A beginner's guide to Monero coin (XMR), the open-source privacy coin that keeps your transactions confidential.

Monero is the premier privacy coin cryptocurrency.

A private and decentralised cryptocurrency, unlike what we see on the completely public Bitcoin ledger, Monero has been designed to keep your finances confidential.

It’s these properties that make Monero’s XMR coin the right choice for those who value the privacy of their balance and transactions, above all else.

Monero’s goals are to focus on the development of privacy and security first, with ease of use and efficiency second.

That sentence should tell you everything that you need to know about why you would choose to use a privacy coin such as Monero, over a cryptocurrency that uses a public ledger.

This beginner’s guide to Monero (XMR) will explain how this privacy coin works, whether it’s traceable and what to consider before buying.

Introduction to Monero (XMR)

An introduction to Monero coin (XMR), the leading privacy-focused, open-source cryptocurrency.

Monero has a somewhat similar beginning to Bitcoin, with a pseudonymous founder known as Nicolas van Saberhagen, forking the Bytecoin (BCN) chain to launch.

Some going as far as suggesting that Nicolas van Saberhagen is in fact Satoshi Nakamoto himself.

After avoiding identification for this long, I think it’s safe to make the call that we’ll never actually know the identity behind either.

We do however, know that the Monero project began as a grassroots movement in April 2014 with absolutely no pre-mine or VC funding.

Practising what they preach, Monero still remains completely open-source and minable using nothing more than your own CPU.

The XMR Privacy Coin

Looking at the Monero (XMR) coin is an interesting one.

Monero is a privacy coin designed to be spent, not hidden away as a pure store of value like you see with some of the more die hard Bitcoin HODLers.

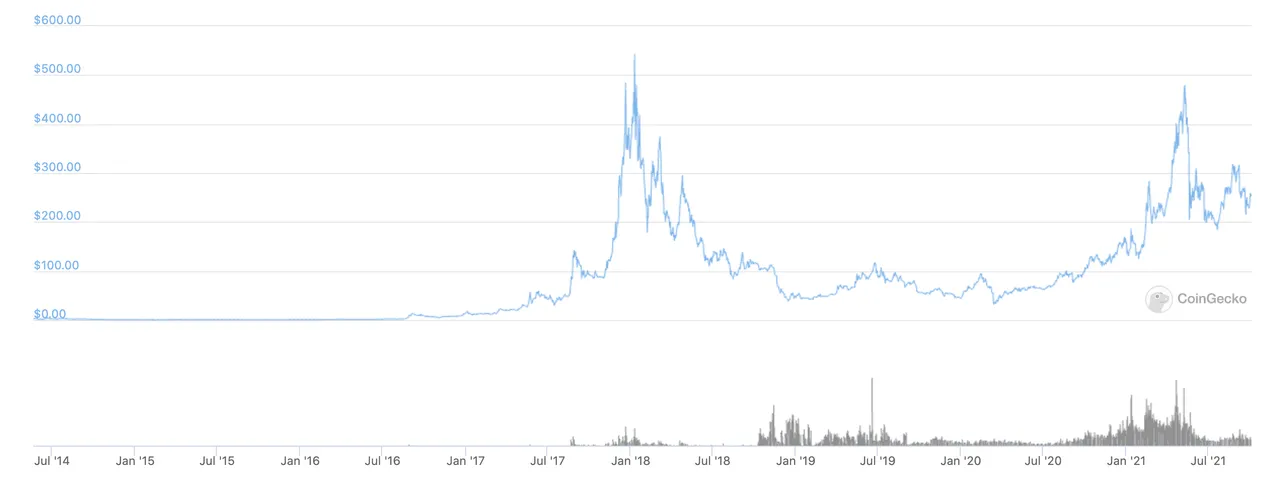

Either way, the XMR coin still trades on the open market like any other cryptocurrency, the price of which can be seen on the CoinGecko chart below:

With that in mind however, the XMR price is forever going to be open to extreme FUD thanks to its position as a privacy coin.

Monero can and will always be used for illicit activities such as for use on the dark web, but that shouldn’t ever take away from the legitimate privacy issues that cryptocurrencies using public ledgers face.

One example that comes to mind, is trying to spend BTC that had been previously used in a criminal bust.

Heck, something as mundane as using coins in a gambling app could potentially see them flagged by some.

The receiver could choose to blacklist those particular coins, rendering the BTC that you legitimately received unrelated to any past transactions, worthless.

By keeping addresses and transaction histories private, Monero (XMR) avoids these potential issues that are no doubt going to continue to pop up as cryptocurrencies gain greater adoption for everyday use.

Monero’s XMR token offers a level of fungibility that other cryptocurrencies can not.

2 XMR coins can be mutually substituted for each other in a way that 2 dollars or BTC can’t

While 2 different USD notes are technically equal in value, they each carry a unique serial number that can be traced.

We see exactly the same thing with Bitcoin addresses on its public ledger, offering savvy detectives the ability to trace identities via on/off ramps and the like.

Monero’s fungibility is unrivalled and clearly the biggest advantage offered by using XMR to transact over any other unit of account currently out there.

With that being said, we encourage you to now take a deep dive into the rest of our Monero (XMR) guide below and see that the project’s scope is so much wider than the cliche criminal activities that the mainstream media portrays.

How does Monero coin (XMR) work?

Monero (XMR) is a privacy-oriented open-source peer-to-peer decentralized cryptocurrency. Its ability to help users go anonymous makes it a popular choice among people who are meticulous about their financial transactions. Both sender and receiver would be able to transact privately without risking their identities stored on public & immutable blockchain. For an outsider, it's two random one-time generated addresses transacting between each other.

If you want to know more about Monero in detail, please check out our basic yet comprehensive guide to Monero. In this blog, we are going to explore how it works and how the transactions done on the Monero network are untraceable. But before we move ahead, you need to know some of these terms to understand everything a little better:

Key Terms To Know

- Input: The input is a "deposit" ($XMR) to your account which you can use to do transactions. Let's just say one friend sends you 6 XMR and another friend sends you 4 XMR. These are called inputs.

- Output: The output is the part of the transaction that informs Monero Network about the receiver of that output. A transaction also has a fee component apart from outputs associated with it. This fee is given to miners on each transaction.

- Change: Now you want to spend 2 XMR out of your total of 10 XMR. The transaction will have an output of 2 XMR, a fee component, and another output to yourself of the remaining funds which will be sent back to you. This happens quickly in the background, and on the UI, it's as simple as sending funds from one address to another with one click. Once the transaction is over, the 'change' gets reflected in your account which you can spend further.

If you are a little confused right now, please move ahead to understand where all of these terms fit inside Monero's Blockchain network.

How Does Monero Privacy Work?

Monero utilizes three different types of privacy technologies to ensure confidentiality of the transactions and nobody but the sender and the receiver will have the knowledge about it:

- Stealth Addresses: These are used to obscure information about the parties involved in a particular transaction. On Monero Network, whenever a user sends XMR coins from their wallet to another, a one-time public key (Stealth Address) is created for the recipient. The recipient can have one Monero Address but it can receive funds (multiple outputs) on multiple stealth addresses which will point out to his public address with no links. For an outsider, the information available publically will only reveal random addresses transacting with each other.

- Ring Signatures: Ring signature protects the information on the input side i.e it's used to shield the sender's information while sending input to an output. It's a type of digital signature where multiple members are grouped together (Ring) to form a unique signature. Since All Ring members are considered equal, any one of them can use their keys to perform the signature while sending their input out of the wallet. Ring Signatures hide the identity of the person who used keys hence there is no way for an outsider to trace the outputs to the sender's public address.

- Ring Confidential Transactions (Ring CT): Monero transactions are untraceable with the help of Stealth Addresses and Ring Signatures. Ring Confidential Transactions (Ring CT) are responsible for hiding the transaction amounts. Whenever a transaction happens, each input (total amount of XMR in the wallet) is divided into two outputs - Reciever will get one output with the amount that was sent to them and the other output is the remaining amount called 'change' that will be sent back to the sender. In-Ring CT, the sender has to commit to the amount of output sent from their wallet providing the proof of transaction without publically revealing the amount spent. With the required proof, miners confirm the transaction. This is done via zero-knowledge proofs called 'Range proofs' which prevent senders from committing to negative values. Due to this, outsiders do not see the actual sum of inputs or outputs.

How Does Monero Prevent Double-Spending?

Monero prevents outputs from being spent twice by the use of Key Images. A key image is a cryptographic key that is unique to each output included in a ring transaction. It's not possible to find which output is linked to which key but a list of the used key images is maintained on the blockchain. This list is used by miners to ensure that no output in a ring transaction has been spent before. Once a miner validates the transaction, used Key Images will then be added to this list and other miners can verify their own blocks using the same.

How Does Monero Mining Work?

Monero works on Proof of Work consensus called Random X. You don't need to have heavy equipment (ASIC) to mine Monero. Both CPU and GPU will work fine but having a better system is more efficient. XMR has seen immense growth in the last few years and mining has been a profitable affair. Developers who are just beginning their crypto journey can find mining Monero pretty cheap and easy.

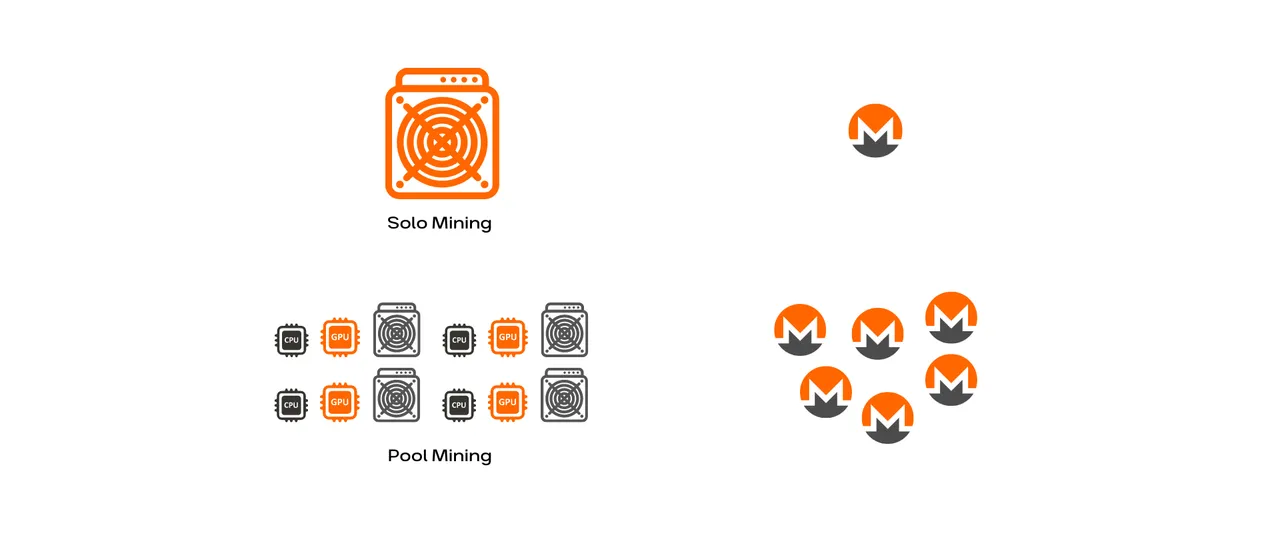

Miners validate and record transactions in exchange for a small fee in XMR coins. Once Monero supply hits 18.4 million XMR coins, new coins will start getting added to the supply at 0.3 XMR per minute. This will ensure that miners will get incentivized for validating the blocks. A Monero block is mined every 2 minutes for which miners are paid around 4.99 XMR/block. Anyone can mine Monero in two ways:

- Independent Mining: This one is recommended for the PROs who can afford heavy equipment to mine Monero. You can mine directly through Monero's wallet. The more power you have, the better chance you will get to be chosen for validating blocks. Independent miners enhance the decentralization and security of the network.

- Pool Mining: Pool mining is perfect for newbies because it doesn't require much capital or effort to set up. Anyone can join these pools by paying a little fee or just by sharing your CPU power to mine Monero. The fees generated by validating blocks is distributed among pool members depending on the level of their participation. Since multiple miners come together to combine their power, the chances to validate the blocks get high which means members will be paid out regularly.

Depending upon your requirement and budget, you can choose which mining technique suits you the best.

What is Monero (XMR) used for?

While Monero (XMR) has stereotypical criminal use-cases on the dark web, it also solves numerous privacy-related problems that legitimate businesses face.

Let me guess, you think you already know what Monero (XMR) is used for?

Monero is the go-to untraceable cryptocurrency that criminals use to avoid the prying eyes of the law while perusing for dRuGs on the dark web.

Everyone knows this.

Well, you certainly are correct.

But the privacy aspects of Monero have so many other use cases beyond the criminal underworld.

Use cases that regular, functioning members of society like you and I can take advantage of.

This section of our Monero (XMR) guide has been written to help open your eyes to the numerous ways Monero can be used to enrich your financial life.

Bitcoin has a privacy problem

There’s no denying the fact that Bitcoin's biggest flaw is its lack of privacy.

Every transaction conducted on the Bitcoin network is printed and permanently stored on an immutable blockchain.

This makes all transactions on the network entirely traceable.

Balances of both you and those you do business with, all out there in the completely public domain.

Cash flow data featuring EVERY transaction in and out that you have ever made.

While the Monero is for criminals narrative is the easy one, can you start to see some legitimate business and personal use cases starting to emerge?

Being entirely transparent is kind of the idea of a public blockchain, there’s no denying that there are legitimate times when privacy would be the preferred option.

3 legitimate Monero use cases

Monero is designed to solve the issue of transaction privacy, protecting the balances and identities of both senders and receivers.

Monero solves this issue, by automatically implementing privacy systems to every single transaction made.

When it comes to legitimate use cases, let’s go over 3 examples below.

Monero use case 1 - Keeping business accounts private

Consider every single piece of commercially sensitive information that you could reveal from a company if you were privy to the details of every transaction they made.

All the things you could do with that information maliciously toward the business in question.

Heck, just think how extremely beneficial that could be to you!

Let’s just say you would suddenly hold all the cards and leverage in any negotiations that would follow.

As a business, you don’t want to find yourself bent over the boardroom table like this...

Monero use case 2 - Keeping personal accounts private

Your spending data is valuable.

I mean do you think Facebook is actually a social media company that gives a shit about your family and cat photos?

Facebook is a data mining company that sells all the data you freely give them to the highest bidding advertisers.

You’re their commodity.

Now think about the what it could mean if every single transaction you make was publicly published.

You become EVERYONE ELSES commodity.

Monero use case 3 - Ensures the safety of ALL

Government officials looking to ban privacy coins sit safely in their ivory towers completely unaware of how fucked up the real world is.

Or actually, its more that they’re simply too drunk on power to care.

In some parts of the world, having the ability to keep your finances and transaction history private is imperative.

You don’t walk around with a flashing billboard advertising how much money is in your wallet.

Well, the Bitcoin blockchain is essentially a virtual version of that.

Not cool.

But Monero is used by criminals

So, is Monero used by criminals?

Well duh, of course it is.

I mean they’d be stupid not to, the privacy aspects of Monero is amazing tech.

But before we get too far ahead of ourselves, the US Dollar is obviously still the preferred currency of criminals.

Yet we don’t have that discussion in every second mainstream economic article.

This section of our guide to Monero has hopefully helped explain how the legitimate use cases of Monero far outweigh the risks of criminals also using the coin.

But being able to keep your transactions private and free of a 3rd party benefits EVERYONE.

This is the reality.

Monero (XMR) vs ZCash (ZEC)

In this section of our Monero guide, we are going to compare two blockchains:

- Monero(XMR) and,

- ZCash(ZEC)

This guide is meant to show you an unbiased comparison of each blockchain’s features.

Monero vs ZCash comparison table

The below table shows you the comparison points between the two blockchains:

| Monero (XMR) | ZCash (ZEC) | |

|---|---|---|

| Monero is a crowdfunded, community driven cryptocurrency launched in 2014. | Zcash is based on the 2013's work done by Prof. Matthew Green's work and their mainnet launched in 2016 by the zCash company. | |

| Monero has the total coin supply of 18.300.000 and Circulating supply of 17.9 million. | Zcash has the total supply of 21.000.000 and circulating supply of 10,028,406. | |

| Monero does not support the smart contracts on it's mainnet. However there are attempts from community in context of wrapped monero or using monero on external chains for use with smart contracts. | Zcash community has attempted to do the smart contracts in a proof of concept. Yet there is yet to see any official work on the mainnet. | |

| Monero is primarily written and extended in C and C++ programming language. Some of the command line community tools for Monero are written in Python. | Zcash makes use of the C++ and Rust on it's core work. However other languages can be used for extensible work on the top of the Zcash. | |

| Monero makes use of the Proof-of-Work (PoW) as the underlying Consensus mechanism. | ZCash also makes use of the Proof-of-Work Consensus mechanism. (PoW) | |

| Monero does not support staking as the staking reveals the privacy details of the user. | Zcash allows staking through 3rd party custodial lending providers for a specific amount of APY. | |

| Typical Monero transaction fees are around 000015 XMR ($0.003 USD). | Zcash too has a low transaction fees around 0.00001 ZEC. | |

| Monero hides the information about the transaction which includes sender, receiver, fees included. | Zcash has transparent option where it can show transaction amount while hiding sender and receiver, it also has shielded option where every detail is hidden like in Monero. | |

| Monero has more chances of adoption due to it's privacy capacity which is more required than smart contracts. Monero is often used by the darknet users, money laundering users, criminals and even VC Exit sharks. | Zcash has been mainly used to hide the swaps and the market bridges as they are partially shielded and also appear in public chain for transparency. Compared to monero, zcash is less interest to the community that is into criminal activity or illegal activity. | |

| Due to strong privacy it's hard to find out the Whales in the Monero cryptocurrency. | Zcash having commercial and the company background on the top of the foundation, it's possible to spot the funding whales and team that is working behind the privacy protocols in it. |

Is Monero better than ZCash?

Now the question comes in, which one among the two is better? So that question can be answered only by having a more depth in your question. Like do you want privacy only or do you want privacy along with support for smart contract?

If it's just Privacy you are seeking then Monero is much better option and is likely to be adopted more by token swaps and bridges when the regulation bill comes in. Monero would be a good choice for DEFI, DAO and SWAPS.

Whereas if you want smart contracts and support for privacy both, then Zcash is definitely a good option. It's not one over the other question from my context but more of who fills the shoes in which scenario.

Is Monero traceable in 2023?

We discuss why Monero is as untraceable and anonymous as ever in 2023.

When it comes to tracing transactions on the Monero network, nothing has changed.

Monero remains untraceable thanks to the use of ring signatures and stealth addresses.

Inside this ring or fan of transactions, Monero allows you to be nothing more than an anonymous part of a crowd so large and distributed that there is zero chance of having your true transaction details discovered.

As more and more people join the Monero network in 2023, creating more addresses and transactions as they do, the network effect takes hold.

This section of our Monero guide is here to put your mind at ease that in 2023, Monero is as untraceable as ever.

We discuss Monero’s increasing fungibility advantage over Bitcoin and discuss the measure Monero employs to remain untraceable.

Monero remains untraceable and anonymous in 2023

Monero is as untraceable in 2023 as it ever has been.

It still remains the only cryptocurrency, privacy coins or otherwise, featuring anonymous addresses by default.

This means that the sender, receiver and all details within the transaction are hidden from the prying public eye via the blockchain.

It’s this anonymity around Monero transactions that means Monero is untraceable and makes it truly fungible currency.

It's in its fungibility where Monero has a clear advantage over cryptocurrencies running on public blockchains like Bitcoin.

All thanks to the privacy technology that makes Monero unique.

Consider a Bitcoin transaction featuring coins that had previously been stolen or used by criminals in the past.

As every address and transaction is made public on the Bitcoin blockchain, these tainted coins can be easily tracked and are often refused.

With only 21 million BTC to ever be created and a lot more criminals in the world, realists will soon see how the rejection of tainted coins could quickly pose serious threats to the fungibility of Bitcoin.

Monero, however, employs a number of privacy-enhancing measures to ensure the anonymity of its users and keep the fungibility of the XMR token high.

Let’s move onto some of these measures to protect the privacy of addresses and transactions made on the Monero network.

How Monero remains untraceable

As we briefly mentioned above, Monero remains untraceable thanks to the use of ring signatures and stealth addresses.

Both of these measures ensure the identities of both the sender and receiver remains completely anonymous.

Ring signatures

The most important part of keeping Monero untraceable are ring signatures.

Ring signatures create decoy transactions that mean someone watching the blockchain is unable to tell which transaction is actually yours.

Within a ring of possible signers, all transactions are entirely equal and valid to any prying eyes from the outside.

There is no way to tell which of the possible signers within this ring actually belongs to your account.

But for those who are really paranoid, you know that one of these is still yours.

This means that technically someone could follow the fan of transactions and reach your exact one and discover details of your transaction and address.

However, there is an easy solution that will all but ensure your transactions remain completely untraceable.

This involves adding maximum background noise to your actual transaction.

Prior to sending funds to sensitive destinations, you can blend into this fan of transactions even better by simply sending your entire balance back to yourself a couple of times at random.

Also keep in mind that Monero's stealth addresses mean that there is absolutely zero difference between sending funds back to the same wallet and sending funds between wallets.

Speaking of stealth addresses...

Stealth addresses

The second major implementation that ensures Monero is untraceable, are stealth addresses.

Stealth addresses allow the sender to create random one-time addresses for every transaction on behalf of the recipient.

The recipient can publish just one address, and all of their incoming payments will go to different addresses on the blockchain.

Consequently, they can’t then be linked back to either the recipient's published address or any other transaction's address.

Stealth addresses allow only the sender and receiver to see where a payment was sent.

Final thoughts on Monero’s untraceability

This section of our guide to Monero has hopefully helped show why Monero is untraceable in 2023.

Not to mention that as long as the network continues to be adopted and used, its untracability will only increase.

Remember, your aim is to be anonymous within a crowd so large and diverse that even the most paranoid person would be entirely unfazed by the risks of having their transaction details uncovered.

If you’re implicated in something, then everyone else will have to also be implicated because there's no way of telling who's who.

But the ultimate upper bound of your privacy will remain the number of people transacting on the Monero network.

So as crypto in general expands through 2023 and beyond, Monero continues to provide the biggest crowd to be anonymous within.

...and always pay your taxes.

Monero (XMR) pros and cons

Monero pros

Here are the aspects of Monero (XMR) that we consider to be positive:

Privacy

Monero is one of the so-called privacy coins, meaning it was designed to provide anonymity and untraceability.

In practical terms, that means that, unlike with traditional coins, such as Bitcoin for example, the identity behind a Monero transaction is hidden.

It's also virtually impossible to track the trail of transactions using a block scanner.

Fungibility

A token’s fungibility goes hand in hand with privacy.

Monero tokens are fungible, meaning they are indistinguishable from one another.

So if some XMR tokens that were used in a previous illegal transaction somehow find their way to your wallet, you don't need to worry about any headaches.

Because it's extremely difficult to trace them.

Large development team

The Monero project really takes privacy seriously.

It has a dedicated team to research and develop privacy features for the project.

While most of the core team prefer to remain anonymous, the open-source project is a big success among developers.

Some sources put it as the third largest developer community in cryptocurrency, behind only Bitcoin and Ethereum.

ASIC resistance

Most large-scale coins nowadays are mined using Application-specific integrated circuits (ASICs), but Monero discourages that and is mined with CPUs instead.

The advantage in that is because more users can afford to participate in the mining process since they don't have to spend thousands of dollars on specific hardware to do so.

Dynamic scalability

Monero doesn't operate on a pre-set block size.

This means that Monero block sizes can be increased based on demand and that is very advantageous for scalability.

Monero cons

Here are the aspects of Monero (XMR) that we consider to be negative:

Not the fastest network

Even though a new block is mined every 2 minutes on average, a transaction on Monero takes about 30 minutes on average to be processed.

When compared to some of the other major cryptocurrency projects on the market, this puts Monero on the slower side.

Prone to FUD

Because of Monero (XMR)’s anonymous transactions, it can and obviously is being used for certain illegal activities.

When the mainstream media highlights this fact, it can lead to unwanted attention and the associated FUD that comes with it.

But are there more Monero (XMR) pros than cons?

We believe Monero’s privacy features are still very underrated but think it will gain more importance in the future.

Especially with all the talks on regulations and things associated with government control.

Many experts say that it shouldn't have any scalability issues, so it has a real potential to become a central project in cryptocurrency once mass adoption takes place.

Keep in mind that these pros and cons are only a starting point and those who are considering investing in Monero (XMR) should always do their own research and never risk any money they can't afford to lose.

Should I buy Monero (XMR) in 2023?

Within today's investment markets, cryptocurrencies remain one of the riskiest of all. Significant sums of money are lost daily, and this loss is exacerbated by an investor's failure to do due diligent research prior to opening their wallet. Research is no guarantee against loss so the axiom 'you should never invest more than you can afford to lose' applies.

But research does level the playing field somewhat. It is an integral step in the investment decision process. So let this sub-section of our Monero Coin Guide be your research starting point on making an informed decision whether or not to invest in Monero (XMR).

SHOULD I INVEST IN MONERO (XMR)?

FACTORS IN FAVOR OF INVESTING IN MONERO (XMR)

Monero split from Bytecoin in 2014 and as such is a relative 'old-timer in the cryptoverse.

Monero aims to be the best electronic cash, saying the components of the best digital money should address what some refer to as the electronic cash triangle meaning it’s: Electronic, decentralised and private.

In pursuing the goal set forth in the preceding bullet, Monero developed three privacy systems:

- Ring Signatures (Sender's Privacy)

- Stealth Addresses (Recipient's Privacy)

- Ring Confidential Transactions (Transactional Privacy)

Like Bitcoin, Monero (XMR) is a Proof-of-Work coin. However, mining Monero does not require the powerful computers that Bitcoin does, so Mining is open to more participants who can mine with their present laptop.

Monero's consensus system, CryptoNight, allows the profitable mining of XMR using CPU's AND GPU's, and prevents the centralization of mining.

Monero possesses the advantage of unlimited scalability. The system has no set block sizes and it is the miners decision as to the size of the block they wish to approve.

Monero's network functions anonymously by employing the use of multiple keys.

There is a limited supply of Monero (XMR) coins in circulation.

Year over year there is a large growth in network transactions performed.

Several payment gateways (NOWpayments, CryptAPI, and CoinPayments) accept Monero (XMR) for settlement.

Monero (XMR) now features 'Atomic Swaps'. With this, network transactions will either execute or fail and neither party loses money upon a transaction failure.

FACTORS AGAINST INVESTMENT IN MONERO (XMR)

- There are, at present, at least 63 privacy coins in addition to Monero (XMR). As such there is a high degree of competition in this space.

- World Governments are not too keen on privacy coins. Several months ago in the US, the IRS invested millions into developing systems to uncover users of privacy coins. The IRS is also seeking to hire private contractors tasked with the job of insuring more transparency in the privacy space. And in Russia, regulators began using a a tracking system to break both Monero's and Dash's privacy security systems.

- There is a very high bar for Monero to overcome based in the association of financial anonymity with shady and illegal activities.

- In the same vein, Monero has the reputation of being 'the hackers' choice' further tarnishing the public's perception of the coin.

Final thoughts on buying Monero (XMR) in 2023

This subsection has provided you, the potential investor in Monero (XMR), with the key elements to consider in reaching a final decision on this coin. In reaching a final investment decision many differing opinions should be sought out. Reliance on one research source is highly discouraged.

It is a given that every individual investor possesses a different present financial circumstance, tolerance for risk, and investment strategy. These must be weighed in light of the factors and information above provided in finalizing any investment decision.

Please remember, this subsection of the Monero Coin Guide is merely a starting point and should not be deemed a substitute for doing your own diligent research. And as always, never invest more than you can afford to lose. Good luck!

LeoFinance Crypto Guides.

Why not leave a comment below and share your thoughts on our guide to Monero coin (XMR)? All comments that add something to the discussion will be upvoted.

This Monero coin guide is exclusive to leofinance.io.