rewards for content that they can view for free. Therefore, content would need to be put behind a wall revealing a short teaser to encourage voluntary rewards. Placing a wall on content will restrict exposure for the content and reduce activity on the platform. The level of activity generated from rewarding directly from own stake would be considerably less than the level of activity generated from distributing from a rewards pool. The social media platform ‘yours.org' rewards through direct payments for content; the level of activity and value of rewards is considerably lower on this platform compared to Steem.

Constant flow of activity

The existence of a continuously replenishing rewards pool encourages activity through incentive. There is an incentive to produce content because of the possibility of being rewarded. Content is rewarded as there is incentive to reward content through curation rewards. These incentives attract people to the platform to either create content or curate content. If more people are attracted to the platform, so is more investment. The platform can be used to promote products, projects, business, innovation, ideologies, entertainment, information, and many more. If the platform attracts attention to all or any of the above, investment will follow in the form of sponsorship and advertisements.

Let’s use an example of a travel blogger. A travel blog could be indirectly promoting resorts, hotels, airlines, destinations, restaurants, etc. This is a form of free advertising for all of the companies mentioned in the blog. This advertising is worth more if it gains more attention. The potential for attention is much higher if Steem has more active users. The rewards pool is the biggest driver for these active users. To maximise this potential, companies can upvote this content to gain further exposure as well as reward the content creator to keep promoting their company. For this to be possible, the company will need to acquire Steem Power. If activity remains high on the platform, the risk from acquiring Steem Power is greatly reduced. The increase in the price of Steem from other investors taking advantage of the activity on the platform will further reward investors with an increase in the price of Steem.

Provides a great source of funding for projects

Many great ideas and initiatives struggle to obtain funding. Steem has a rewards pool that can become a great source of funds for projects that struggle to obtain funds through other channels. I have seen several charities obtain sizeable rewards by promoting their activities on Steem. There are several alternative media channels that are struggling for funds that are flourishing on Steem. I found out about Steem from a YouTube video by wearechange. This alternative media channel, which was predominantly based on YouTube, was struggling to survive. YouTube was restricting a lot of their content and was removing the opportunity to monetization their content as well. Steem offered them, by having a rewards pool, an avenue to support their work and they keep providing their viewers with their great contributions.

Voice for the voiceless

Not everyone can easily voice their opinions without facing some form of censorship. This can be direct censorship through banning or indirect censorship by restricting access to funds which could have enabled a person's voice to be heard. The existence of the rewards pool allows users to distribute rewards to those that cannot financially support their expression of freedom of speech and action. There can be great benefit to the community from giving visibility to the stories that would otherwise remain hidden.

Providing a voice to the voiceless is also an ideology that has gained considerable traction and support over the last few decades with the rise of many groups that strongly support freedom for all. These groups are going to be inclined to support Steem and possibly invest in Steem to provide greater support for their objectives of providing more freedom to society.

One of the reasons I put my content and research on Steem is because it is very difficult for it to be funded otherwise. I have presented my work at many conferences, funding of my research was previously provided by the Government. Unfortunately, in order to keep Government support, my work was increasingly pressured to present a pro-Government perspective rather than a neutral one. Steem has allowed me to at least partially support some of my research and eventually I am hoping that I will be able to use Steem to fully support it.

Builds a strong sense of community

The presence of the rewards pool can contribute to building a strong sense of community. This can be expected to develop as we can play a role in helping each other grow, which in turn helps the platform grow. Helping each other is the most effective way of helping ourselves in the long-run. A strong sense of community will encourage those on Steem to invest more money and time into the platform. The sense of belonging that I found here was certainly one of the reasons I bought Steem.

The community giving exposure to posts we believe deserve the highest rewards creates the best image to external parties. These external parties will be more inclined to contribute to Steem either in investment of money or time. The pull of community spirit through sharing of rewards using the rewards pool will serve as a far stronger magnet for those who want to commit on a long-term basis.

Weakness of the rewards pool

Even though the rewards pool has many amazing strengths, it also has several weaknesses. These weaknesses mostly play on the nature and character of people who lack the ability to comprehend the bigger picture and/or are very short-sighted in their objectives.

I have identified the following weaknesses of the rewards pool.

- Dilution of stake

- The existence of multiple prisoner’s dilemmas.

- Negative externalities are produced from acting out of self-interest.

- The full cost of negative externalities are close to impossible to value.

- The platform attracts those with short-run goals of making money quickly.

- Those with minimal stake have minimal influence.

Dilution of stake

The creation of the rewards pool dilutes the stake of those invested in Steem. As discussed earlier in the post, this puts downward pressure on the price of Steem. The larger the rewards pool as a percentage of the total supply of Steem, the greater the downward pressure. If the rewards pool is too large, the downward pressure would be too great for the upward pressure achieved from the content to create an overall increase in the price of Steem. If the rewards pool is too small, content creators will not be attracted to the Steem platform to share content and the platform will not grow.

What is the optimal size for the rewards pool? Is the Steem rewards pool the optimal size? I do not have the answers to either of those questions. Over time we will start to get a better picture of what the ideal size for the rewards pool should be.

The price of Steem also plays an important role in determining the optimal size of the rewards pool. As the number of content creators increases, the average rewards per post in Steem, will fall. The increase in the price of Steem needs to keep up with increase in the number of content creators in order to maintain the average rewards per post in national fiat currencies (e.g. US dollars). Ideally, to maintain this balance, those investing time to create content should also invest in buying Steem.

Multiple prisoner’s dilemmas

I have discussed prisoner’s dilemma in several of my other posts. It seems like the rewards pool is a magnet for this problem. It appears that actions that are most beneficial to the user in the short-run are also the most detrimental to the community and the platform in the long-run. Such actions include:

- Circle voting (vote-for-vote)

- Self-voting

- Vote selling

These activities benefit the users in the short-run as they allow users to accumulate more Steem. If only a few users engage in these activities, it is not particularly harmful to the platform. Those not involved in these activities can act against those engaging in these activities by downvoting their content. This approach can be successful against circle voting and self-voting but not against vote selling, as the vote seller is rewarded immediately by the vote buyer. The vote buyers’ content can be downvoted but this becomes more difficult if vote selling becomes a large operation as it is currently on Steem.

If there is an inability to act against something, those losing out might join in the activity instead. This is in order to reap the same level of rewards. This is what is happening in regards to bid-bots. Bid-bot upvoted content is dominating the front page of Steemit and the community is unable to do anything as this content is very heavily upvoted. This is likely to have a negative effect on the price of Steem. This leads me to my next point regarding negative externalities.

Negative externalities

A negative externality is a negative effect on a party not involved in a particular transaction. The best example of negative externalities relates to buying upvotes from bots. There are many users of bots and a very large amount of Steem is delegated to bots. As bots are being used so widely and on such a scale, there are two notable negative externalities those not using bots will experience. These two externalities relate to curation and the price of Steem.

Let’s start with curation. The amount of Steem Power delegated to bid-bots that is being actively used to upvote content, is causing a considerable drain on the rewards pool. I have calculated that, at the time of this post, at least 32% of the rewards pool is being distributed by bid-bots and bot vote selling services. I calculated this number by summating all vote values of bots on bot tracker and multiplying by 10 (approximate average number of full votes per day per bot). There are still several bots that upvote posts that have not been included in my calculation. If we also include the rewards pool that is being distributed by circle voting and self-voting. It is quite possible that the real rewards pool that content creators are competing over is almost halved (less than 25,000 Steem a day).

It is not just the reduced rewards pool that those not using bots need to contend with. It is also the lack of visibility of being pushed down trending and hot pages by posts that have been promoted by bots. Non-bot users contend with reduced rewards pool and less exposure to capture that smaller rewards pool.

The next externality is the price of Steem, in my post ‘Bid bots and the possible economic implications’, at the time of that post, I determined that approximately 90% of the value of the top ten posts on the front page (trending page) of Steemit is from upvotes from bots. This content is not on the front page because of the support from community but instead because of the decision that a user has made to pay for their post to appear on the front page. This creates a very high risk of not portraying an accurate picture of Steem to the potential users and investors in the platform. This will have a negative effect on the price of Steem. The extent of this negative effect is very hard to determine. This now takes me to my next point regarding valuing the cost of externalities.

Hard to fully value the costs of negative externalities

We have a reasonable idea of the negative externalities faced by those not using bots and I have been able to roughly quantify at least some of that in terms of the rewards pool consumed by bid-bot voting. This negative externality can be captured and repaid into the rewards pool by bid-bots removing upvotes on Day 6, see my post ‘How do we prevent market failure caused by over delegation of steem power to bid bots’ where I explain this idea in detail. This idea is likely to be met with opposition as bot income would be reduced and Steem Power delegators’ short-run interests are hurt.

The negative effect on price is very difficult if not impossible to quantify. There are many factors that affect the price of Steem. Content on the front page is just one of those factors. Regression analysis could be attempted but this would be very difficult and most likely unreliable. Steem is unique, there are no other platforms that comparisons can be made against in regards to bot usage. A longitudinal study of the price would also be unreliable as so many others factors have also changed over the two years of Steem’s existence.

Attracting the wrong people

The wrong types of people seem to be attracted to Steem. These people appear more interested in earning as much as possible with as little effort as possible. This was particularly evident with the recent ‘Byteball Airdrop’. This problem mostly has its roots in the approach used to market Steem and the rewards pool externally. Steem is often promoted as a place to earn rewards from content. This is only a part of the Steem experience. To earn on Steem takes time, as users need to become established. It is not something that can be achieved overnight as it is often portrayed to newcomers.

There are users that invest in Steem to simply just delegate to a bot and then leave. This is not productive for the platform or for the new investor who is effectively earning to recover from the dilution of stake by the creation of the rewards pool. These investors would be better off buying a cryptocurrency that has a lower inflation rate.

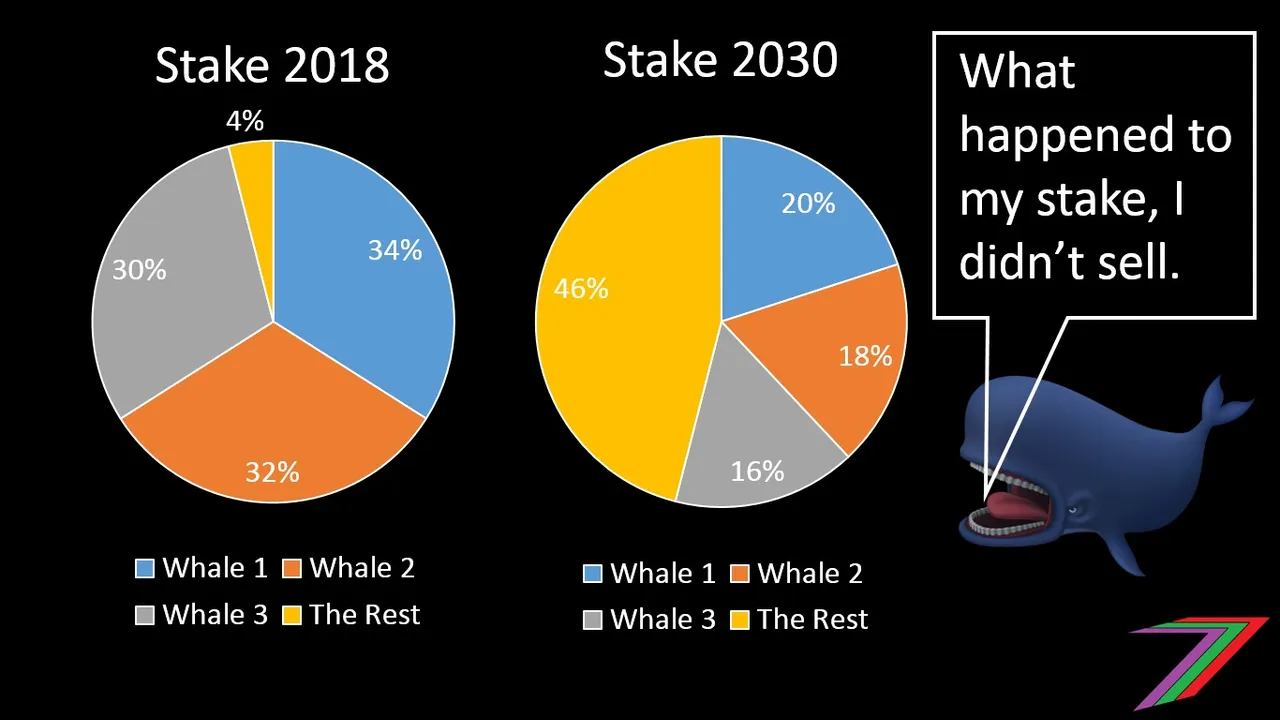

Those with small stakes have minimal influence

About 99% of Steem users have very little Steem Power. These user’s upvoters are worth about 0.01 Steem or lower. Therefore, these users cannot reward the content they want to reward because of their lack of influence. This is likely to cause many users of the platform to become disenfranchised and leave. This problem relates to the current stake-based voting used on Steem rather than a direct fault with the rewards pool. A few people have proposed switching to a 1 vote per account approach. This would encourage greater participation from those very little Steem Power but would antagonise those with a large stake as they lose a great benefit from holding Steem Power. A 1 vote per account system is likely to result in many investors leaving the platform because of the loss of benefits from holding Steem Power.

I have a solution to this problem, which I describe in some detail in my post ‘Changing the way voting works to improve fairness and rewards – My little fantasy’. In this post, I suggest that those with a higher stake are rewarded with more votes rather than higher valued votes. This may appear illogical at first but the post explains in some detail how such an approach could work.

My overall opinion on the rewards pool

I have described how the rewards pool functions. I have explained what I believe to be the main strengths and weaknesses of the rewards pool. Overall, I believe the rewards pool to be quite a marvel. I have not seen anything else anywhere near as effective at distributing rewards to content that is available free to be viewed by all. The rewards pool has a number of weaknesses but most of these have become exaggerated by users that do not understand the importance of growing Steem as a community. These users have instead opted for short-run gains that pale in comparison to the long-run potential.

Possibly the biggest challenge is having the right size rewards pool. Not too big and not too small. The rewards remains fairly constant in terms of the amount of Steem. The value of the rewards pool will fluctuate in national fiat currency (e.g. US dollars) as the price of Steem fluctuates. As the number of users increase, there will be greater competition for the rewards pool and average rewards in Steem will fall. It is therefore important that the price of Steem increases to maintain the value of the average rewards in US dollars.

Where else will my economic analyse of Steem take me?

I enjoy analysing Steem from an economics perspective. I believe I am one of the first economists to dedicate this much time to understanding Steem and the potential of a social media platform built on the blockchain. I still have a few more posts that I am planning to put together so I can dig even deeper into this fascinating world of Steem. I still have the final post in my market structure series. This post will focus on the oligopsony market structure. I felt I needed to dig deeper into Steem before I attempted such an ambitious post, which will liken the market structure of many of Steem’s top content creators to that of an oligopsony.

This takes me to end of another fairly detailed post about another important feature of the Steem platform (rewards pool). I hope you have found this post useful. I welcome any comments, feedback or questions regarding the rewards pool or any other area that has been raised in this post. Thank you for reading.

Below are links to my other recent posts regarding the Steem platform. Feel free to have a read, most of the ideas I have expressed in my previous posts are consistent with the views I have shared in this post.

Here is the link to the post ‘Bid bots and the possible economic implications’

Here is the link to the post ‘Bid bots and the possible economic implications’

Here is the link to the post ‘The trending page aka the front page of Steemit’

Here is the link to the post ‘Changing the way voting works to improve fairness and rewards – My little fantasy’

Here is the link to the post ‘Steem explained by an economist’