Hello and welcome to this SPinvest post

SPinvest is a tokenized investment fund/club for all users of social blockchains. Everyone is welcome! The concept of SPinvest is to get rich slowly by using time tested methods of earning, saving and compounding long term. This lets SPinvest offer an ROI of 20% per year on SPI tokens. We encourage long term investing on and off the blockchain. We hope someday everyone will HODL some SPI tokens that can be bought directly from @spinvest are through the hive-engine

.

For as long as I can remember, when it came to investing, banks were always based upon a different metric. It was the one industry where book value is a metric that is discussed.

Why is that?

The idea behind book value is it creates a baseline for what the institution is worth. If you could determine its book value, the amount of money that basically could be liquidated out, then we could see how much it was worth. Then a comparison to the stock price could be made to see how much of a premium over book value was being paid.

Naturally, there are other facts the market looks as such as returns on assets and the overall growth of the institution. However, this metric is extremely valuable.

Each Saturday, @spinvest puts up its report detailing how much it earned and what it is holding. In it, there is a value per token based upon the assets that SPInvest is holding. This is the real gem to the project.

As the value of the SPInvest assets goes up, so does the token value. This is common sense so I am sure most can follow along. The math is rather simple: asset value divided by the number of tokens outstanding.

The fact that SPInvest's value has grown so much causes people to worry about missing out. They think the ship already sailed. The challenge with this viewpoint is the fact that we are seeing the value of the assets held consistently grow. Hence, this is one of the most conservative investments there are. It is akin to investing in stodgy old banks.

Here is the real kicker: the value that is backing the SPI token is real. It is there. This is something that is not dependent upon the pricing mechanism of SPI. Nor is it reliant upon the liquidity of the token. Certainly, those are important from a market mechanism standpoint but for one's asset holdings, it is not.

How can this be the case?

It is the same with banks: what is the breakup value? In other words, if everything was liquidated out and sold, what would be given to the holders of the SPI token?

The answer to this is in the weekly report. What is listed as the token price is not the market pricing of SPI but, rather, the market value of all of its holdings. This is key.

Thus, if the decision was made to close down SPI, the assets would be sold off and each person would get the associated HIVE as it pertained to the number of tokens held.

To be honest, SPInvest is a rather exclusive club. There are few members which is shown by the trading volume of the token. On this surface this looks bad since a lack of liquidity can make exiting a position, especially for large token holders, difficult.

However, when we realize there are real assets backing the token price, and each token effectively can be thought as a claim against a certain percentage of said assets, then we see how, worst case scenario, the token holders are protected.

SPI's value is not derived from speculation on the token. Sure there is a price the market sets for it. Nevertheless, the value is set for each asset. That is where SPI's growth comes from.

As for the idea of it being too late, just look at SPI's assets that are being held. Do you think the ship left dock on them? There is more than 1 full Bitcoin held; do you think that will go higher over the next few years? How about the Leo holding? We already saw a near doubling in the price of Hive, is there more? What about the airdop's that are coming from Leofinance and 3Speak?

All these adds to the value of the holdings of the fund which, can be liquidated if needed, and given back to the token holders.

This means that SPI is one of the sounder investments out there, even before we take the dividends into account.

.

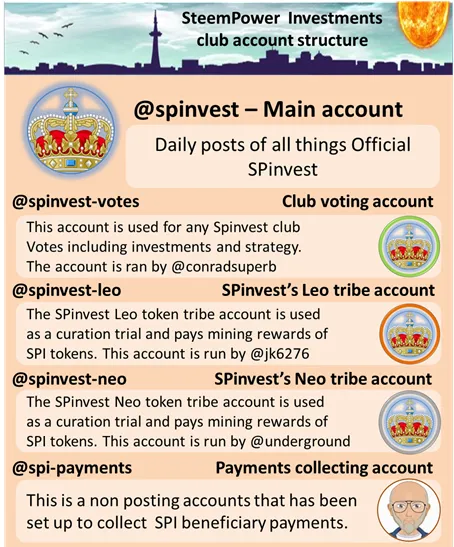

SPinvest's content is contributed by @silverstackeruk, @no-advice, @metzli & @taskmaster4450

Today's post comes to you from @taskmaster4450