Binance constantly adds new crypto opportunities and offers a plethora of methods to earn crypto. From Launchpad/Launchpool to locked staking, there is always something that can generate profit. Checking constantly the news and updates can lead to a higher awareness and a higher rate of earnings. I follow Binance on Twitter and I check the "Latest Binance News", "Latest Activities" and the Launchpad tab daily. Knowledge is money and being up to date with the opportunities is mandatory for success.

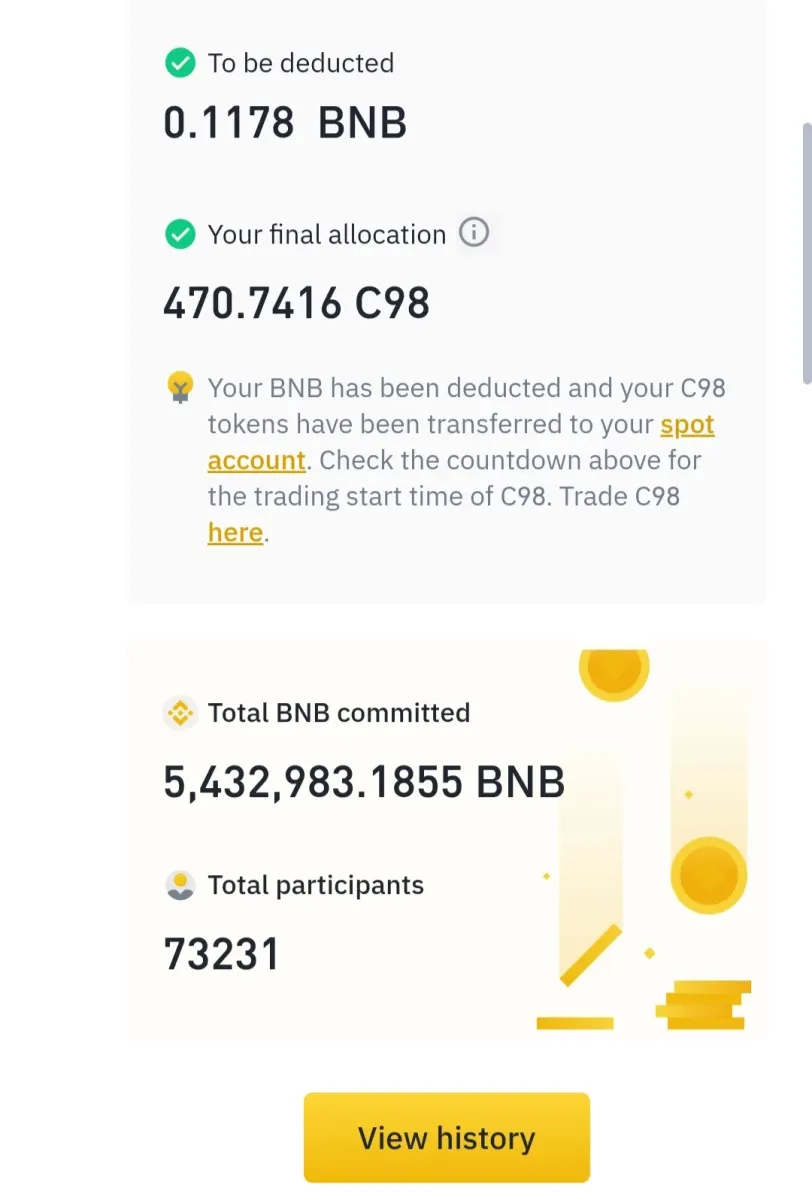

Binance Launchpad - Users must hold BNB and the daily average will be calculated over the preparation period. After the preparation ends, the participants must commit BNB to receive a share of the allocation. For the Coin98 Launchpad I committed my full BNB stash and only 0.1178 BNB was deducted. This was enough to receive 470 C98 tokens, which I sold for $506 and added 2 more BNB in the Vault. The Binance Launchpad is a quick method to earn crypto, as the earnings are obtained in only few hours.

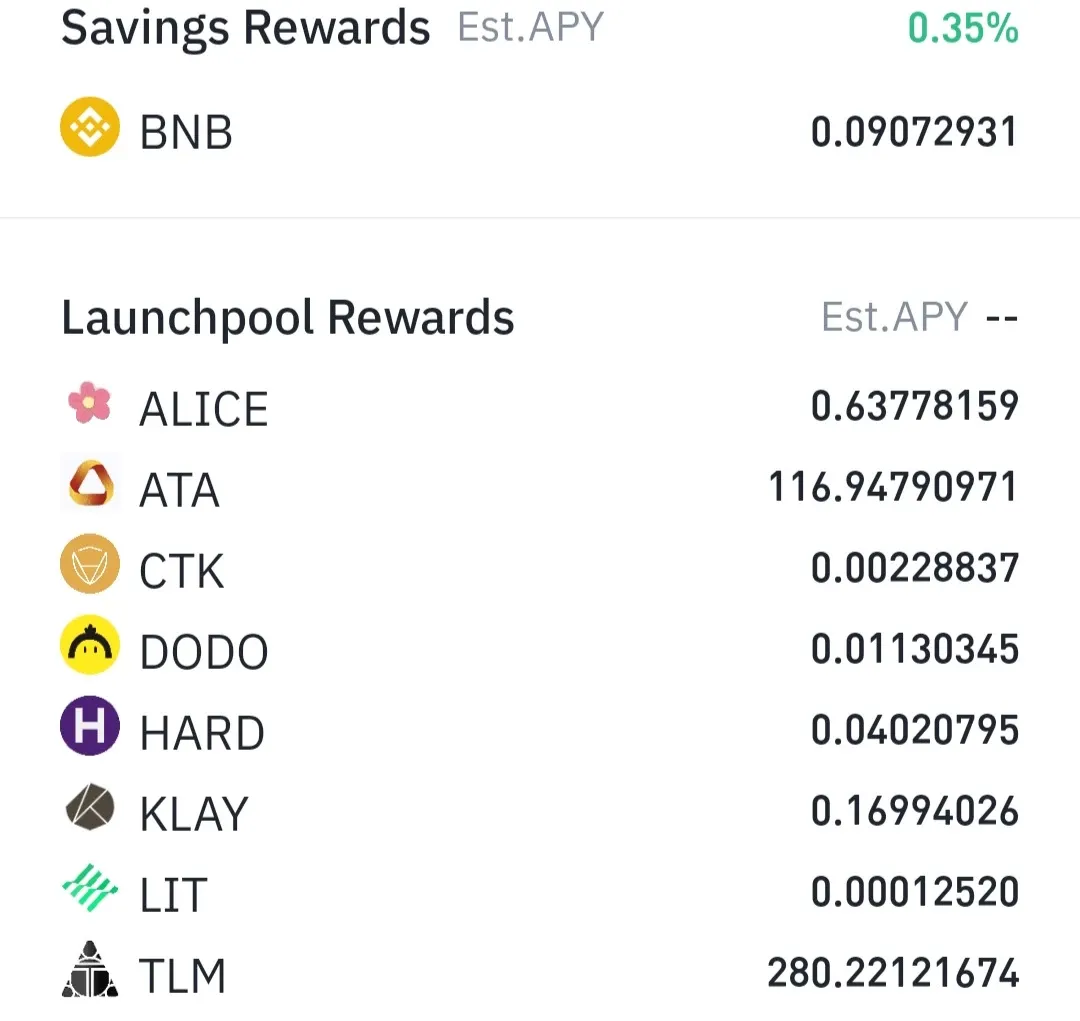

Binance Launchpool - Staking Binance Coin (BNB), Binance USD (BUSD) and sometimes another token related to the Launchpool is required to earn. Holding BNB in the BNB Vault will also distribute rewards, but will share the Binance Coin amount in equal parts if more then one Launchpool will be active. The usual farming period will be 30 days, even if some events had a shorter timeframe. The period before the official listing will reward more tokens, and the farming rate will drop after the token will be added into the Innovation Zone.

Klaytin was the last event, at the end of June, which makes me think that a new Launchpool may be announced soon. I usually sell my farmed tokens on listing day, at a higher price, and I will buy back once the price drops if I consider the project promising.

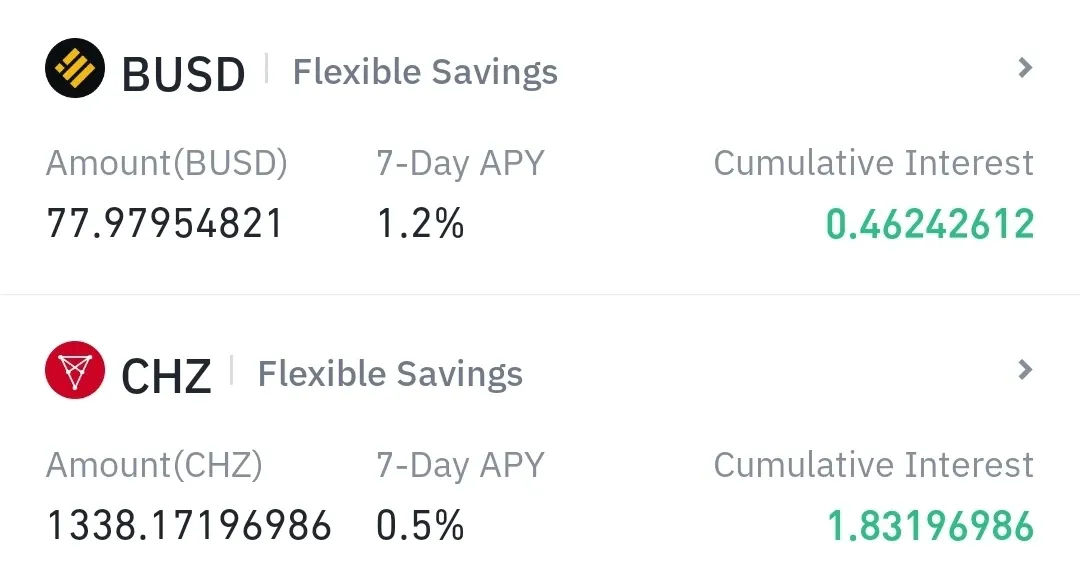

Flexible Staking - Binance keeps adding new crypto for flexible staking. If the "Auto-Subscription" is activated, the asset and every earnings will move automatically into savings on a daily basis. The APY is low but earning little is better than not earning at all. The funds from flexible staking can be redeemed at any time, with no locking period or fees. If the Flexible Savings option is available, than I will auto-subscribe and keep the tokens in Savings, until a locked stacking opportunity will arise.

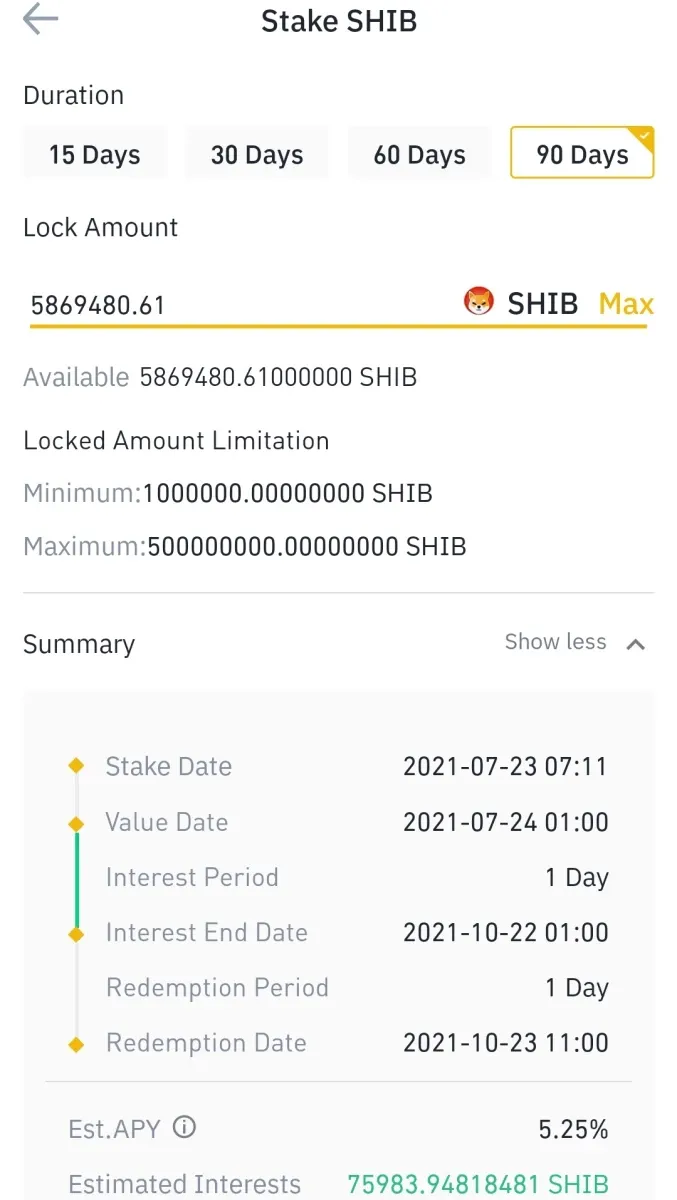

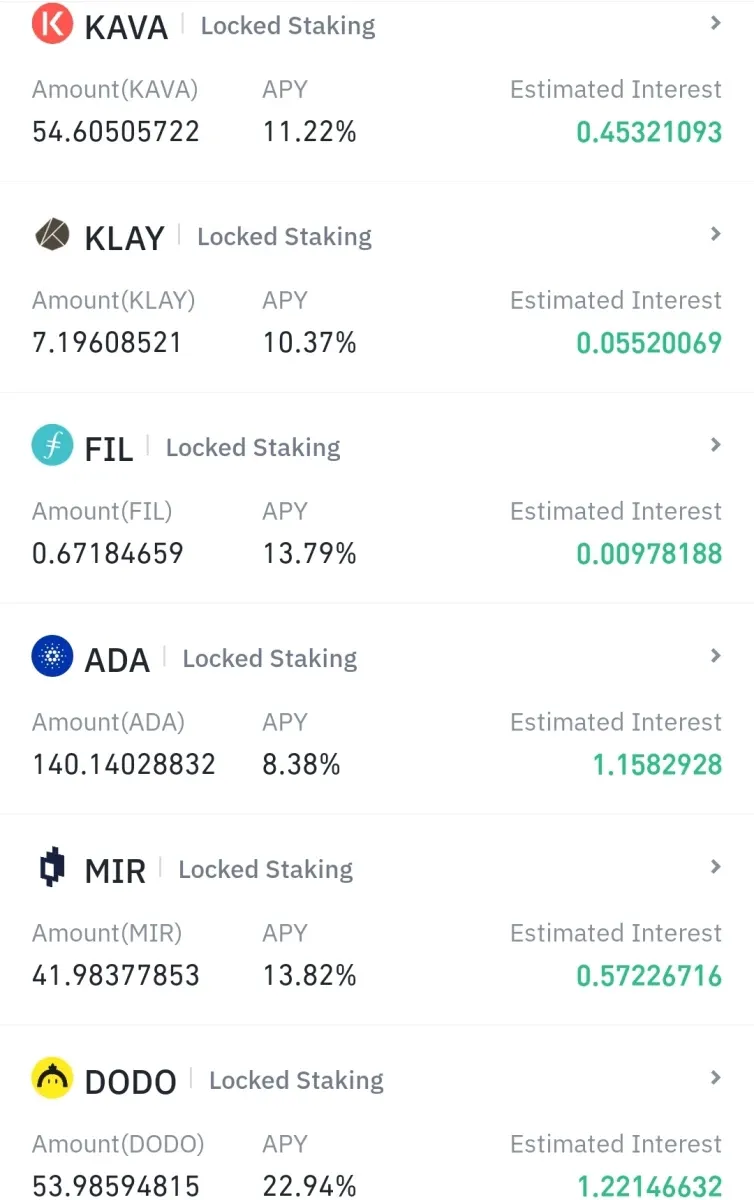

Locked staking - The name says it all! Cryptocurrencies are locked for a fixed period, between 15 and 90 days, and will earn rewards at a higher rate than Flexible Savings. Usually the longer periods are the first to sold out and I was "lucky" to catch the 90 days $SHIB lockout only because I followed the news. I locked 5.8 million Shiba Inu for 3 months and I will earn an estimated 75,983 SHIB during this period. Three months are not an issue, considering I paid $20 for my coins and planning to hold them until they will match the Dogecoin Hype.

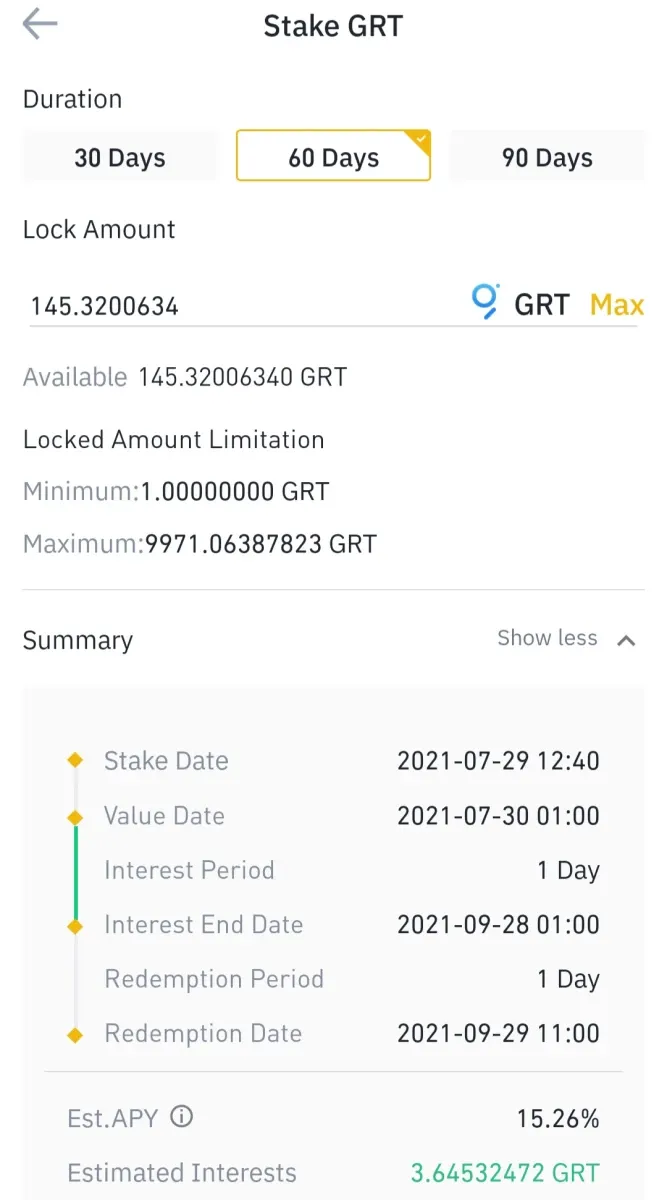

Only a 60 days locking period available for The Graph ($GRT), 15% APY and an estimated 3.6 GRT reward after two months, $3.15 at the current value.

Knowledge is power... knowledge is money! Keep following the news to be one step ahead of others. The Locked Staking updates and new opportunities are added at mid-day and being ready to stake close to that time will increase the chance for a longer locking period. I don't sell unless the price is right and having the tokens locked helps me to HODL. The enhanced APY helps to grow the portfolio, putting lazy crypto at work.

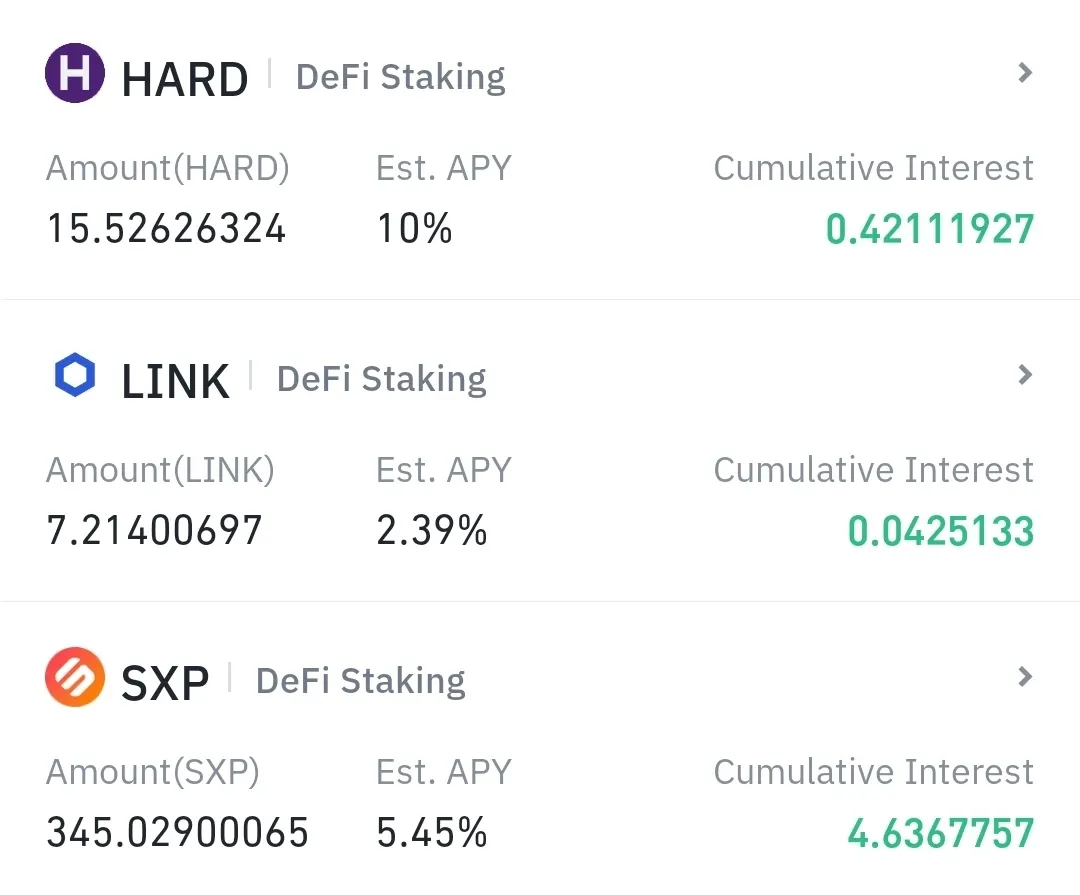

DeFi Staking - Binance acts as a platform to showcase projects and provide accessing to funds on behalf of the user. This staking has a risk warning, as Binance is not liable for any losses incurred due to security issues. Well... I assume the DeFi lenders are still verified by Binance and the risk is low. I will still add assets into DeFi staking, regardless the risk warning.

BNB Vault - The BNB interest is calculated daily, excluding any BNB added on the day of staking. The BNB kept in the Vault is eligible for airdrops, Launchpad and Launchpool, adding daily BNB rewards on a daily basis.

Library:

Binance - create a new account

I successfully participated in the Coin98 (C98) sale on Binance Launchpad

Binance Launchpool - Klaytn (KLAY) added as the 21st project

Resources:

The fountains: PipeFlare ZCash, GlobalHive ZCash & Get.ZEN

Publishing bundle: Publish0x, ReadCash, LBRY & Presearch

- This article may have been published on ReadCash or Publish0X