Economy: Turns out, people do less when it's freezing out. Retail sales fell 3% last month, and factory production also dipped due to snow + brutally low temps. Analysts aren't too worried, since the economy is projected to bounce back this spring in historic fashion.

Markets: All eyes are on the Fed today, which will update investors on its current view of the economy. Given concerns that a surging economic rebound might lead the Fed to ease up on its pandemic-era stimulus measures, Bank of America called the meeting “one of the most critical events for the Fed in some time.”

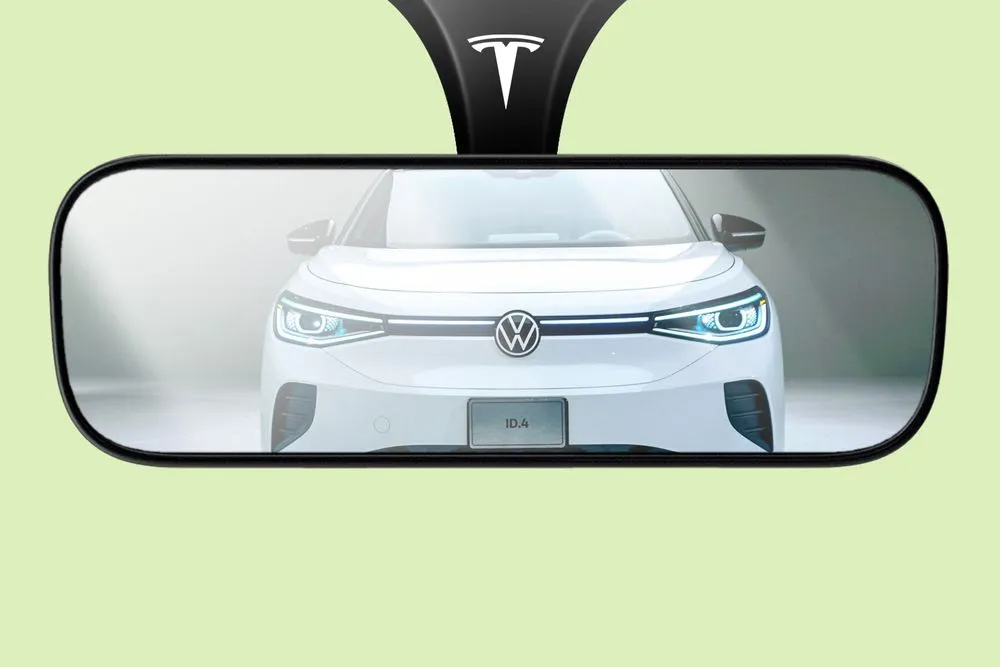

-Volkswagen Comes for the Technoking

Volkswagen shares rose 10% yesterday after execs detailed their master plan to be No. 1 in the electric vehicle (EV) market by 2025, which includes:

More than double the number of EV deliveries this year

Build six new European battery factories

Employ 10,000 developers (making it the largest European software firm behind SAP)

Will that be enough?

Tesla's slipping market value (shares are down over 23% since their January high, including a 4.4% dip yesterday) shows that investors see real competition as Volkswagen and other legacy automakers double down on EVs. While Tesla is years ahead in the software department, Volkswagen could gain an advantage in batteries, which currently account for over 30% of an EV's cost. VW thinks it can halve battery costs with next-gen solid-state batteries starting in 2025.

And with 70 new electric models on the way this decade, Volkswagen could match Tesla EV sales as soon as 2022 and outstrip it by a margin of 300,000 come 2025, UBS predicts.

Big picture: Analysts see room for Tesla and Volkswagen in the growing EV market, per Bloomberg. If Tesla is the Apple (a dominant luxury brand with charging tech no one else can use), Volkswagen is well positioned to become the Samsung.

Still, this won't be easy

Most Volkswagen revenues come from gas- and diesel-powered vehicles, and the pandemic sent overall sales down 15% last year. In its first disclosure of individual unit performance, the company said that operating profits fell almost 90% at its namesake brand and 40% at Audi.

Plus, the company is still lugging around some heavy baggage. Former CEO Martin Winterkorn goes on trial next month for charges related to Dieselgate, the massive 2015 scandal where the automaker was found to have cheated on emissions tests.

ALEX HICKEY

-Uber Fought the Law and Uber Didn't Win

In a first for the company, Uber said it will reclassify its 70,000+ drivers in the UK as “workers.”

Seems like a minor edit, but in the world of the gig economy titles matter. The change means that Uber drivers in the UK will now earn the minimum wage (roughly $12.11 per hour), receive vacation pay, and be automatically enrolled in a pension plan.

The backstory: Uber’s business model of employing drivers to give strangers a lift has been challenged by governments around the world for not providing sufficient benefits.

The UK has proven to be the most successful foe. Last month, the British Supreme Court dismissed Uber’s argument that its drivers weren't workers.

Zoom out: As part of the agreement, Uber will only pay the minimum wage for drivers when they’re with a passenger, so overall earnings may not change much. But the decision will certainly give labor activists a big confidence boost as they take on Uber in other courtrooms, including in the US.

NEAL FREYMAN

-Finance Biz Itchy to Return to Their 900-Screen Desks

If HBO's Industry is any guide, working in finance involves a lot of flirting and cruel jokes. Both of those are trickier to do on Zoom, which might explain why banking execs are so antsy to get back to IRL office work.

Last week, anti-WFH Goldman Sachs CEO David Solomon told employees that he hopes to have them back in offices by this summer.

The announcement came at a time for Solomon. Goldman's numbers are gold, man—revenue surged 22% in 2020 and the stock has doubled in the past year. But Solomon's complaints about remote work have reportedly caused frustration among employees.

Then yesterday, we learned that JPMorgan is planning for summer interns in New York and London to work in-person.

Zoom out: JPMorgan's NYC interns will get lunch from very empty Midtown Sweetgreens. Less than half of Manhattan's 1 million office employees are expected to return to the office by September, per the Partnership for New York City.

ELIZA CARTER

-Q&A: What the Fund?

Q from Andrew: Why have I seen so many new ETFs pop up recently? And...what exactly are ETFs?

The Brew's A: ETFs, or exchange-traded funds, are investment products that give you a way to buy and sell a basket of assets without having to buy all the components individually. The cooler part is they trade on an exchange like any stock, making them easy to buy and sell.

The first ETF launched in the US in 1993 under the ticker "SPY." It tracks the S&P 500.

Most ETFs are like SPY—they track indexes. But there are many other kinds of ETFs, including sector ETFs, bond ETFs, commodity ETFs, and even inverse ETFs, which seek to cash in on an industry's decline.

ETFs are attractive because they're easy to access and allow you to invest in many different assets at once, plus they're often more tax-efficient than mutual funds. And in recent years, ETFs have been one of the most disruptive forces in investing. They topped $5 trillion in assets under management last November, and Bank of America projects the market will hit $50 trillion by 2030.

ELIZA CARTER