Disclaimer: Your funds are your responsibility. All information in this article is reflecting my own investing strategy and should not be taken as financial advice.

Diligent farmers diversify their investments and don't plant all of their seeds in one place. That is why we will travel over to Polygon today and try to figure out if we can snatch a quick profit or maybe even build a portfolio from scraps.

The farm we will be looking at is PolyLion and there are two reasons for this. Number one, Cubs and Lions go well together and number two, it is one of my favorites on Polygon.

How?

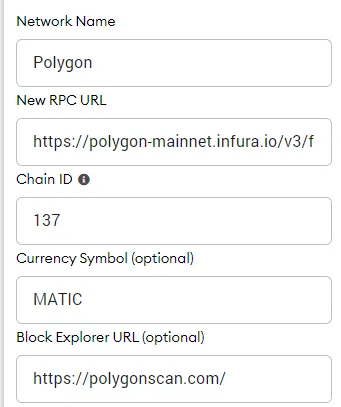

Just like last time, we will need to set up Polygon as a custom network on Metamask. Click on the dropdown menu on Metamask, chose "custom RPC" and enter the following parameters:

Network Name: Polygon

New RPC URL: https://rpc-mainnet.matic.network

ChainID: 137

Symbol: MATIC

Block Explorer URL: https://polygonscan.com/

It should look exactly like this

Once this is done you will need some Matic to pay for transaction fees. There are a few ways this can be done. The easiest one is to purchase Matic on Binance and withdraw directly to your Metamask wallet. There is a 0.1 Matic fee included and a minimum withdrawal of 0.2 Matic.

If you are looking for Fiat onramps, there are a few available for Matic. You can find them here.

Once you have enough Matic to pay for transactions on the network you can then bridge funds from other chains as well. BSC users can go through xPollinate. A fairly easy bridge to navigate but it only supports Dai, USDT and USDC.

ERC20 tokens can also be bridged through the official Matic bridge here. Follow the instructions and get some ETH ready to pay for those juicy fees.

Why?

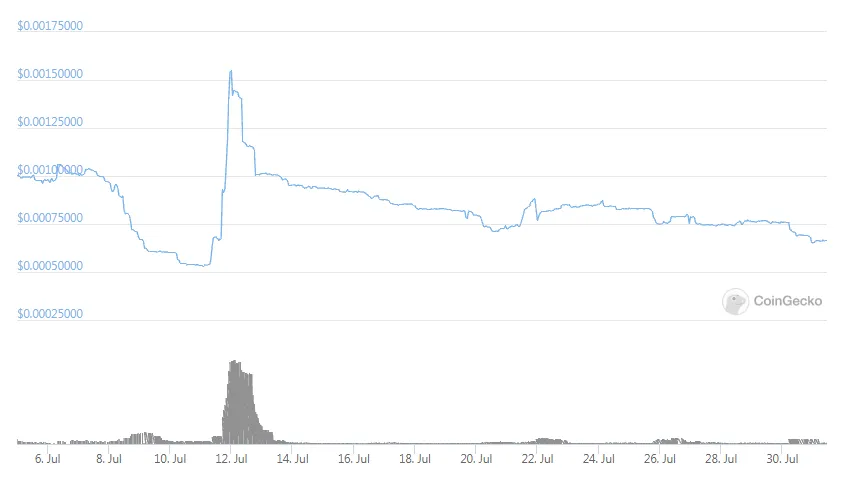

Before we get too excited here it is worth mentioning that PolyLion is a medium-risk/medium-reward farming experience. It has launched about 3 months ago and the price of the Lion token went from $5.5 to $0.00066. Some would call that an epic flop but Jerry calls that an opportunity.

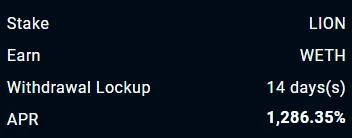

Everyone capitulated too early in my opinion. The price was already in the gutter when mountain farming launched and little did everyone know, that proved to be the best feature on that farm. The premise is simple - stake Lion to earn other currencies like ETH and USDC. Currently, the WETH farm is live and sitting at 1.2k% APR. That number didn't change since it was launched.

WETH farming lasts for about ~45 days and based on simple math, whatever you put in on day 1, you will get back in WETH. This means that Lion could go to zero at the end of the farming period and you would still break even. Luckily the price was fairly stable during the farming period.

Other farms range from 50% APY to 400%+ APY but I do not recommend using any of them. Mountain farming is the safest for now because it is rewarding you with an uncorrelated asset such as WETH. For those interested, it will be live for another ~16 days.

Investing Strategy

Purchase Lion with 5-10% of your farming funds

Put 100% of your Lion into Mountain farming and earn WETH

Reasoning:

There are just a bit over 15 days left for WETH farming. During that period you will get roughly 50% of your dollar value back in WETH and your tokens will be locked for 14 days. This means that you can withstand a 50% price drop in Lion and still break even at the end of the farming period. A very realistic risk that you shouldn't be taking with a large bet.

A small market cap is also a concern because it implies low liquidity. I personally see it as an opportunity because the farming craze isn't over just yet. If the markets stay green we will see fresh money pouring into farms and Polygon is one of the first stops newbie farmers like to explore.

According to their mod on Telegram, after the WETH farm is finished they will open a new one with the same mechanics. Looking back at the USDC and WETH farms, I wouldn't want to miss out on that opportunity.

There is also no specific reason why the market cap of PolyLion is only $90k. The protocol never got exploited and there was no event that would force you to panic sell. If Mountain farms keep popping up a comeback in price action is to be expected, in my humble opinion.

Risks Involved

As discussed above, a small market cap implies low liquidity so investing thousands would simply be foolish. There are only 688 addresses holding Lion and any of the top holders selling a lot would hit the price hard. Investing with extreme caution is advised.

Development on the project is unclear. There is a roadmap and a fairly detailed website but the deadlines on the roadmap have been broken very obviously. A lottery system is well overdue and some other developments were completely ignored but mountain farming seems to be coming at least. Without any clear communication from the devs in the Telegram channel, you can't really know what is going on in the background so double down on caution.

The lock-up period for the WETH mountain farm is 15 days. Claiming rewards at any point in time will reset the timer back to 15 days and after farming has ended the timer will keep on going. You will need to plan accordingly if you want to withdraw the Lion tokens as soon as the farm ended.

Jerry Rating - 7/10

Even though the whole farming experience on PolyLion isn't that good, it feels like a bet worth taking with lunch money. If it ever picks up the pace your investment could turn into a very nice profit, and if it doesn't work out you lost what you could afford to lose. I like those bets.

The Good:

1200% APR for Lion staking

Micro market cap

The Bad:

- Telegram channel is a ghost town most of the time

- Reflection tax 5% on every transaction you make. This includes depositing Lion on the farm.

- Almost no communication from the dev team most of the time.

- Terrible price action

Final Verdict

I like the odds on this one.