In about a month my little project Hive Power Ventures and the token $PWR will be one year old.

And yes, as I stated in the first roadmap , it's time to talk about Hive Dividends.

During the last year, the PWR token was obtained as a reward for a delegation of Hive Power and its main purpose for most users was to sell it for a profit on Hive.

There was an alternative route, which is basically to become a liquidity provider and contribute the PWRs obtained to a pool together with HIVE in exchange for a higher APR (paid in more PWR).

For obvious reasons, leaving Hive in the pool is not attractive to most users as it adds a factor of uncertainty (although it is technically possible to do so without risk if you stick to Hive and PWRs obtained from the delegation's APR).

Hive Dividends to PWR holders come to partially change that and add intrinsic value to PWR.

Ok, so for having PWR in my wallet I will receive a daily/weekly payment in Hive, right?

Nope! That's not how it's going to work.

To receive HIVE for holding PWR you will be required to be a Liquidity Provider of the SWAP.HIVE - PWR Pool.

Or in other words, apart from receiving PWR , you will also receive HIVE for pooling both assets in a daily payment to your Hive-Engine wallet.

This is done like this because for now it's a very cheap solution (no coding required and tools already available on HE) but more importantly because it's sustainable and potentially much more atttractive vs. regular dividends. It's also fairer and in my opinion better for everyone.

An important factor to note is the ratio of the two assets.

As the title says, initially it will be 50/50 in HIVE and PWR.

This means that you will receive both Hive and PWR equally.

You will no longer need to sell your APR paid in PWR if you want to compound. You can just keep adding liquidity.

I will give more exact numbers as the date approaches, but I think it's realistic to expect APR's NO SMALLER than the current ones.

So, expect an APR of 20% as long as liquidity on the pool doesn't increase dramatically;

(10% in HIVE, 10% in PWR) at least initially.

But the truth is that I want higher APR's, potentially 30 or 40%.

However, let's launch and well see later.

From September onwards the APR for delegating HIVE Power to @empo.voter will decrease from 12% to 8%.

This will mark an important moment in the life cycle of the project as the balance will shift in favour of the project vs. the delegators.

It has been in balance for the last six months, but from this point onwards Hive Power Ventures will earn more gross Hive than it will ‘nominally’ pay out in PWR.

This means that ''easy PWR farming times'' will soon come to an end.

PWR will be much scarcer and harder to obtain than before. And it will be supercharged with a high APR.

These changes will take effect the week beginning 9 September 2024.

So approx ~40 days from now.

I will fine-tune the date as we get closer.

Maybe this is not fully related with the dividends matter but... It's worth to mention.

You may recall that a couple of months ago, I ‘self-repaid’ the initial liquidity I used on day one to ensure a minimum depth of the liquidity pool.

The main reason was to keep prioritising the stacking of Hive Power rather than a deeper pool (with project funds).

With the upcoming changes I see more important than ever to have a deep liquidity pool.

The Problem is... If I use funds on my name I'm not giving any guarantee about ''for how long this liquidity will stay there?'' (since I'm not really forced to anything, my tokens are the same as the tokens of everyone else).

For that reason I decided to make a move and finally address this matter in the most neutral way i could thought about:

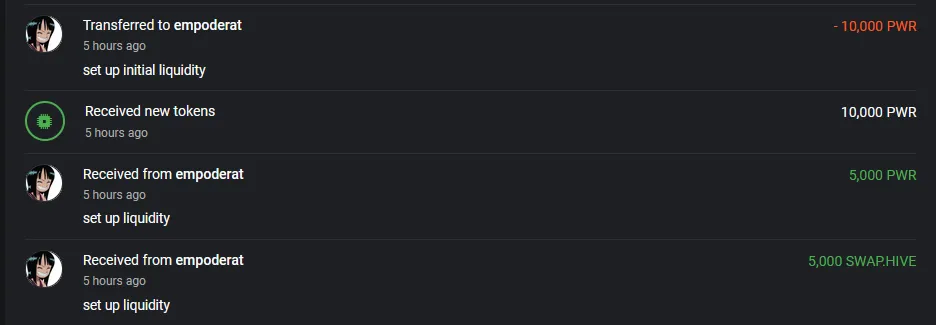

Provided @vventures with 5000 HIVE and 5000 PWR (from my own funds).

In exchange (since this is not a donation), I minted and sent to myself 10.000 PWR.

TL;DR: I funded the project with 5000 HIVE and 5000 PWR were minted and sent in exchange.

The purpose of this tokens is nothing more than guaranteeing a minimum level of depth in the pool. With dividends coming will be increasingly important and I don't want to desestabilize the market just because I want to move funds around and I'm the biggest LP. This liquidity will simply stay there.

Dividends obtained by @vventures will obviously be recycled back.

I'm very excited to see how people react to the fact of seeing a pool which pays liquid HIVE.

Hive Power Ventures and it's token $PWR is evolving and this is only the next natural step.

For now it's 'soft pegged' 1:1 with HIVE but long-term the goals has always been to overcollateralize and be a grow token. But this is matter for another day.

For now, let's enjoy SUMMER!

Wake me up... when September starts!

Thanks for reading!