PDF DOWNLOAD: https://drive.google.com/file/d/0B8q3CwnJVwZsaS1vWlIxRFM5LVE/view

Source : http://www.ril.com/

RIL

■India based largest private sector company

■Market cap : US$36bn

■Revenue : 2.8% of the GDP

■Contribution to total export : 8.2%

■Contribution to Gov't tax revenues : 8%

■Weighting in Sensex : 11.5%

■Credit rating : Baa2 (Moody's) and BBB (S&P)

<- one and two notches above Indian's soverign rating.

■Business through whole hydrocarbon value chain, Refining 57%,

■Third largest refinery -> Construction (Ahead of schedule, within budget)

and O&M (100% Utilisation, Complexity 11.3, GRMs US$2~$3 above Singapore

benchmark) well done

RPL

■Location : Special Economic Zone

■Export-oriented refinery complexes

■Scale : Sixth largest globally

■Capacity to process (Supply) : 580,000 barrels per day of crude oil, 900,000

tonnes/annum polypropylene plant

■Output product: Light and middle distillates (mainly transportation fuels)

■License: UOP, EMRE, Foster Wheeler & Dow (Proven technology)

■Offtake : European market : jet fuel, kerosene & diesel / US & Asia : gasoline /

Asia : polypropylene.

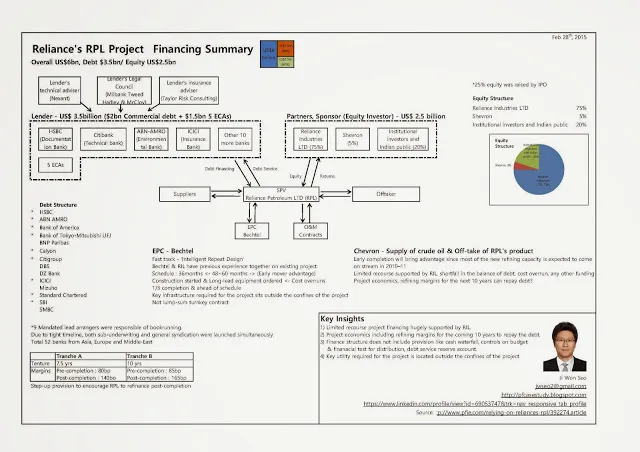

■Cost : US$6bn <- Equity US$2.5bn / Debt $3.5bn

■Equity -> IPO

Source : http://www.pfie.com/relying-on-reliances-rpl/392274.article