Today marks the day that the Shapella Hard Fork is deployed on the Ethereum blockchain. This has a few notable impacts. One of the main ones being that staked ETH will start to get unlocked.

Note that I said start to get unlocked. The upgrade doesn't allow all staked ETH to suddenly get unlocked. It's a churn process.

Despite this, many people think that this could be a bearish event for ETH. It seems like you can land firmly in one of two camps:

- This is going to have a neutral to bullish impact on ETH's price

- This is going to be super short-term bearish for ETH's price

The Bullish Camp

Let's start with the bulls, shall we? A lot of people think that this is all a net positive for Ethereum. Allowing withdrawals is also coincided with some updates that make it easier to stake ETH in the first place (and more attractive).

Some people think that this will attract a lot more stakers in general. Especially institutional stakers, as staking ETH can provide a sort of "risk-free" crypto yield in the mid-single digit %'s.

"the “Merge” upgrade transitioned the Ethereum blockchain to a proof-of-stake consensus system, and the implementation of EIP-1559 turned ETH into a deflationary asset. EIP-1559 introduced a more predictable and stable transaction fee mechanism and enabled the burning of a portion of transaction fees. These features will continue to make ether even more deflationary, thereby increasing its value over time." Coindesk

EIP-1559 was seen as a majorly bullish event for ETH. It integrated some changes to TX fees and one of them was the burning of a % of all TX fees. This has created a significant amount of burning for ETH on a daily basis.

Not that many people will sell, because they aren't in profit

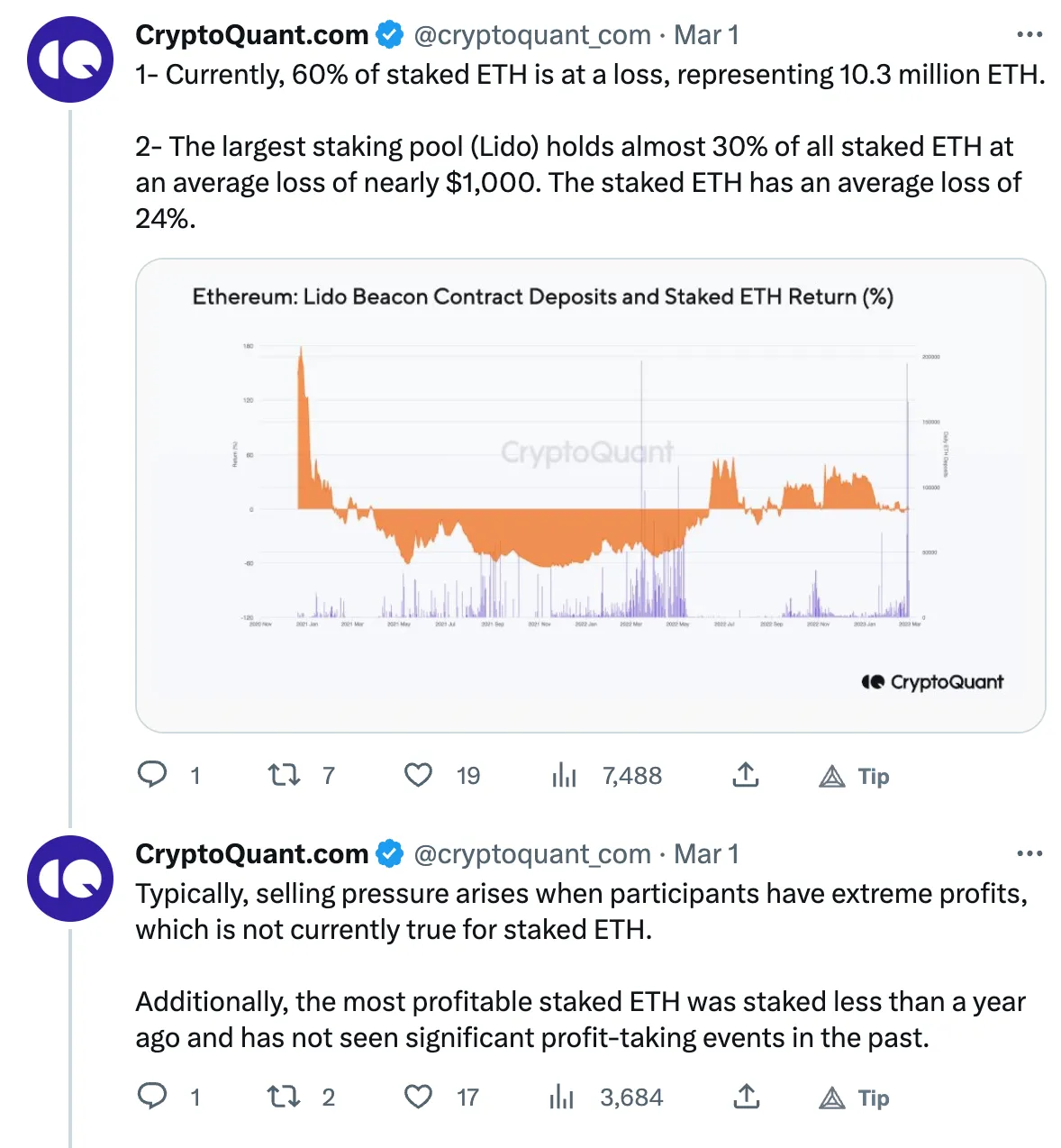

A cornerstone of the bullish case for this update is that most of the ETH that's staked - ~60% - isn't profitable. Most investors will sell at a major profit (people say) and that means that these coins won't move.

This is one of those arguments that can make some sense but on the other hand, how often do people dump at a loss? That being said, these are long-term investors and believers in ETH. These stakers also have some level of sophistication (generally), so perhaps it can apply moreso than the average investor on Coinbase:

ETH's move to Proof of Stake has generally been seen as a positive event. People believe that the lower fees which have long been a joke in the crypto space combined with various other improvements and calming of ESG concerns will lead to more retail + institutional adoption.

"All of this lays the groundwork for increased institutional adoption of cryptocurrencies. We are already seeing growing interest in ether from institutional investors who are increasingly looking to diversify their portfolios and hedge against inflationary pressures. The Merge upgrade addressed Ethereum’s ESG concerns that kept many investors out." Coindesk

The Bearish Camp

The bears are focused largely on how much ETH is becoming available to sell. Right now, there is 18M ETH staked.

After the update, this ETH will slowly be available to unstake. It won't happen all at once because of a mechanism that churns in withdrawals.

Essentially, you need to wait in a queue to get your staked ETH unlocked and available as liquid ETH.

"A maximum of 1,800 validators per day will be allowed to fully unstake, which equates to 57,600 ETH ($109 million) per day that can be withdrawn, in addition to partial withdrawals, according to estimates by Pooja Ranjan, founder of EtherWorld.co and project manager at Ethereum Cat Herders." theblock

$109M is a lot. If a large % of this were to be sellers, then it could have a materially bearish impact on the ETH price. The question remains: how much of this ETH is looking to be sold off?

We know that this ETH has largely been staked since 2020. It's been locked up. A lot has changed since then and there are plenty of people in the crypto space who are hurting for liquidity. They have bills to pay and crypto isn't as hot as it once was thanks to the overall bear market.

"Ethereum imposes a churn limit on how many validators can withdraw each epoch. This limit increases with more validators on the beacon chain. Currently, the churn limit is between 7-8 validators per epoch by the time of the upgrade. So when the upgrade occurs, 1,800 validators can fully exit every day, which is over 57,600 ETH per day," said Ranjan. theblock

Additionally, Kraken and Celsius have a large amount of ETH staked. Kraken recently got a wells notice and will likely unstake (and maybe sell?) the ETH that was staked by U.S. customers.

Celsius is in a bankruptcy process and the bears think that they will dump all of the ETH they have staked to repay investors.

My Thoughts

I tend to land more in the neutral camp. I would maybe put my hat in the ring as neutral-slightly bearish.

I agree with a few of the things said on both sides of the spectrum. I think that this event has largely been priced into ETH. I also think that the entire Proof of Stake system is bullish for ETH long-term.

I do see more institutions jumping into ETH staking as a kind of "risk-free rate of return" in the Crypto space.

I also can see that a lot of ETH (~$109 million per day) is potentially going to hit the market.

That being said, I think only a fraction of that ETH is going to get sold. That's why I'm netural / slightly bearish. I think this will be largely a non-event for the ETH price in the short-term.

How I'm trading this event: I may put a small short hedge on because I have a rather large long ETH position. The short hedge would be to play some short-term volatility and help offset some potentially short-term selling pressures from unlocked ETH. That being said, the trade would be super small.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io