I am officially anti-SBD after making this comment on @krnel's post.

According to coinmarketcap.com, over 50 million Steem have been printed over the last year. Yes, you heard me right. We've generated over 20% inflation in the last year. How? SBD.

SBD is a completely failed experiment. It can't hold it's peg and it devalues our currency. It's less than worthless. It actively hurts our platform by increasing volatility and forcing us to print more coins than we should.

What?

SBD is viewed as the debt of Steem because you can destroy them and receive $1 worth of Steem for each SBD burned. However, this mechanic only soft-pegs the bottom-end of the currency to $1. Even this peg is broken because of our haircut rule. As of this moment, you only get around 60 cents worth of Steem for each SBD burned.

When?

During the bull run, way more SBD was being printed than we can now afford to pay back. When Steem was $5 a coin, a post worth $40 generated 20 SBD. None of this SBD got burned because SBD was valued higher than $1. Why would anyone trade an asset worth more than $1 for $1?

Today, that same $40 post would have a face value of $2 because Steem has lost 20 times its value. The $40 post should have created 8 Steem coins of inflation. Instead the SBD alone generated somewhere between 20 and 50 Steem coins because SBD didn't come back to $1 until August when Steem was also $1. Today, the haircut rule allows 1 SBD to be traded for 2.5 coins. This downward pressure will continue until SBD finally gets back up to $1.

Where?

The main problem with SBD can be pinpointed to the fact that it is too closely correlated with the price of Steem. If the value of SBD approached $1 every week or even every month we would not be having this problem right now. However, we obviously don't print enough SBD fast enough to devalue it, and we can't afford to burn them fast enough either because by the time we get to that moment we've already dug too big of a hole. It's quite the Catch-22.

Why?

SBD was supposed to be a less volatile asset than Steem soft-pegged to the dollar. With a peak of $14 and a low of $0.60 we see that it is no less volatile than Steem ($8 - $0.25). Unless we want to have a more volatile coin with high inflation there is absolutely no point in keeping SBD around except for the fact that it would be a pain to remove.

Alternative?

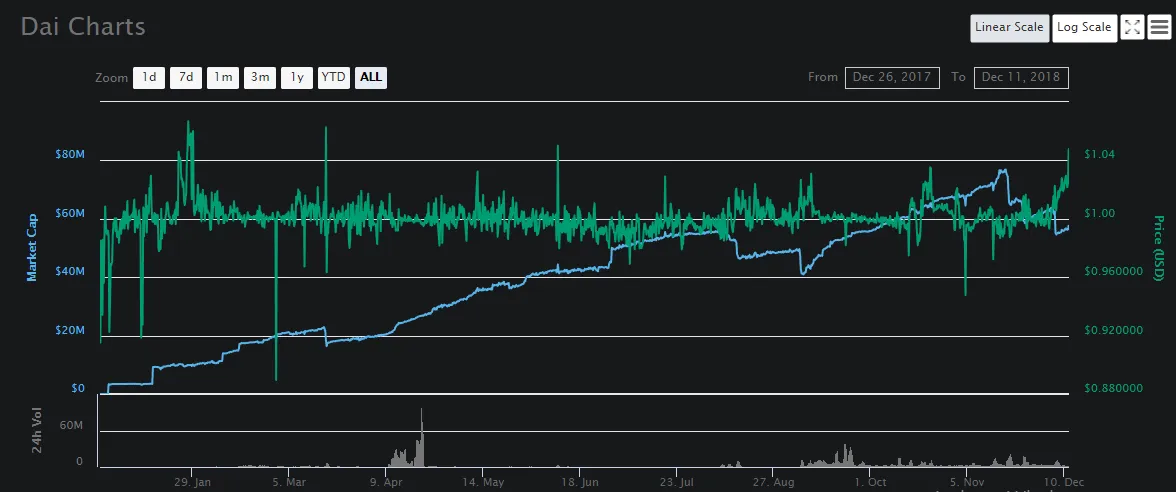

I've been saying for a while that I'd really like to see a version of the MakerDAO platform on Steem. If we provide an alternate way for users to create and burn SBD the problem will get solved and we might not even have to hard-fork.

The way it works is simple... ish. Steem coins would be staked in a collateralized debt position. Anyone with one of these positions is allowed to create SBD based on how much Steem collateral they've staked. For example, let's say I stake $1000 worth of Steem in a CDP. I would now be allowed to create 500 SBD "out of thin air" but I wouldn't be able to withdraw my Steem until I paid it back.

The Maker/Dai solution is absolutely superior to what we have now. The price often hits $1 multiple times a day. When the value is less than $1, users are incentivized to buy in order to pay off their loans at a discounted price. When the value is > $1 there is an incentive to stake more collateral and create more stable-coins.

If we somehow combined this system with our own I think we'd have a product that was far superior to Maker/Dai. With zero fees and three second blocks our blockchain can react faster to crashes in the market. In addition, the old stabilization methods would still be in effect, which would make it slightly more stable. We'd be able to burn coins by either paying off a CDP or converting SBD for Steem. We'd create coins with inflation or by backing them with collateral. Having all these options would finally break the correlation of SBD value to Steem value and we'd stop being put in a situation where we're forced to create more inflation than we claimed we were going to.

Unfortunately, this is a lot of work that no one really has a direct incentive to develop. Obviously, Steemit Inc. has quite enough on their plate :(