Hello HODLers,

Today I was going over some big metrics in the DeFi space as I was thinking I should stop with the degen craze for a few reasons:

- It is very risky and therefore stressfull

- I do not get amazing returns for the amount of time spent that I could allocate to continuing learning programming or spend with my family.

- There are dozen of legit platforms giving long term APY of +100% so why risk it on some dodgy platform?

Realizing this and deciding to move my capital around I checked some metrics on DappRadar

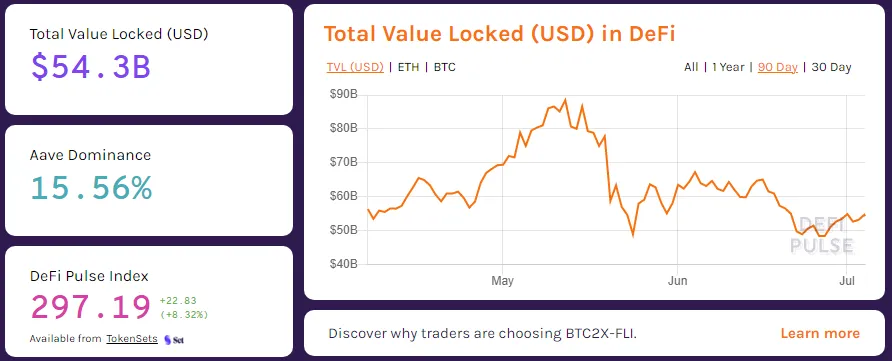

Total value locked (TVL) in DeFi Crypto

As we can see, the total DeFi TVL has been trending up over the past few days and this is great to see as Crypto investors are taking a breather.

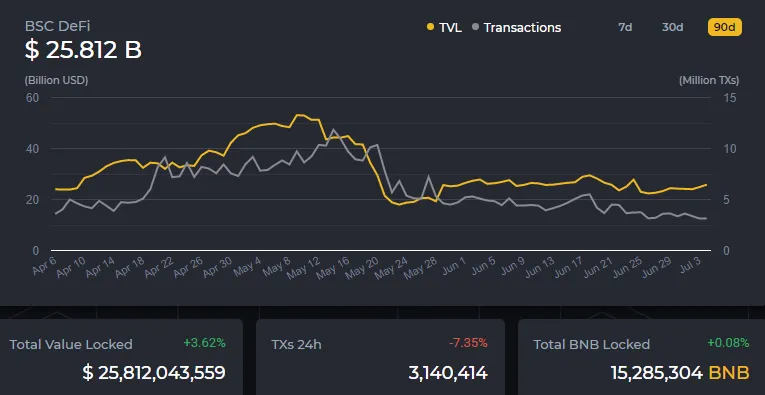

BSC Total Value Lock (TVL)

Ethereum Smart Chain TVL

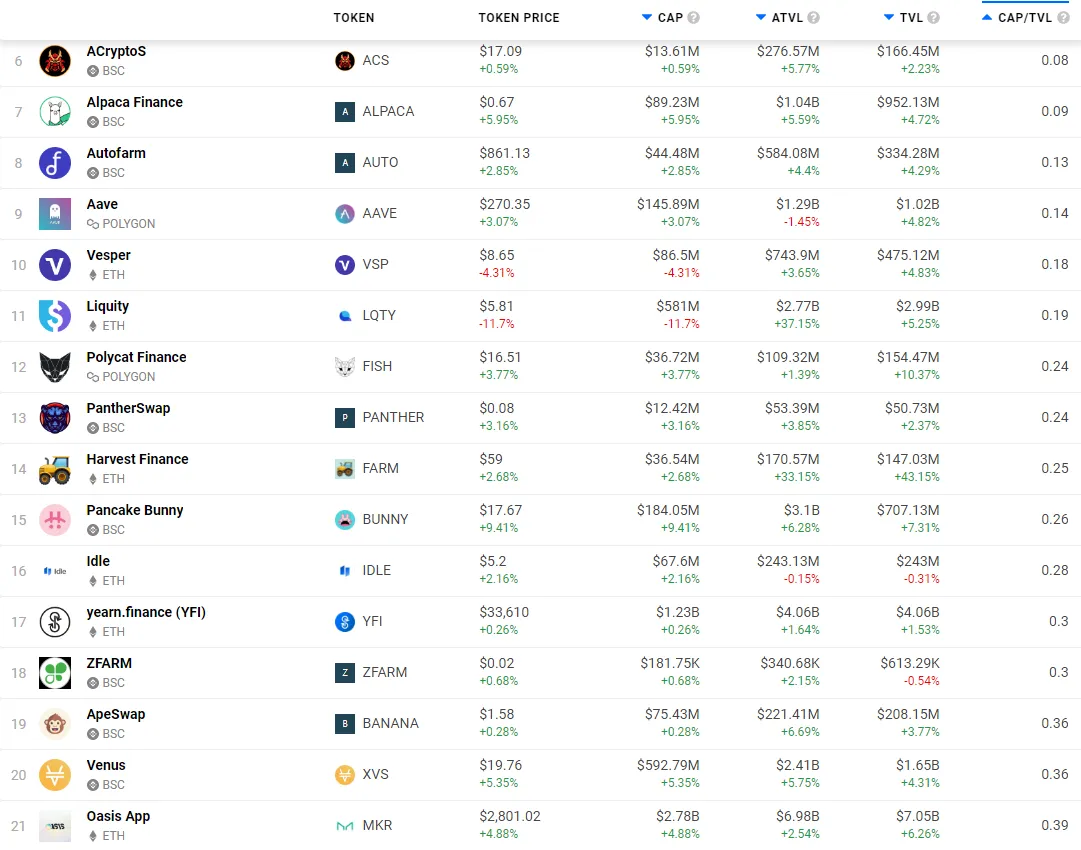

The magic ratio?

Below is a graph of the following ratio:

Fully diluted market cap / nominal TVL.

What does it means?

Basically this is the current total valuation of a project divided by the assets under management on their platform.

As you probably guessed, it means that the lower this ratio is, the cheaper this project/crypto is !

Caveat: It also depends on what business they run as a project that takes more management fees could be valued at a higher Diluted MktCap/TVL.

I am not familiar with all these platforms but I would think a $ on an AMM (PancakeSwap / Uniswap) is probably worth more than a $ on Autocompounding platform such as Autofarm, Yearn.finance, Harvest Finance...

Looking at this list, there are a lot of paltforms I need to do research on but this made me double down on Apeswap (PancakeSwap fork) and Harvest Finance: legit project with a lot of innovation but still a low TVL imho.

Which platform do you like in this list?