The cryptocurrency world "coined" its own virtual terms.

Hodling and staking are two of these new slang words that encompass trivial purposes with complex means.

It all comes down to the possibility to make benefits and earn interests.

A shared benefit of staking and hodling compared with mining resides in the fact that one does not need a lot of money or a powerful machine running all the time to earn money.

Here are considerations for both terms.

Hodling

Hodling has the same exact meaning as holding.

It is simply a recommendation to keep one's assets in his wallet during a lengthy market correction.

In 2013, when the Bitcoin price was going down at an extremely rapid rate, an apparent drunk man mistakenly wrote the word in order to hold his BTC as an investment rather than undergoing the market fluctuations. The misspelled term became popular because of Bitcoin’s high price volatility.

Here you can find more information on the origin of the term.

Hodling only makes money on the market when it is going up as opposed to trading where one can make money from the market in both directions. One can earn impressive annualized returns by holding cryptos. One has to keep an asset long enough until he can resell it at a much higher price.

To hold, you need to own crypto that can be acquired on a cryptocurrency exchange or a trading platform. Then you have to store your coins in a wallet where you then hold your highly volatile digital assets.

In essence, hodling will not maximize capital potential and can even result in significant losses in the short term. However, it will avoid getting shaken out during violent corrections and it is an easy investment to earn benefits on a positive and long-term market.

Hodling is a great passive income strategy on one dormant crypto account. If you feel a bit weary by crypto fluctuations, you can simply leave your assets stored for a year and effortlessly earn benefits thanks to the bullish market trend.

Staking

Staking is almost the same as hodling with two fundamental differences at least.

First, in order to stake, you have to follow a project built on the Proof-of-Stake blockchain. Thus it is mostly linked to the Ethereum blockchain and the DeFi world.

When it comes to staking, once you own a private designated wallet and buy Ether, you will be able to make some extra benefit thanks to the Proof of Stake consensus algorithm. For that, you will simply have to lock up your crypto holdings to receive rewards.

Your deposit will in turn serves as collateral for the network resources to compute the next block to the chain. The collateral (the stake) is similar to a guarantee that one pledges for the payment of security (block rewards).

Once you purchase a minimum amount of coins on a PoS network, you earn a voting power; the stake. The more coins you hold, the more voting rights you are entitled to.

If you stake on ETH2.0 for example, you will be rewarded for the simple act of locking up your assets as it is considered a contribution to the network. The Ethereum blockchain network resources will compete to use your stakes to mine blocks.

As soon as the mining block is complete, you are paid with a proportion of the newly minted ETH. Your voting rights are the fuel to mine blocks and earn PoS benefits.

The second major difference with hodling is that staking means holding coins with the additional goal of receiving interest.

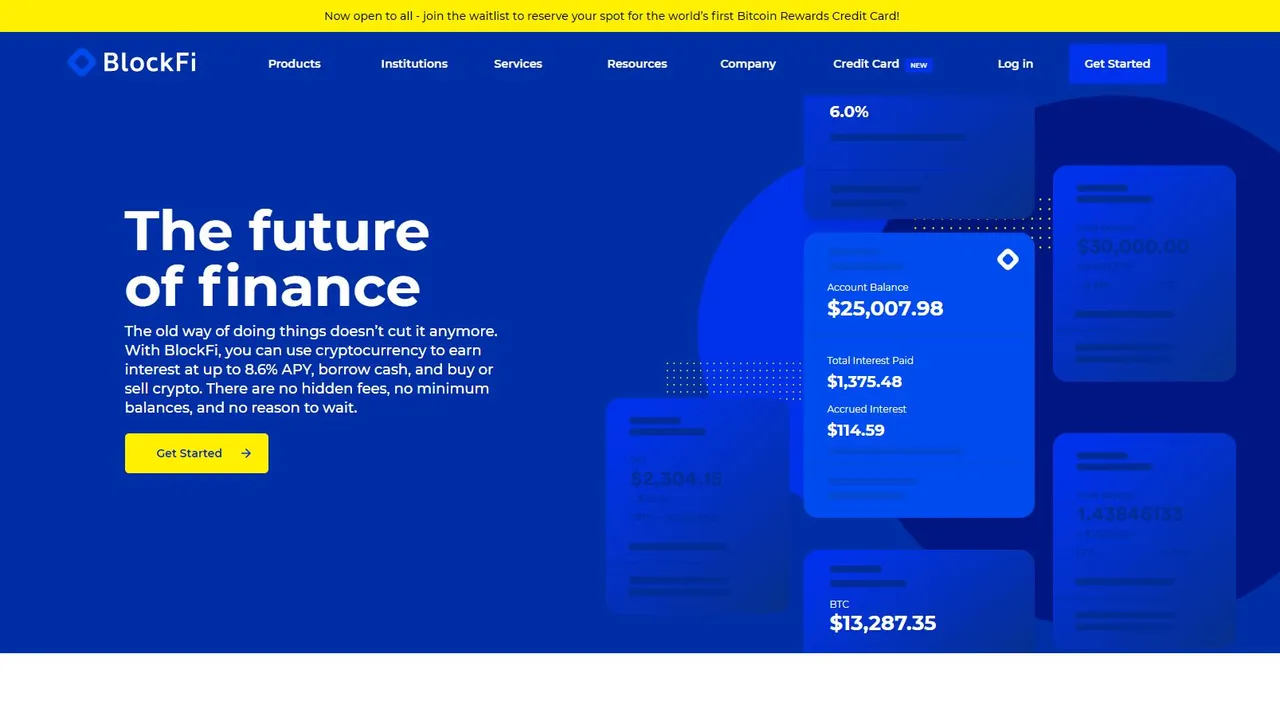

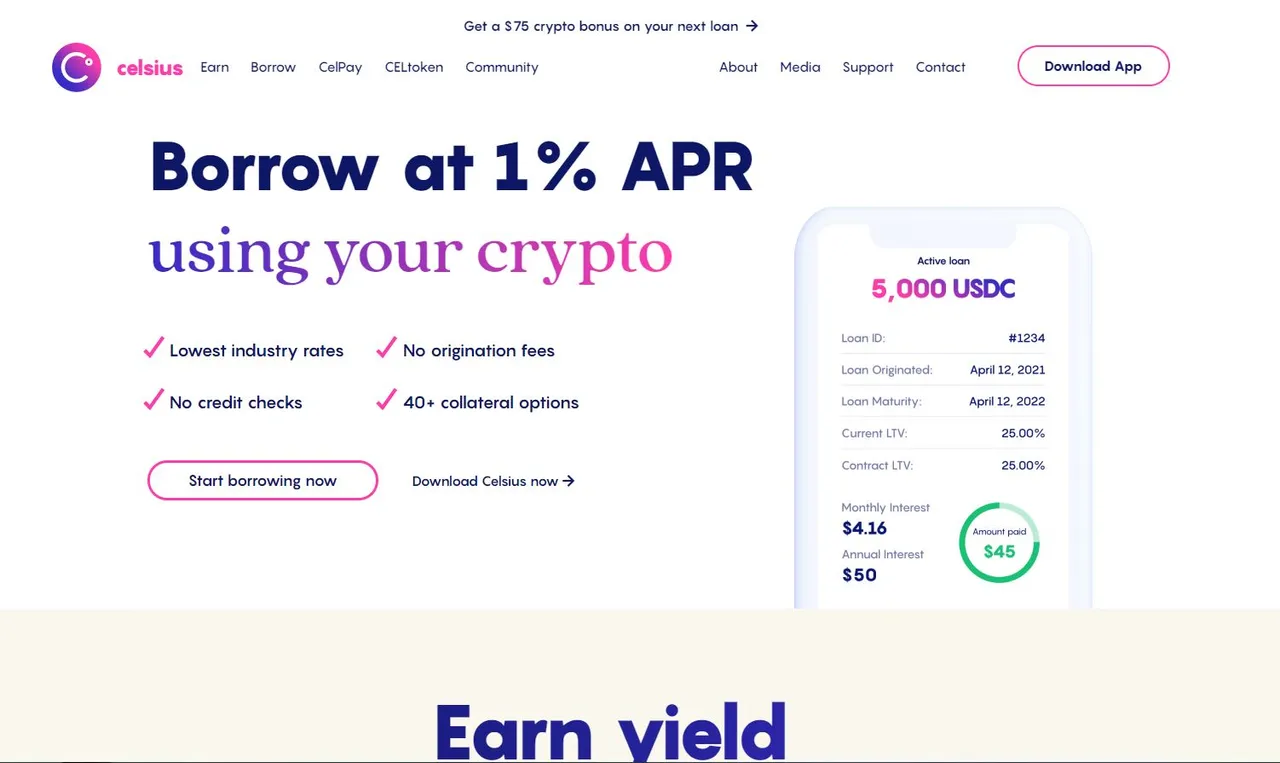

BlockFi and Celsius are two such crypto platforms that deliver interest on your deposit. These are like crypto savings accounts that aim at giving fair interest, close to zero fees, and lightning-quick transactions. BlockFi lets investors instantly transfer their funds out of the account.

Both sites have expanded their products and services even further like crypto trading or the first bitcoin rewards credit card for BlockFi.

A BlockFi Interest Account (BIA) supposedly earns up to 8.6% APY. APY stands for Annual Percentage Yield. It is a measure of the actual rate of return that will be earned on the compounded interest after one year.

As one term is chained to another, we also need to explain what is compounded interest.

Compounding is the process of gaining more interest thanks to the previous increase of one's balance due to the earning of previous interest. One asset's earnings are reinvested to generate additional earnings over time. It is thus a virtuous circle. The more often one's interest is compounded, the bigger one's return.

Albert Einstein allegedly referred to compound interest as mankind's greatest invention.

By the way, Annual Percentage Yield (APY) is not the same as Annual Percentage Rate (APR). APR is the annual rate of return before factoring in compound interest whereas APY is the same with compound interest factored in.

On BlockFi, your interest ought to increase daily with the general bullish trend of the crypto market. The interests are paid monthly and in principle, there are no hidden fees and no minimum balances as well. However, if the market undergoes an elongated correction, it is not guaranteed that the same minimal interest rate can be expected to apply after a few months.

For its part, Celsius claims to provide from 6 up to 17.78 % interest if one transfers his currency to Celsius. It is actually a little more than 6 % for Bitcoin and Ether.

If you stake your belongings in CEL token instead (currently values $6.08), a deposit of $1000 will bring up to $5.5 a month and $66 a year with a theoretical 6.61 % APY (for orders over $25,000 USD of CEL, the 17.78 % APY applies and it gives access to higher rates on earnings and lower rates on loans).

As another example, USDT Tether yields at 13.30 % APY.

Both all-in-one crypto bank companies also offer low-cost loans and a high compounding reward income wallet. Yet only Celsius owns an Etherium based coin, the CEL. End of last year, Celsius contributed 25,000 ETH from Celsius's pool of community assets to help launch Ethereum 2.0.

On the other hand, BlockFi appears satisfied enough by being capable of producing interest for account holders. Offering interest capable of outpacing inflation is already a big challenge.

Youhodler and AAX are other examples of staking platforms among other features. All of them offer dedicated mobile apps and all-sprawling financial products.

Along with trading, staking is certainly a spearhead in the world of DeFi while holding plays a shield-like investment role.

TLDR, Too Long Didn't Read!

Pray for no Proof-of-Vaccination blockchain!

More seriously (actually no), both staking and hodling are two different ways of making crypto investment.

The bottom line remains in the end that staking is making rewards for participating in the creation of new tokens while hodling is for making benefits by holding a digital asset for a long period.

While one offers direct rewards, the other offers a more stable yet less sweaty investment.

The difference can still be blurry though as it is possible to make big gains in the short term while hodling and make fewer profits by staking at the same time.

One has to decide what kind of investor he prefers to be, to look for stability or prefer the more complex rewarding approach.

With all that said, it is always smart to finish an article with a famous quote that makes you look smarter than you really are.

Money is coined liberty, and so it is ten times dearer to a man who is deprived of freedom. If money is jingling in his pocket, he is half consoled, even though he cannot spend it. Fyodor Dostoevsky

Simply put: “Good Money Is Coined Liberty"