A great deal of attention was paid to the Hive Backed Dollar (HBD) over the last few months. After being overlooked for so long, it finally started to receive the attention it deserves.

Many steps were taken before the last hard fork and with the coding during the upgrade to provide the tools to peg the price of HBD to the $1. Prior to this, the range on HBD was anything but stable. With a cycle of .50 to 2.00 (or worse), that simply did not fill the need.

Source

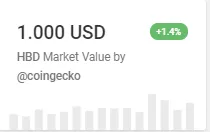

Since the changes were made, we seem to be on a better path. Over the last couple weeks, it appears the range tightened to where the price is between .95-1.00. While this doesn't quite hit the market, it is close enough where we can start the discussion about HBD as a stablecoin.

One point we have to add is that we are still mired in an overall market pullback. A recent change in the hard fork should provide some defense against the price moving to the upside. That, however, has not really been tested. It is likely that if the bull does start to run, we could see a different scenario play out. On that front, we can only wait.

That said, we did see this happen yesterday:

For a little while, HBD was pegged.

A Unique Stablecoin

One of the most fascinating things about HBD is that it could be a rather unique stablecoin. This differs from some of the main ones such as Tether which came under fire of late.

What makes HBD so interesting?

To answer that, we need to look at what the premise of the token is. From its design, the goal is for HBD to be backed by $1 worth of Hive. This brings up a huge distinction that has to be made.

The token is not backed by USD. That is just a valuation method. The $1 is a unit of measure. The actually backing is the code on the blockchain that converts HBD to $HIVE. Thus, we have a stablecoin that is convertible into $HIVE yet is really backed by the code on the blockchain. There are certain things that the Witnesses can alter to aid in the operation of the token. However, they are limited to what is allowed by the code.

At the same time, token creation is not decided by them (or any other centralized entity). The amount of HBD available is driven by two factors.

- The percentage of HBD to Hive in value

- What the community decides through their conversion to and from HBD

The former is something that is hard coded into the blockchain. When the total value of HBD exceeds 10% of Hive (changed to 30% in Hard For 26), then the blockchain stops printing it. In other words, the 50/50 payouts begin to use liquid $HIVE as opposed to HBD. This continues until the value gets back within the parameters outlined by the Haircut Rule.

With the later, the community now has the ability to convert both ways: from HBD ---> Hive and from Hive ---> HBD. This means that the community has a part in how much HBD is created or destroyed.

To significantly increase the amount of HBD is going to require a great deal of Hive especially at these prices.

Commerce And DeFi

Having a stablecoin is vital for the ecosystem to engage in Decentralized Finance (DeFi) and commerce. One of the biggest drawbacks to cryptocurrency right now is the fact that most are involved in speculation. When tokens are treated like stocks, then the utility of them diminishes. HODLing does not expand economic activity and that is precisely what we see.

If Bitcoin is going to 4x over whatever timeframe one is looking at, why would that individual use it to buy anything? The reality is that it will not be used for purchase. Instead, it is held in hopes of price appreciation.

We see the same with Hive albeit on a smaller level. People who are holding the coin do so because they believe there is higher values ahead (there are also other utilities that should be factored in). Nevertheless, none of this endears itself to commerce.

With HBD this is not the situation. In fact, with that token, we are looking at the opposite. Speculation in the sense just described is not desired. We are looking to reduce the volatility on the price. Where speculation enters the picture is in the form of arbitrage. We want people buying the token when they see an opportunity to make money. The reason for this is arbitrage ends up keeping the token pegged. If it gets too far to either side of the $1 line, there is an opportunity to make money by helping to bring it back to the peg.

Another factor working on this is the recent change in the interest paid out on HBD. Prior to the hard fork, all HBD received payments. However, now only those tokens that are moved on chain and into savings are eligible. This is an incentive to remove HBD from the exchanges and lock it up on chain.

Since the fork, a fair bit was moved in a couple weeks. @dalz reviewed the HBD transfers to savings.

All this could ultimately lead to the establishment of commerce taking place on Hive. As outlines in the impact of Hive Backed Dollars, we can see how having a stablecoin could entice merchants to accept it as payment. If they are able to engage in commercial activity while knowing the value of what they are receiving as payment will not fluctuate greatly, they are more apt to engage in it. We are not going to see this with Hive, Bitcoin, Ethereum, or most of the other cryptocurrencies out there. We even have people now questioning the validity of Tether.

This is a grand opportunity for HBD to establish itself.

What Is Lacking

While we are dealing with a small window, the recent range is near the level of acceptability. It certainly is not perfect but a 5% swing either way can be dealt with.

Ideally, of course, we would like to tighten that up. We could be confronted with the situation where some tweaking is required. However, for the moment, it appears that liquidity is the problem. This enters the picture in a couple ways.

To start, liquidity is required for major arbitrage players to enter. Presently, we are sitting on 10 million HBD in existence, with a fair chunk of that in the DAO. It is counterintuitive to think that more HBD is required when the price is on the low side. Logic says more HBD will increase supply, sending the price down.

On this level, that is true. Nevertheless, without the larger players, the peg is tougher to hold. Non-liquid assets always have more volatility, something that is soothed by market growth. Increased liquidity will allow for a greater amount of volume, which entices the bigger fish.

Another reason why liquidity will have to increase is due to the aforementioned commerce. To have a thriving economy, we need to see liquidity in the system. If HBD is going to be the currency used, the supply will have to be greatly expanded.

Here is the breakdown from @dalz's post:

There is a total of 10M HBD supply at the moment, out of which 4.5M HBD in the dev fund, meaning 5.5M HBD in circulation. 3.7M HBD is in the exchanges wallet, that leave us with 1.8M HBD in users account. This means that 800k out of the 1.8M, or almost 50% of the HBD in users accounts was moved to savings in this short period.

There seems to be a bit of disagreement with the HBD in savings since some appears to move out. Thus, the 800K could be wrong, with the number closer to 500K. Either way, there is 1.8 million HBD in user accounts.

In this situation, that isn't going to generate a ton of commercial activity unless the velocity of money is through the roof. A VoM of 5 would still be less than $10 million worth of economic activity.

This is not an issue at the moment since we are not engaging in that activity. However, over time, liquidity will be required if commerce really starts to take off. Fortunately, the community can increase the amount of HBD available as needed. The conversion of Hive ---> HBD allows anyone to "print" HBD as needed.

We can see how this will help the issue for the peg, so it all feeds upon itself.

HBD: A Hidden Gem

It is possible that the Hive Backed Dollar is a hidden gem. The fact it was overlooked for years left a bad taste in people's mouths. Now, however, that attention is being given, the possibilities are mounting.

Here we have the potential of this coin providing a basis for commercial activities on Hive which will, ultimately, increase the value of the entire ecosystem. This will help to push the value of the main coin higher, especially since the percent is coded into the blockchain. As the amount of HBD is expanded to meet the needs of the platform, the value of $HIVE will have to increase to mirror the move. Ultimately, $HIVE is swallowed up to generate HBD.

Thus, if there is reason to produce HBD on a large scale, the value of Hive will be pushed higher simply due to demand. There is no way to escape this outcome.

We will keep an eye on this but HBD could well be on its way to becoming a stablecoin.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z