Crypto Turns Green As SEC Loses

What a wonderful end to the week today is for the east coast with with Crypto turns green as SEC loses their court case against Ripple finding that XRP is not a security. Although the victory is not over just yet because the finding was only partial but it helps clarify a few market questions.

The partial win for XRP identifies that sales of XRP on centralised and decentralised exchanges did not constitute investment countracts however, did find institutional sales did violate federal law.

Ultimately what this means is that Decentralised and Centralised exchanges are free to list digital assets and the SEC can not deem them contractual. A bit of a free for all in that regard but it has raised some confusion for the broader sector with some claiming it raises more questions than what was set out to answer.

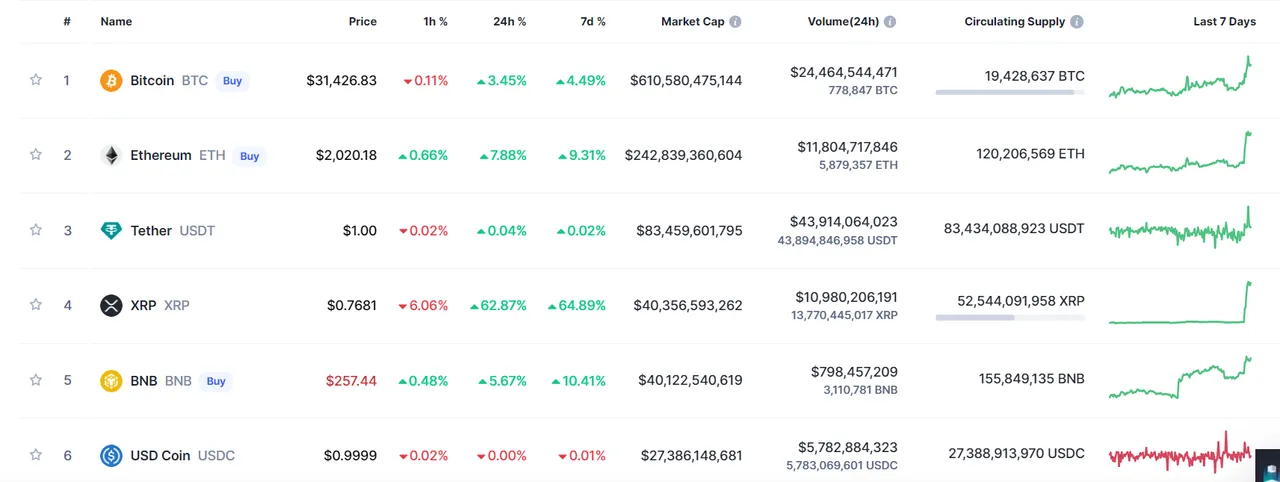

But the news has been welcoming and has resulted in Crypto Currencies surging as now investors know their investments are free from SEC action on centralised and decentralised exchanges. This has caused markets to flood with cash providing a much needed boost to the weary digital asset community.

Confusion and Doubt

While the news is welcoming it is also concerning to many as there is an increase of Tweets highlighting the confusion at the outcome that one transaction is legal but the exact same transaction in another space is not. The finding perhaps contradicts itself.

There is further news circulating that the decision could potentially be reversed on appeal and quite successfully which could have a negative impact on the current boom we are experiencing within the digital asset sector.

The reason why the US Judge made this ruling does make sense and once we break down the time line of XRP sales we can understand the broader picture a bit more in depth and understanding the thinking behind the ruling.

The Ripple Effect

Let's take a quick summary of what has occurred in XRP's history to see how the judge made its finding which will help shed some understanding on the broader situation and how it can apply to other digital assets.

Just over USD700 Million of XRP was initially sold to hedge funds, investors and institutional buyers which is the section of the ruling which has been found to violate US Federal Securities law. The reason behind it is that these investors did so on the basis of speculation that Ripples development and progress would lead to profits.

As such the US Judge ruled that those sales were in breach because it was being offered as a security. Ripple than used the funds raised to have it's token listed on centralised and decentralised exchanges where it was offered to retail investors.

The second process of sale the judge ruled in favor of Ripple because there was no clear way that investors who purchased XRP off centralised and decentralised exchanges had the same intention of speculating on the projects growth and value.

Now I know what you're saying. But everyone is speculating on digital assets? Yes and no. If you look at the current market operation it is a free for all and there are no regulatory bodies or processes in place to protect token value. Purchasing off the open market where all other digital assets are is a greater risk and lets be honest. If you don't play the market your not making profits.

The only people that benefit are those who get in early like the pre-sale offerings by XRP to hedge funds and institutional investors and if we look at XRP price it did exceed USD5 at some stage which would have netted all the pre-sale buyers hefty profits off the back of retail investors.

Markets Surge

It is yet to be seen if the decision will be appealed and the SEC is likely to do so but in the interim it has caused significant bull runs across the entire crypto sector and a period of Green that hasn't been seen since last year. Given that the US Judge has made a finding of Non-Security there are likely to be further findings.

It is a ground breaking case which will provide further clarity amongst investors and projects alike which is why there has been such involvement and a lot of people following along because it is a make or break case. That being said Crypto probably won't die if the case isn't successful as there would be more work undertaken to bring it inline with whatever findings were made.

The news has been beneficial for XRP which has doubled in price within 24 hours and has shot up to the 4th position of Crypto Currencies with the highest market cap. Can the asset regain lost ground and become a leading project or are the wins short lived? That is yet to be seen but the outcome of the current case will define tomorrows digital asset world.

Happy Friday everyone and have a wonderful weekend!

image sources provided supplemented by Canva Pro Subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.