How Much Debt Is Too Much Debt?

When I read these figures the other day it was kind of mind boggling as having $32 trillion in debt paying back $1.3 billion per day in interest payments alone is crazy. That is the equivalent of $54.16 million per hour or $900K per minute and that is not reducing the debt, but simply making the interest payments. Whilst researching my earlier post I came across different stats and figures which I couldn't ignore and how I came onto this topic. Seriously big numbers involved which is hard to comprehend and possibly what scares everyone, but the government.

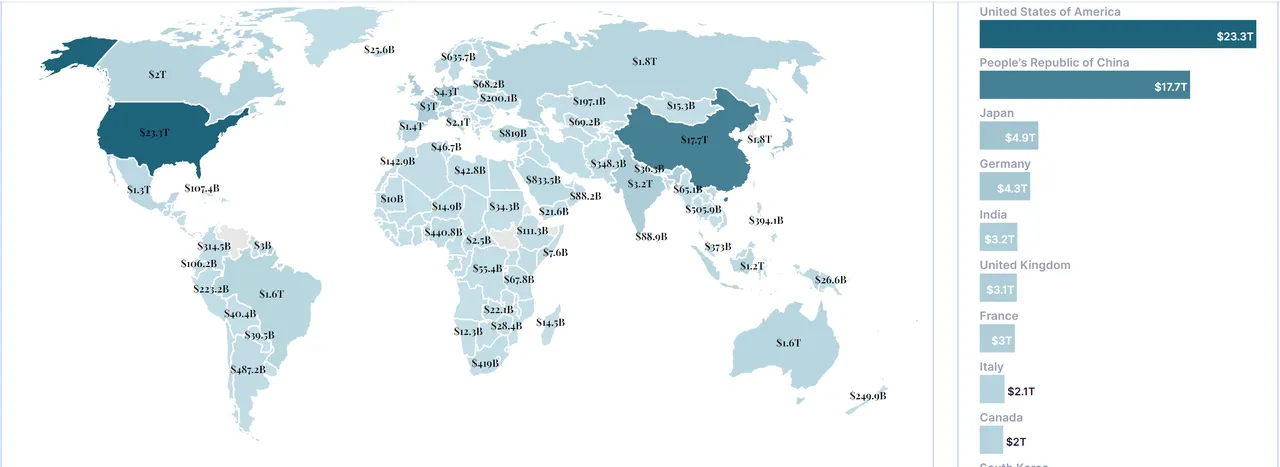

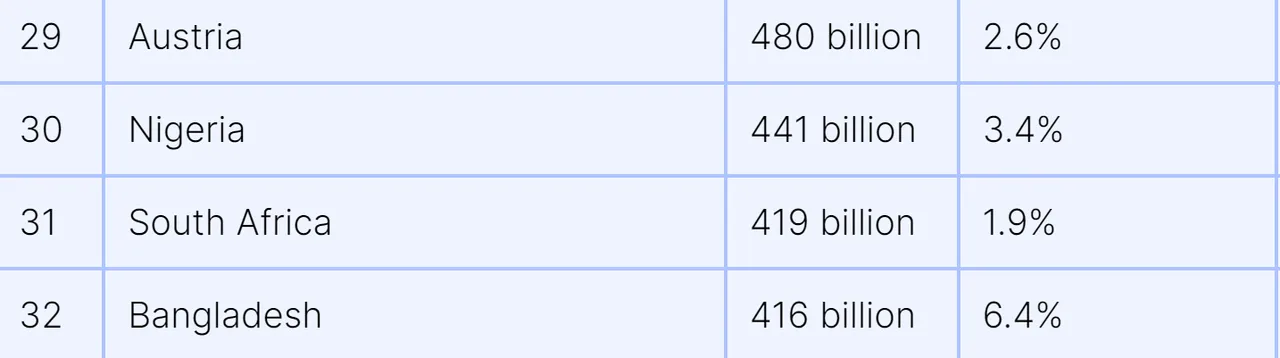

The US has a reported GDP of $23.3 trillion per year which is the biggest by some margin compared to other countries. The interest paid out annually is the equivalent of some country's GDP which puts everything into perspective. $1.3 billion per day x 365 days is $475.4 Billion annually which would rank as high as 29 against other countries GDP's.

The worry is that the debt ceiling is already seen out of control by many as how high can this go as you have to think the number is already unpayable owing more than 130% debt to GDP. The US is still not the worst when it comes to debt however as there are far worse candidates taking that mantle.

Japan spends 22% of it's national budget on interest payments annually which is expected to rise to 25% within the next 2 years. As most of us already know japan has an ageing population which means they are shrinking in size. The imbalance means the social welfare with pensions and health care is out of sink with what we see elsewhere.

The big worry is at what point is the debt too much and countries start to default on payments. Japan spending 25% of their national budget on debt repayments each year has to have long term consequences as I can only see this slowly rising until there is a point that they cannot pay it back. They are only covering the interest and not paying back the debt so this is not looking good long term.

The United States is not looking so bleak as their National Budget of $6.2 Trillion is only affected by the $475 Billion interest payments accounting for around 8% only. For the US to reach the Japanese levels they in theory could triple their debt which would not be advisable or a recommendation.

Personally I do think the concern by many is not with the US defaulting on their loans but finding themselves increasingly under more economic pressure. The world is changing and countries that were once seen as friendly trading partners are no longer playing the American game. They are choosing to trade in other currencies besides the US Dollar which would have been frowned upon in the past. The impact of this on the US economy is an unknown for now, but it has to have implications which could be disastrous long term. Countries cannot just turn on the money printer when they need some extra cash as this does not solve the existing problems and only exasperates the situation long term.