I predicted that the effects of the bear market would weaken by 2023. I see that I was wrong. My predictions were optimistic. Weakness continues in the crypto market as the Fed prepares to end its rate hike cycle, especially in the altcoin market, not a leaf move.

The trend to date is reminiscent of the 2018-2019 bear market. 2018 was a nightmare. Things improved in the first half of 2019, but prices started declining again in the second half. However, as of January 2020, we began to see significant increases again.

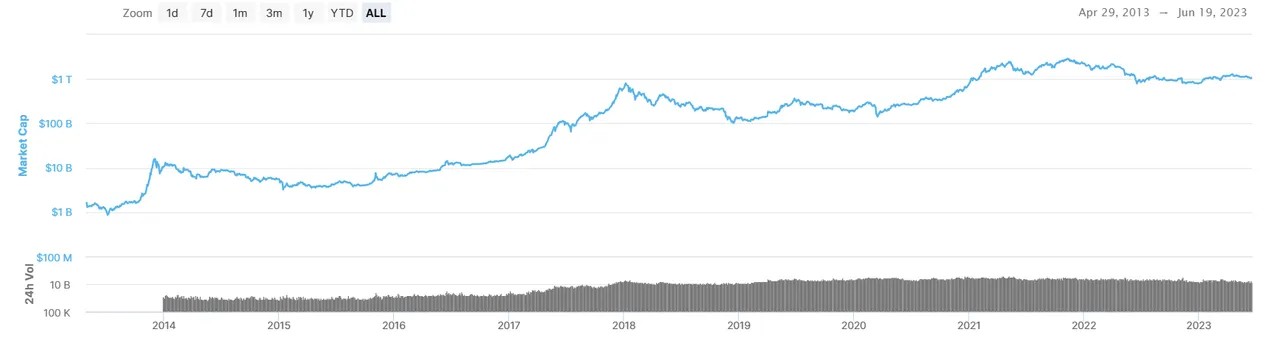

In the logarithmic chart from Coinmarketcap below, we see the change in the total value of the crypto market over the years.

The 2014-2015 bear market lasted for close to two years. After the weak price course of 21 months, prices started to increase in September 2015.

In the current bear market, prices started to decline in November 2021. So, we have left 20 months behind. If the current cycle is similar to 2018-2019, we will have to wait for the last months of the year for the rise. If the events develop identically to 2014-2015, we can see that the prices start to increase towards the end of summer.

But what if this cycle takes longer than the previous ones? Whales like to surprise retail investors. A bear market lasting more than two years could cause many individual investors to give up hope. The most important weapon we have in this regard is the HODL strategy.

I sold my Bitcoins in March, thinking the market recovery might take longer than expected. I'm also gradually selling my Leo tokens, whose price has increased significantly compared to Hive. Thank you, Leo Finance, for the high performance! I will buy back the Bitcoins and Leos I sold. I aim to be ready for a bear market that can last long.

On the other hand, I expect an increase in Hive assets at the end of summer. The FED is playing its game solid; they don't want asset prices to rise. US consumer inflation is at 2.5%, measured daily by Truflation. Therefore, there is no rigidity in consumer inflation. Currently, the official consumer inflation data is at 4%. Things will change rapidly when the official data falls below the three percent level.

The actions taken by the SEC are among the reasons for the weak course in the crypto market. The Nasdaq 100 index has risen 39% since the start of the year. The rise of the Nasdaq 100 index is stable. The crypto market is up 34% since the beginning of the year. This increase occurred mainly in the first 100 days of the year. We have witnessed a severe decline in prices since April.

The small and the big are separated on the Nasdaq and in the crypto market. While the stocks of large-scale companies are increasing on the Nasdaq, the small ones are standing still. In the crypto market, too, Bitcoin and Ethereum outperform others.

Investors' risk appetite has increased compared to last year, but more is needed to buy small-cap tech stocks and altcoins. The primary determinant of the market will be the course of inflation data. As soon as official inflation data below the three percent level is published, things will change rapidly, and interest reductions will begin to be discussed.

TL;DR

The bear market has lasted longer than I anticipated, but I have never doubted the value of crypto networks. Technology is advancing exponentially, and we are just at the beginning. Artificial intelligence has become popular again in recent months and supported the rise of big-cap tech stocks. Future bull runs of crypto will turn into a frenzy. Because no matter how educated we are, we need help to grasp the outputs of exponentially developing processes.

It is not easy to predict when the bull market will start. As I mentioned above, the process may take longer than expected. It's good to be prepared for any scenario. Selling our holdings of coins and NFTs at a low price would be the last thing we want.

During the bear market, Hive performed similarly to other altcoins. It takes work to differentiate positively from the general market. Splinterlands helped Hive's positive divergence during the bull market. The weak course in the play-to-earn market currently does not allow such an effect.

The prices in the market did not justify the passionate dreamers and the hopeless pessimists. Those who are patient and cautious will eventually win.

Thank you for reading.

Cover Image Source: Midjourney App