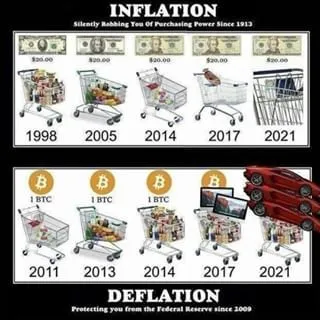

Bitcoin is seen as an inflation hedge mainly because of its limited supply, which is not influenced by its price, and because of its relative attractiveness when real yields head to zero or lower.

Yet, when you buy bitcoin, you’re not just doing so to hedge inflation. You’re buying bitcoin to hedge all the other negative consequences that usually accompany it.

True, inflation is not always bad. “Good” inflation, a result of economic growth and low unemployment that helps to close the gap between supply and demand, encourages investment and even more economic growth.

Runaway inflation, however, exacerbates poverty, heightens uncertainty, demolishes trust in institutions and can lead to the breakdown of social order. This is not isolated to post-WWI Germany – we see it today in Venezuela, Zimbabwe, Lebanon and Argentina, to name just a few.

Bitcoin is also a hedge for unstable governments that close bank accounts, police states that want to seize private wealth, broken payments rails due to corrupted systems or outside cyber attack threats, paranoid leaders that want to disenfranchise opponents, export-protecting devaluations that trigger more inflation.

These are less likely in developed economies. But let’s not forget that tipping points lurk around unexpected corners, and that Venezuela was once one of the wealthiest countries in the world and one of the more stable democracies in Latin America.

Bitcoin is a hedge against inflation, but also against political instability and social disruption, which – if inflation comes roaring back – is not a ridiculous thing to prepare for.

A dollar debasement hedge

Bitcoin is also a hedge against a more gentle but just as pernicious debasement of currency through a loss of trust.

Traditionally, inflation moves in tandem with the strength of the local economy. But it can be triggered by currency weakness, which raises the prices of imported goods.

This is usually corrected when the central bank raises interest rates to combat rising inflation, which increases the attractiveness of the currency compared to others.

But in the current environment, an increase in interest rates may have the opposite effect, given the potentially catastrophic impact on debt-ridden economies. The U.S. bond market is telling us that it thinks interest rates will rise. The dollar continues to head lower, however, and could continue to do so even if those rate increases materialize, as faith in the capacity of the U.S. to employ traditional tools to good effect could be shaken.

And, most bitcoin trading is denominated in dollars. Therefore, if the dollar heads lower without a corresponding fall in the value of bitcoin (and since it’s unrelated to the economy, there’s no fundamental reason why it would), the BTC/USD ratio heads up.

Bitcoin is a hedge for not just the macroeconomic ills that we have been trained to watch out for. It can also provide ballast against the unforeseen problems waiting to be triggered.