Aping into new opportunities can be fun, rewarding, and punishing at the same time. It really depends on your decision-making. That is why we will be talking about doing some propper research today because you will need it in your life, especially in the farming business.

Dig through the Docs

Every half-decent farming project should have documents that outline their future plans, tokenomics, roadmap, and all that stuff. If the project of your choice is lacking this crucial information it is probably better to stay away from it.

Crucial things to look at:

Roadmap

Tokenomics

Github Activity

Contract Audits

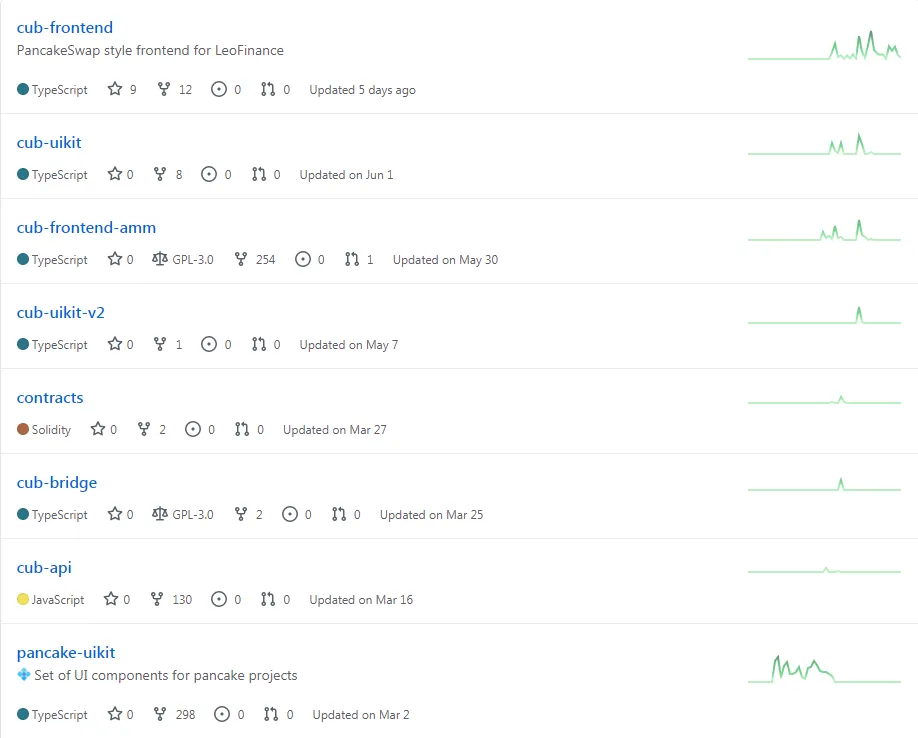

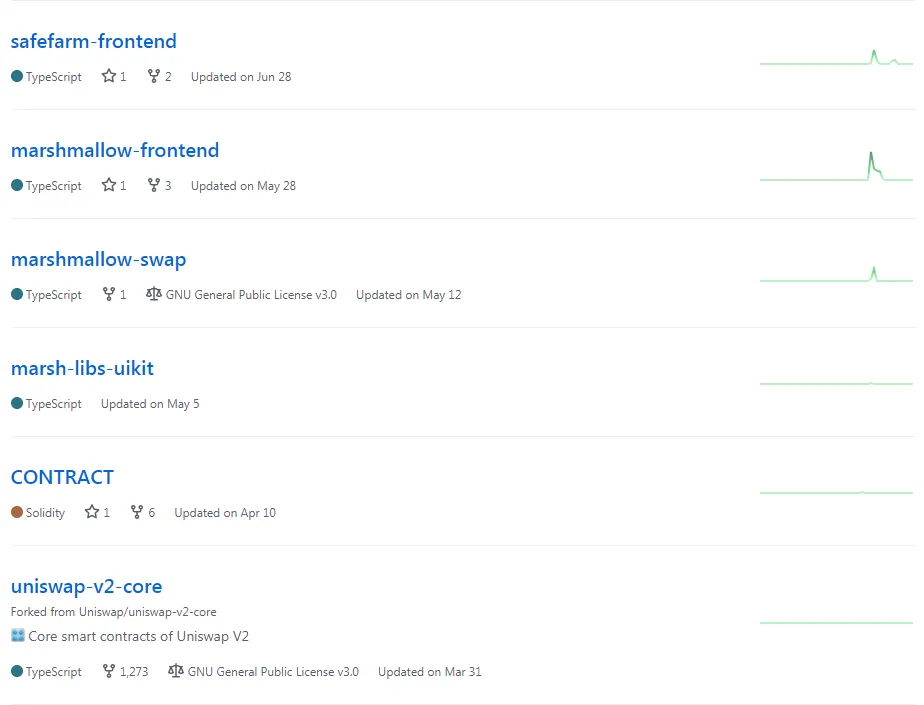

A lot of us aren't developers but that doesn't mean we can't look into the more technical stuff, right? Start by looking into their Github activity and make sure it looks something like this.

This screenshot is obviously from Cub finance and it looks great from where I stand. For comparison, here is the Github activity of a very shitty farm that was hyped for over a month on BSC. Obviously, it died eventually because the tokenomics made no sense but when you compare Git activity with Cub, it was obvious from the beginning.

Flatlines aren't a very good sign.

After you are done with Github move to the roadmap and tokenomics.

The Roadmap should be ambitious, to say the least. Anyone can copy and paste some code, change a few lines and deploy a farm. It takes vision and creativity to introduce new features to DeFi and that is what you should be looking for. Innovation has perspective, copycats always get left behind in the long run.

Tokenomics are also a very important part of a project. How many new tokens are minted per block? Is there a token burn mechanism that would prevent hyperinflation? If no then you should be on your way. Whales always look for opportunity and if they find a money printing machine they will dump as soon as they can. Don't be their liquidity if you don't really have to.

You should also look out for something we like to call "ponzimonics". This is present in projects that have a "transfer tax" and a wast majority of them make no sense. For example, if they have a 10% tax you will lose a ton of money just by participating.

Blunt example:

Jerry wants to invest in token X and farm with it but token X has a 10% tax.

Jerry purchases $1k worth of token X but only gets $900 due to tax. Jerry then proceeds to deposit token X to a pool where it will farm new tokens but instead of depositing $900 Jerry ends up with $810 due to another tax.

After a while, Jerry realizes that the project is shitty and wants to get out. He withdraws $810 but only gets $729. He then proceeds to exchange that for stablecoins but only gets $656... This is almost a 40% loss on just 4 transactions.

Do the math before you give money away to scammers is all I'm trying to say.

Reputation and Social Media activity

Most of the projects in the space are fairly new so it won't be a surprise if you can't find any good info on the developers and project managers. It would be great if you already know who they are and what is their level of knowledge, but even annonimous developers can sometimes create great protocols. It is rare, but still possible.

A dead giveaway should be their social media activity. If they have tons of followers but very little activity on their most recent posts you should be cautious. Most of the time they organize a giveaway that requires you to follow their account and gain followers that way. What we are looking for is a vibrant and active community that is involved in the project to some degree.

Their telegram channels should have active moderators at all times. The same goes for Discord and other communication channels. Serious project managers know that their potential investors need 24/7 support and they will provide it.

Audits

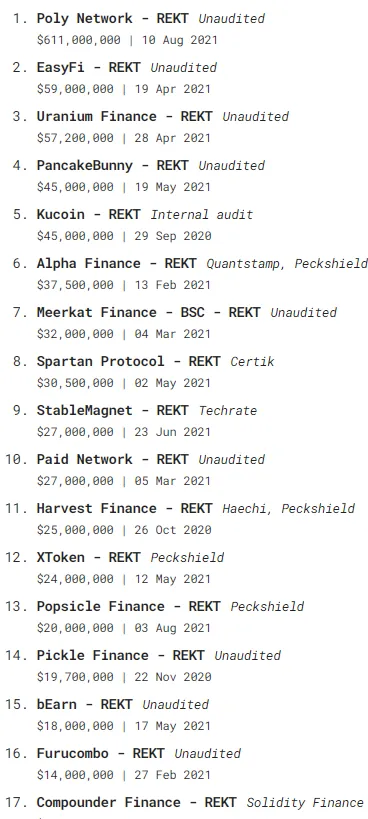

I left audits for last because they are a very specific subject. It seems that these days all projects are audited but they still get exploited somehow. Just look at the top list of DeFi exploits.

So many audits yet so many millions lost... Audits are great but they never guarantee safety. Auditors may be experienced with coding but you never know when a bored kid will spend a year or two learning Solidity and then putting their knowledge to the test. DeFi has created the largest honeypots in the history of the internet and you can bet that we will see a lot more exploits in the future with even bigger losses.

If you can break Uniswap's contracts and exploit them somehow you would have access to over $5 Billion of liquid cash. Knowing that fact alone should make you wonder how many people are working tirelessly to find a loophole in the system.

Bottom line - investing in an audited project means absolutely nothing in terms of safety. It is great that someone else looked at the code but just look at Throchain. Years of development, tons of community contribution and it still got exploited twice.

That is why these two magic words should always be on your mind, no matter how hard you want to ape in a project - RISK MANAGEMENT.