This is the first part of the guide, related to the basic concepts and the new curve introduced in the hardfork 21:

- Steem power and vests

- Reward shares

- Claims

- Convergent linear curve

- Payout distribution

Steem power and Vests

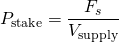

The steem power is the value of your vesting measured in steem. There is a common fund called total vesting fund steem (Fs), which contains all the steem that has been powered up, and each account has a part of it. The vesting shares (vs) determines how much steem of this fund your are entitled compared with the total vesting shares (VT).

Thus, the steem power is calculated as

Actually, this relation (Fs/VT) is equal to 503 steem per million vesting shares and this value is almost constant over time. It has an annual interest calculated by:

where isupply is the annual inflation of the virtual supply, and pstake is the percentage stake, which is the relation between the total vesting fund steem (Fs) and the virtual supply (Vsupply):

Today the percentage stake is 56% and the stake interest is 2.2% annual. The annual inflation of the virtual supply is 8.38% (which decreases 0.42% per year)

Reward shares (Rshares)

Each vesting share in the system has the right to generate, in a period of 5 days, 1 million rshares (positive or negative) plus 250k negative rshares. The generator is called the manabar, and the remaining rshares to be generated is called the current mana. The rshares are generated when voting and are transferred to the post.

As part of the hardfork 21 there are 2 manabars: The principal one for upvotes and downvotes (the one with 1 million rshares per vesting share), and the second one only for downvotes (250k negative rshares).

However, all rshares can not be generated in a single vote, but maximum 2% and 8% from the current mana of the principal manabar and downvote manabar respectively.

Note that the downvote manabar generates 1/4 of what the principal manabar generates, but at the same time it can be consume 4 times faster than the principal manabar. In the end, a single vote has maximum 2% of all posible rshares that can be generated with a certain amount of vesting shares.

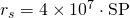

Then, the rshares generated in a vote are:

Where Power is a value between 0 and 0.02 and represents the percentage taken from the principal manabar, or the percentage taken from the downvote manabar divided by 4.

Considering that the relation between steem power and vesting shares is around 500 steem per million vesting share, and that a user is voting with his maximum power (0.02), then the rshares can be calculated as:

Threshold and last minute vote

There are 2 more rules regarding the rewards shares:

- Threshold. Always, no matter the value of the vote, 50 million rshares are subtracted from the rshares (and limited to 0 rshares). This is to prevent spamming. Using the previous formula we get that it represents a difference of 1.25 steem power, a very low value that can be neglected.

- Last minute vote. If the vote is done 12 hours before the payout then the reward shares are decreased proportionally to the remaining time for the payout. That is, half before 6 hours, and 0 just at time of the payout.

Claims

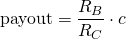

Claims represents the shares in the reward pool. Each 3 seconds, 65% of the new steem generated is transferred to the reward pool (called reward balance, RB). And this amount is compared with the total claims (called recent claims, RC) from all posts of the last 15 days. Each post has entitled some amount of claims, which depends on the number of rshares obtained. Then the post payout, measured in steem, is

where c is the number of claims.

Reward balance and the recent claims are 2 values that are constantly changing, and depend on the activity of authors and curators. Let's try to figure out an approximation.

Suppose that the activity of authors and curators is constant, meaning that new claims are compensated with the removed claims. If this is true then reward balance is equal to the new steem generated for rewards during 15 days, that is:

On the other hand, we know that 1 vesting share has the right to generate 1 million rshares in 5 days. Then, in 15 days it can generate 3 million rshares. Let's define Pactive as the percentage of steem power from all accounts that is used actively used in curation. Then the rshares generated in the last 15 days (recent rshares RR) are

In the harfork 19 and 20, this calculation is equal to recent claims, because one claim is one rshare.

So it is easy to calculate the active percentage in the hardforks 19 and 20 using this formula. Currently is around 50%.

But the problem is that in the hardfork 21 claims and rshares are different. Let's define "claims per rshare" (CR) as the average of claims that are generated per rshare. As we will see later, this value is between 0 and 1, and it is related to the distribution of votes (popular and non popular content). A value near to 0 means that there are a lot of posts with low votes and few with high votes. And the contrary with 1, a lot of posts well voted and few posts with low votes.

I performed a data analysis and today claims per rshare would be equal to 0.9 assuming we were in the hardfork 21.

Then, the recent claims can be calculated as

Taking the previous calculations, and also the percentage stake, we get that the relation between reward balance and recent claims is

If we suppose that most of these values remain constant (503 steem per million vests, 8.38% annual inflation, 56% percentage stake) then

This formula summarizes something evident but important to mention:

- As long as more steem power is used (more Pactive) the payments will decrease because the same reward is distributed to more hands.

- Each claim has more value when claims per rshare is low. Meaning that good posts have better return than the average compared with the linear rewards of HF19 and HF20.

Convergent linear curve

During the hardforks 19 and 20, one rshare was exactly one claim. The reason they are called "linear rewards" is because the claims are proportional to the rshares (1 to 1), and as the rshares are proportional to the steem power then a vote has the same value no matter if a new or popular post is voted.

However, the hardfork 21 introduces a new curve which is non linear, called the convergent linear curve. Its name is because it starts being a quadratic curve but as long as there are more rshares it tends to the linear curve. In this curve, the claims are calculated as

where rs are the rshares obtained by the post, and

Derivative of claims

You maybe wondering what is the value of a vote in terms of steem or sbd. The answer is that it depends on the post you are voting. When a post receives a new vote it increases its total rshares, and this growth represents an increase in the claims.

The derivative of the curve tells us how much is the growth of claims with respect to the growth of rshares.

The derivative of claims is

- This derivative evaluated in infinity gives 1, meaning that 10 rshares give 10 claims to the post if it was already popular (a lot of rshares).

- This derivative evaluated in 0 is equal to 1/2, meaning that 10 rshares give 5 claims to the post if it is new (no previous rshares).

As you see, there is a factor of 2 between voting a new post or a popular post. But what means infinity? at which point we can consider that the derivative is 1? To answer that let's see the inverse function of the derivative:

At which point the derivative is 0.9? in other words, if I vote with 100 rshares and it adds 90 claims to the post, what was the total payout of the post?

The answer is 9.89 Trillion rshares, which are the rshares that an account with 247K SP can give in a single vote. So, at this point we can say that the curve is almost linear.

The following table shows more values for the derivative and the expected rshares to reach it.

| Derivative | rshares | claims | Payout* |

|---|---|---|---|

| 0.8 | 4.65e+12 | 3.18e+12 | 4.5 steem |

| 0.9 | 9.89e+12 | 7.68e+12 | 11 steem |

| 0.99 | 4.86e+13 | 4.51e+13 | 64 steem |

| 0.999 | 1.71e+14 | 1.67e+14 | 238 steem |

- The payout value assuming that active percentage is 50% and claims per rshare is 0.9

The gap

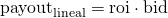

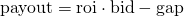

Let's define clineal as if the claims were calculated in linear rewards, and payoutlineal as if the payout were calculated using clineal:

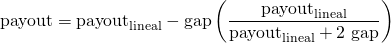

Now, let's rewrite the formula for claims. The idea is to see what is the difference between the payout and the linear payout. After some calculations it is easy to get:

If we evaluate this formula in infinity (popular content) we get that:

Meaning that claims are almost proportional to rshares, to the steem power. If the post is popular then we just have to subtract 2s from the rshares to calculate the claims.

This difference of 2s is what I call the gap. If we multiply the formula by RB/RC we get the relation seen in terms of steem:

being the gap equal to

This formula is very important, because is telling us that the payout can be calculated as the linear payout minus 5.7 steem* in popular posts.

- This value assuming all the constants calculated in the first part of the post.

If the post is not popular, the amount subtracted is less than the gap. In general, the payout is:

Self voting farm

Suppose that an account is creating k1 posts daily for self votes. Also, suppose that the account can create a total of X rshares daily. This means that to maximize the returns he is giving X/k1 rshares to each post. What is the payout he is getting?

Supposing that the posts are greater than 40 steem, we can consider they breach the gap and the rewards are almost linear. Being c1 the claims obtained per post then:

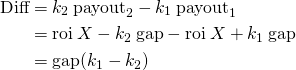

Now suppose that he changed the strategy to k2 posts daily. In this case:

What is the difference of these 2 strategies in terms of claims?

Which in terms of steem represents a difference of

Let's see some examples:

- Suppose that an account is making 60 posts daily. How can he maximize profits? If instead of dividing the steem power between 60 posts it is divided by 10 posts daily, then the account will get 285 more steem daily.

- Suppose that a guy has 4 accounts and each account creates 20 posts daily. How to maximize profits? If all the steem power is concentrated in only 10 posts of one account, then the extra profits are 5.7(80-10) = 400 steem daily.

Note that in these examples we do not mention what is the payout of each post. The unique assumption was that they were big. However we can calculate the extra profits.

Another way to understand this concept is using the analogy of taxis. When you take a taxi you pay a basic fare and on top of that the price of the distance to the final destination. But what happens if this distance is divided in two travels and you take two taxis? you pay two times the basic fare to travel the same distance. Here is the same with the gap, no matter the distance (rshares), what really matters when reducing costs is the number of times you take a taxi (number of posts) and pay the basic fare (gap).

As conclusion, the concentration of power in few posts will have better return than the distribution of power. However, as it is more concentrated then is more visible and discoverable for the community, which can downvote them if it is poor content. This is the principal objective of the convergent linear curve, the concentration of power.

This difference in profits is for the specific case when the payout is much greater than the gap and it can be considered to be in the linear zone. However, if it is not, then a more generic difference can be calculated as:

Bidbots

We saw before that the value of the vote depends not only on the rshares but also on the previous votes to the post. Then, regarding to bidbots, is difficult to measure what is the actual return for a particular bid. The relation 1:1 between rshares and claims is not valid anymore.

For this reason I think bidbot owners will calculate the vote using rshares as reference and not claims. In this scenario the payoutlineal will be proportional to the bid:

Then

Again, let's see a similar calculation to the previous section. Suppose that X amount of money is used to promots k1 posts. Then the payout is

If instead of k1 posts this money is distributed between k2 posts then

And the difference between these two strategies is

Example: A bid of 7 times 100 steem will get 34 more steem than 7 bids of 100 steem to different posts. And the conclusion is the same: There are more returns if the power (and bids) are concentrated in few posts.

Payout distribution

The hardfork 21 introduces a new change in the payout distribution. Now, 50% of the payout goes to the author and 50% goes to curators.

All payments for curators are powered up and transferred as vesting shares. In the case of the author, he can decide how much is payed as steem power and how much as SBD, with maximum 50% for SBD.

At the same time, the author can decide to distribute the payment among previously defined beneficiaries. The relation steem power / SBD is kept the same in this case.

The conversion from steem to SBD is done using the median feed price defined by the witnesses. Some rules are implemented in order to prevent the excessive debt and hyperinflation. They are described with the following concepts:

Debt ratio. This ratio is defined as the percentage of the SBD supply (converted to steem) with respect the virtual supply. It is expected that this value does not exceed 10%.

SBD print rate. When the debt ration is between 9% to 10%, then the SBD print rate varies from 100% to 0%. In this case, the author will receive part in SBD and part in steem depending on the amount that was converted.

Haircut. If the debt ratio reach 10%, meaning that the steem price is very low, then the peg to the dollar is broken and the haircut price is used for all conversions. This new price is exactly 9 times the sbd supply divided by the steem supply, which does not let the debt ratio increase beyond 10%.

This guide continues and finishes in the second part where we discuss the distribution of curation rewards.