Alright, people, it's time to kick off the #ELI 5 content on Leofinance and Hive and we will start with a question from @forexbrokr - How much money can I borrow using DeFi?

To know the answer we must first understand how DeFi lending platforms work so let's dive right into it.

What Is a DeFi Lending Platform?

To put things in very simple terms, you can compare a DeFi lending platform to one big financial marketplace where everyone can be a lender and everyone can be a borrower, as long as they have enough capital to participate in this game.

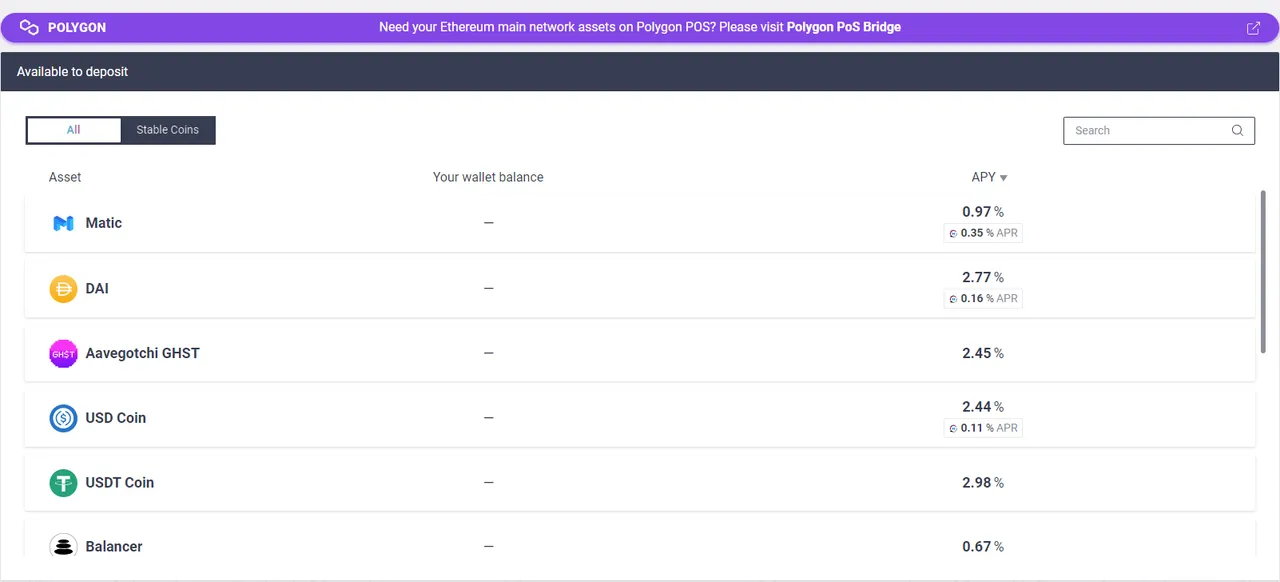

If you, as a new player, wanted to join the same game you would need to own some cryptocurrency such as Ethereum, Bitcoin or Matic. For the sake of simplicity, let's say that you bought some Matic on an exchange, sent it to your wallet, and now want to put that crypto to work. To do that simply go to AAVE and deposit as much Matic as you want.

As soon as the deposit transaction is confirmed your funds will start earning a staggering 0.97% interest a year. To be fair this APY is not set in stone and changes depending on market conditions which will be explained below.

The important thing is that you are now a depositor and your Matic can be used as collateral for borrowing as well.

How Much Money Can I Borrow With DeFi?

This highly depends on the platform you are using and the cryptocurrency you are using as collateral. On average, borrowers can take out loans that don't exceed more than 70% of their deposits. More specifically, if you deposited $100 worth of Ethereum, you will be able to take out a loan of roughly $70.

Most lending protocols are governed by their community and token holders so sometimes the community may decide to increase or lower the percentage depending on the risk factor of a specific cryptocurrency.

How To Win At The Lending Game?

Lending platforms may seem boring at first but they open up a lot of opportunities for those that want to hedge against market conditions. Here are a few examples depending on where you think the market is headed in the short term:

- Expecting the prices to go down in the next 6 months

Convert your crypto holdings into stablecoins > deposit stablecoins into a lending protocol > take out a loan in ETH or BTC > convert the loaned assets into stablecoins > deposit the stablecoins in the same protocol to lower liquidation risk.

If you were correct, buy back the loaned ETH or BTC and repay the loan at much lower prices.

- Expecting the price to appreciate in the next 6 months

Deposit ETH, BTC or any other crypto > take out a loan in stablecoins > buy more of the same crypto and deposit in the same protocol to lower liquidation risk > repeat until satisfied, or don't.

If you were correct take profits at higher prices and repay the loan in stablecoins.

Obviously, this should only be done if you are willing to trade crypto and take some risks. If that is not the case you can simply deposit your funds and treat the lending platform as a savings account.

Rules

Lastly, we want to understand the rules of the lending game and they are very simple.

What happens when someone owes more than what they deposited?

This can not happen on fully decentralized and automated protocols. The reason why you can't borrow more than 70% of your collateral is so that the protocol can have enough time to cover your loan and liquidate your collateral before you end up owing more than your deposits.

In layman terms, if you deposited $100 in ETH, took out a loan of $60 with a 70% collateral rate, as soon as your loan reaches $70 or ETH loses enough value so that your loan exceeds 70% of the USD value of the deposited Ethereum, the protocol or a liquidator will have the right to repay your loan and take their cut.

When liquidation occurs someone pays your debt for you, takes out your collateral, and sells it in the market for a small profit that is usually in the range of 3-8%. What is left is always returned to you and this depends on market prices at the moment liquidation occurred.

What happens to my profits if my loan APY is higher than my deposit APY?

Depending on how much money you borrowed, usually, your loan APY will be a lot higher than your deposit APY. For this specific example, if you deposited $100 ETH at 5% per year and took out a loan of $10 at 15% per year your earnings will cover the borrow rates. The number of stablecoins owed to the protocol will increase to $11.5 but your ETH balance will also increase by 5% negating the interest rate and even earning profits.

Applying the same math to your own example should give you a general idea of your net profit/loss margin on a yearly basis. Also, this is if we assume that prices and APY stay stable which is rarely the case.

Why does the borrow and deposit APY change all the time?

As we mentioned already, this is a marketplace that sets prices based on supply and demand. When you deposit ETH and I take out a loan in ETH, we are interacting with the same ETH pool. If there are more borrowers than depositors the protocol will offer higher APY rates to incentivize more depositors to lend their ETH.

The same happens when the situation is reversed. If there are more depositors than borrowers for ETH the deposit APY and interest rate for borrowing will start going down because the market is sending a signal that it is not ready to take out loans at current rates and wants to wait for them to go even lower.

And now, to answer Dane's second question - Can I get a mortgage using DeFi?

No... For now.

There are no protocols (that I know of) that offer these services but many will in the near future. Once we find a secure way to tokenize property and turn ownership contracts into NFTs you will be able to deposit your home into a lending protocol and take out a loan based on the value of your property, just like you can do with Ethereum or Bitcoin today.

The best part is that DeFi will give you more flexibility than traditional banks. If the value of the property goes up, you will be able to take advantage of that by taking out even more loans or selling fractions for profits to repay the old debt.

To clarify, selling fractions of your house or car should be standardized in the future.