The infamous Group that succeeded in making the Wall Street Giants lose heavily!!

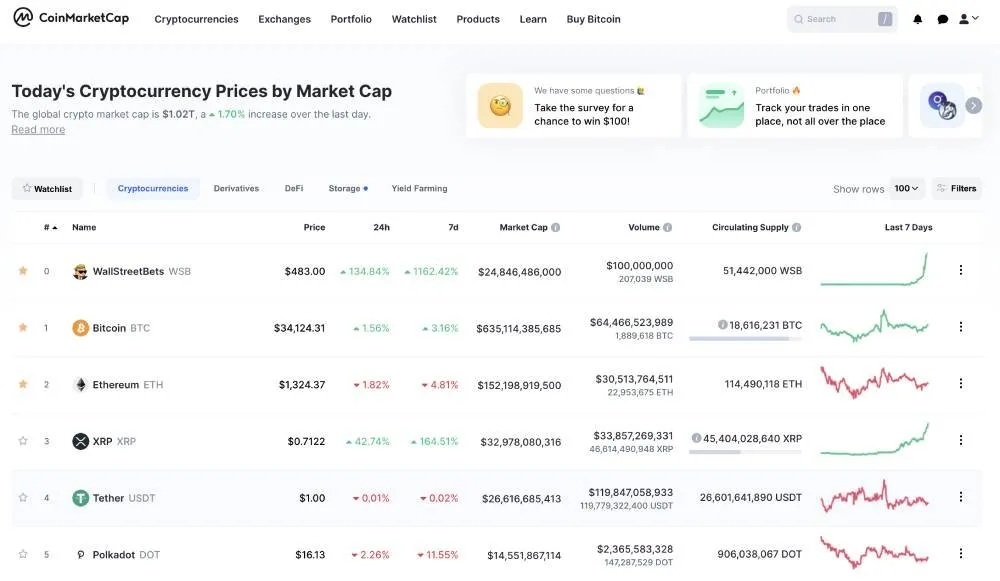

Yesterday when I opened coinmarketcap website to check on crypto currency standings, I found WallStreetBets(WSB) listed on 0 before Bitcoin, and wondered what that was all about.

Coinmarket Cap has WallStreetBets(WSB) listed on its page

However, I guess this WallStreetBets gets a special honourable feature in the website, because this reddit group r/WallStreetBets successfully teamed up and had the big Wall Street investment firms lose billions of money. Yes this relates to last week’s soap opera event, where GameStop shares went up suddenly by 600% and it was all over the news.

The Wall Street invest firms get a taste of their own medicine with the GME stock blow!!

These Wall Street firms are wealthy investors, big players in the stock trading arena known to make profits out of the moves made by small retail investors, this time they got a taste of how painful it is to be on the losing side in the game of stock market trading. It appears that the world in general does not have much sympathy for these Wall Street investment firms - the hedge funds, private equity firms, as they got the taste of their own medicine.

Absolutely no fundamentals supporting GameStop’s Meteoric price rise!!

GME Stock shoots to 480$ from 39$

HA!! Now, let’s recap the episode of this GME stock price flying about last week.

This is interesting because we get to see how a stock price can be artificially inflated, without any fundamental reasons for the shares to fly up, as if it got some Bitcoin power, he..he..he…

GameStop is a video game and consumer electronics company, whose business involving sales of video games is down ever since the era of online games began. Covid-19 period, had them completely off business with closure of shops and malls.

Wall Street investment firms became victims as short-sellers as the price of GME stocks rocketed!!

The Wall Street biggies had shorted GME stock, believing that the firm’s stock would collapse. Meanwhile, the followers of r/WallStreetBets reddit group which has over 2 million subscribers brought these GME shares, which did the trick of exponentially pushing up the price of GME stock which was the most shorted stock in the market.

Wall Street investment firms had lost out here because their clever plan with their short positions on this stock was to make money betting on GME stocks crashing. However as the opposite happened, it forced these Wall Street investment firms to cover for the shorts, and suffer loses.

Two wall street firms Citron Capital and Melvin Capital have reported huge losses.

A look into this Short squeeze phenomenon that had Wall Street lose billions of dollars

What happened was a short-squeeze which youtuber NIcholus Mertin explains in this podcast explains here in this video. In brief, what happened was something called a short squeeze.

Here, the Wall Street firms borrowed GME shares and betted against its price. However, as the price shooted up instead of plummeting, the Wall street biggies had to return back these shares buying them back at current prices which are higher than when they borrowed the shares and shorted it. This further increased the price of GME, while wall street firms lost huge money totalling 5 billion at the least.

For a more in depth understanding of this short squeeze that took place with GamesStop stock watch Nicholus Mertin as he explains it. You can read about this short squeeze phenomenon here as well in investopedia.

GME Meme stock used by r/WallStreetBets to beat Wall Street!!

This whole episode entertained many people, it’s branded as a social movement against Wall Street. GME became a meme stock, through which r/WallStreetBets group gave a blow to the big, wealthy wall street investment firms.

More followed post this episode and I will cover them in my next article, that will talk about Robinhood Exchange acting to protect interests of these Giant Wall Street firms rather than retail investors(even though its named as Robinhood), and forums like discord banning the r/WallStreetBets group, and the price of DOGE cryptocurrency shooting partly because of the r/WallStreetBets group, although those group members are not crypto enthusiasts, and made it clear they are not interested in making any crypto investments!!