Introduction

As an investor in both cryptocurrencies and traditional stocks, the difference in standards and maturity is clearly visible for me. When trading in stocks I can instantly buy and sell stocks and can monitor rates real-time to place my order. The best part is all this happens through the same platform and I don’t have to bother sifting through multiple sites or platforms. The picture though is not so rosy on the cryptocurrency side.

It will be foolish to overlook the potential of cryptocurrencies and I, much like other prudent investors, looked at trading in the crypto space too. That was my first step to realization of many problems. Let’s take the simplest of examples.

I trade in “Steem” and “SBD” cryptocurrencies used on Steemit platform. Now, the exchange in my home country only trades in Steem and not SBD. To counter this I looked at a popular exchange in the U.S. which trades in both Steem and SBD, however, not in my country’s FIAT currency. So, if I have to convert Steem or SBD into my native currency, I can’t do it from the U.S. based exchange. However, SBD can be converted in the U.S. Exchange while Steem can be traded on the exchange in my country. To make matters worse, if I convert SBD to USD at the U.S. exchange and move dollars directly to my country’s exchange or my bank, I will have to explain to the tax department about the source of income and prove that it was not through any fraudulent means. Besides, each time I trade on both exchanges, I have to toggle through different webpages and interfaces. Even the experience is different with the U.S. exchange being better than the exchange from my home country. Oh, did I forget to mention that my native exchange has some incredibly long downtimes? I never experienced that when trading on traditional stocks or traditional platforms. See the challenge? And I have so far spoken about just two of the thousands of cryptocurrencies available for trade in the market.

But am I the only one with such difficult experiences?

-----------------------------------------------******-------------------------------------------------

Turns out there are many more

This is the general trend when it comes to cryptocurrency trading across the globe. There are many exchanges which have come up to enable trading in cryptocurrencies and they are at different levels of success. Adding to this there are new blockchain solutions, and therefore, cryptocurrencies coming up across the globe at an exponential pace almost every three months. So the resulting mesh of exchanges and cryptocurrencies are only making things complex for users. There are more than 200 exchanges enabling trading to the tune of 325 bn. USD globally. Since there are not really many regulations around exchanges there is a spurt in the growth of exchanges too. Many of them are built from scratch with hardly enough thought given to redundancy or speed of transactions. The result being that if the trading load (or volume) goes beyond a certain threshold then the exchange may trip (or have a down-time). If this is irritating for an individual investor like me, then seasoned traders and institution cannot accept it at all. After all, they are investing with a view to manage cryptos as a portfolio not only for themselves but also their customers’.

Now that few regulated exchanges also allow trading in cryptos means that investors have to switch between the crypto world and real world continuously, but there is hardly any tool available which allows this at the moment. So, users are going to be toggling between two different exchanges on two different windows on the PC. Not only this, the disparate and fragmented nature of digital asset exchanges globally does not give an investor an easy possibility of rebalancing his or her portfolio; needless to mention the tumultuous task of toggling between such exchanges.

In the case of traditional exchanges, trading, as well as trader security, is taken care of and it is assumed to be a given while trading. This is not as much true in case of crypto exchanges while concepts like risk management could be unheard of. Since 2011 there have been numerous instances of hacking of exchanges leading to loss of more than USD 4 billion. This is only set to exacerbate in the coming years if the security adoption does not grow along with the trading of cryptos. How is the crypto world positioned to handle this?

Compliance, regulatory monitoring, and reporting too are in a nascent stage in the crypto world. If an individual user finds it difficult to track trade across exchanges, it would be a gargantuan task for a portfolio manager to do so for multiple transactions across multiple exchanges for multiple customers. We haven’t even started talking about customer service but then by now, readers would have got a sense of its maturity. I mean how do you think a customer service executive is going to explain the exchange’s down-time? Get what I mean?

These issues not only slow the pace of adoption by small or individual investors but also delay the adoption by portfolio fund managers by many years. In other words, mass adoption of cryptos will be a pipe dream until a solution is found.

----------------------------------------------******-------------------------------------------------

So then, do we have a solution?

Turns out we do and a solution which may excite the fence sitters to participate in crypto world trading. Who are we talking about? We are talking about Caspian.

Caspian is a joint venture between Tora Trading Services Limited, a global leading cloud-based front to back technology provider to buy side institutions and Kenetic Trading Systems Limited, a leading blockchain and cryptocurrency investment firm.

It, therefore, isn’t difficult to understand that Caspian has brought together the strengths of these two firms - knowledge of investments and blockchain on one end and managing reporting and compliance on the other end. All this in one package appears to be just the thing which may attract mass adoption by bringing the crypto world closer to the real world, but more importantly, making crypto-trading a lot easier.

Looking at the track records of these companies there is a sense of confidence that by adopting this solution we are in safe hands. Tora is a supplier of asset management technology, including OEMS, responsible for 17% of Japanese institutional equity trading volume. They have connectivity to over 150 equities and derivatives exchanges across North America, Asia, Europe and Australia and therefore ideally placed to bring forth the Caspian solution.

The companies behind Caspian and their track-record should give confidence to major traders, market makers and individual investors. At the moment, they are already connected with 10 major digital asset exchanges and they plan to increase that number to 40 by end of Q3 2018. The solution includes three modules which are Order and Execution Management System (OEMS), Position Management System (PMS), and Risk Management System (RMS).

-----------------------------------------------******-------------------------------------------------

Let’s get to understand Caspian a bit more in detail?

Well, Caspian is a solution which brings together the trading customers, the digital exchanges, traditional exchanges and crypto wallets on one platform.

Caspian effectively aggregates prices, bid/ask information, orders, positions, accounts, and executions from multiple crypto exchanges and other sources, presenting the information on a single platform. It allows users to act on this information by sending orders to exchanges individually or using a Smart Order Router based on existing Tora technology.

Take a look at the pictorial view of the Architecture:

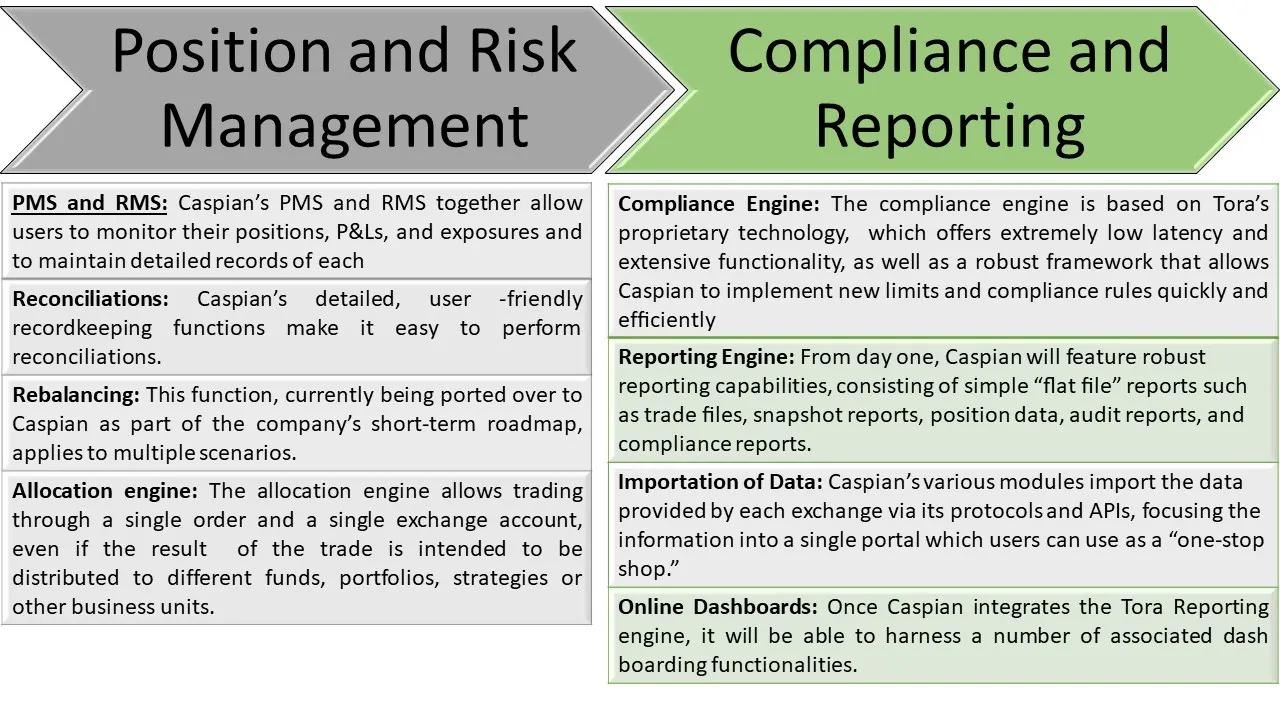

We already mentioned that there are three modules that comes as a solution. What are the key features and benefits? Here it is.

-----------------------------------------------******-------------------------------------------------

These are the benefits and features of each of the module under the Caspian solution. It is also explained through a demo over here.

-----------------------------------------------******------------------------------------------------

What is the benefit of setting Limits and Alerts?

Well, limits and alerts are the features which help us to manage our transactions as much as give us a warning or intimation based on our pre-set rules. This is much like what we have in the traditional stock trading platform but a bit more complex considering the multiple exchanges that the rules can be predefined for.

Limits

Limits help in position and risk management, especially in cases of a volatile market, and the crypto-world is most definitely synonymous with volatility. There are three types of limits that can be set:

Warning Limits – These can be overridden by the user as need be. For example, if I had planned to trade up to USD 5,000 to buy bitcoins and saw that the price of bitcoin fell by 30%, the next day, I can over-rule the warning and increase the investment to USD 10,000 (say) to take advantage of the dip in price. This can be balanced elsewhere by investing less.

Approval Limits – This could be more useful in case of a major trader kind of set-up. Imagine the trader having five offices and each office sets some trade calls which is consolidated at the final trader level at the head-office and approved to be sent to the market. This is desirable where the head office has a view of the entire portfolio whereas branch offices are limited to the set of customers attached to that branch only. Of course, this can be over-ruled by the supervisor, as need be.

Absolute Limits – These are limits which cannot be over-ruled under any circumstances. For example, if I have 10,000 dollars to be invested among Bitcoin and Ethereum then I can decide how it is being allocated but under no circumstances overshooting the limit of 10,000 USD. So trade cannot happen if this rule is not adhered to.

Alerts

Alerts are a passive mechanism in comparison to Limits. Alerts can be set at any level and can be triggered to send messages to the mobile or through emails. Alerts can be set up at the OEMS level to track trade or price or any other parameter that is desirable for a favorable trade. There can be alerts even as pop-up depending on the impact the alert needs to have on the user/trader. In fact, all the alerts are customizable by the user as he/she/they deem fit.

There can be alerts for letting the trader know that a particular order went through on fulfilment of some limit conditions.

-----------------------------------------------******--------------------------------------------------

Will Caspian change the way people perceive the crypto-world and will it help in mass adoption?

The answer is yes. Caspian surely will help in mass adoption not only for individual traders but also institutions and major traders. This is because of what it provides and how it helps in dealing with issues we saw at the beginning of this article. What are those? Let’s do a quick recap.

Performance

This was one of the major problems which hindered adoption when we saw the state of exchanges today and more so, tracking of trades. However, Caspian changes that with its ability to handle large amounts of data with low latency. We are looking at numbers to the tune of 50,000 orders and 400,000 transactions per day per user, with a throughput of 2,500 orders per second. Not bad for performance!

Scalability

Scalability is managed both automatically and manually as required by the customer. Caspian partitions data and communication channels for some set thresholds. These thresholds can be actively monitored through the back-end or automatically changed depending on the usage of the customers. This ensures that availability is as per the need and no additional resources are set unless required.

Reliability

The down-times that we discussed is handled by Caspian quite well. We saw that Tora provides its OEMS for managing 17% of Japanese institutional equity trading volumes. Besides they have an industry beating uptime of 99.99% in the last decade of operation. These are achieved by taking care of fundamentals like:

- Built in redundancies and replication should a need arise. That means seamless takeover by the built in redundancy is possible quite immediately

- Load Balancers are deployed as part of the solution to ensure that trades are routed to the least congested gateway

- Active Business Continuity Plans (BCP) and Disaster Recovery Plans(DR) in place in case of unforeseen calamities. The 99.99% uptime speaks a lot about the BCP and DR being effective

- Periodic Health Check to ensure that tools and equipment are functioning as per design for real usage conditions. Depending on need, corrective measures can also be taken

These are the same set of benefits which Caspian brings to the crypto world.

Security

We spoke about hacking to the tune of 4 billion USD in the beginning so this point is, of course, important, in fact, very important. Here too, many aspects make the Caspian solution secure. These are:

- Two-factor authentication

- Whitelisted IPs for trading

- Encrypted data through the internet

- Restriction on users accessing the backend

- Integration with API signing service to safeguard exposing of client’s key

These are some of the components that are built in to ensure security.

Support

Having experience in handling real-life trading it is easy for Caspian to transfer those learnings to the crypto-world and its clients. Predefined SLAs will ensure that prioritization is brought in and trading-related activities and security are given higher priority as compared to administrative needs. Both Level 1 and Level 2 support are strengthened by the periodic involvement of development teams to ensure that the customer care support is able to effectively handle issues with minimum delays.

Ongoing Development and Adaptability

For those working or trading in the crypto – space it is easy to see that there are quite a lot of changes happening almost every quarter. These are things which necessitate that any solution for the crypto space should be adaptable. Adaptability should not be a challenge for Caspian, though. Their strength of 150 developers allows them this adaptability with ongoing development and thereby, keeping pace with the crypto world dynamics.

Audit

This is one of the most important needs for the institutional community to look at crypto space seriously. Caspian handles this area well by ensuring timestamping of every activity/transaction and even recording where required. This provides a strong audit trail, if the need arise, and also backs-up well for regulatory reporting.

Modularity and Third Party Integration

An effective product is known for its modularity and capability of integration. This is exactly what makes Oracle or SAP effective products for the ERP world. Caspian does the same to the trading world. Being modular allows each module to independently integrate with client’s systems, as need be. This frees customers to work out their own workflow as they deem appropriate making Caspian a flexible and easily integrating solution.

Well, these are the sum total of benefits that Caspian brings forth, thereby, making it easier for institutions to adopt crypto trading.

-----------------------------------------------******--------------------------------------------------

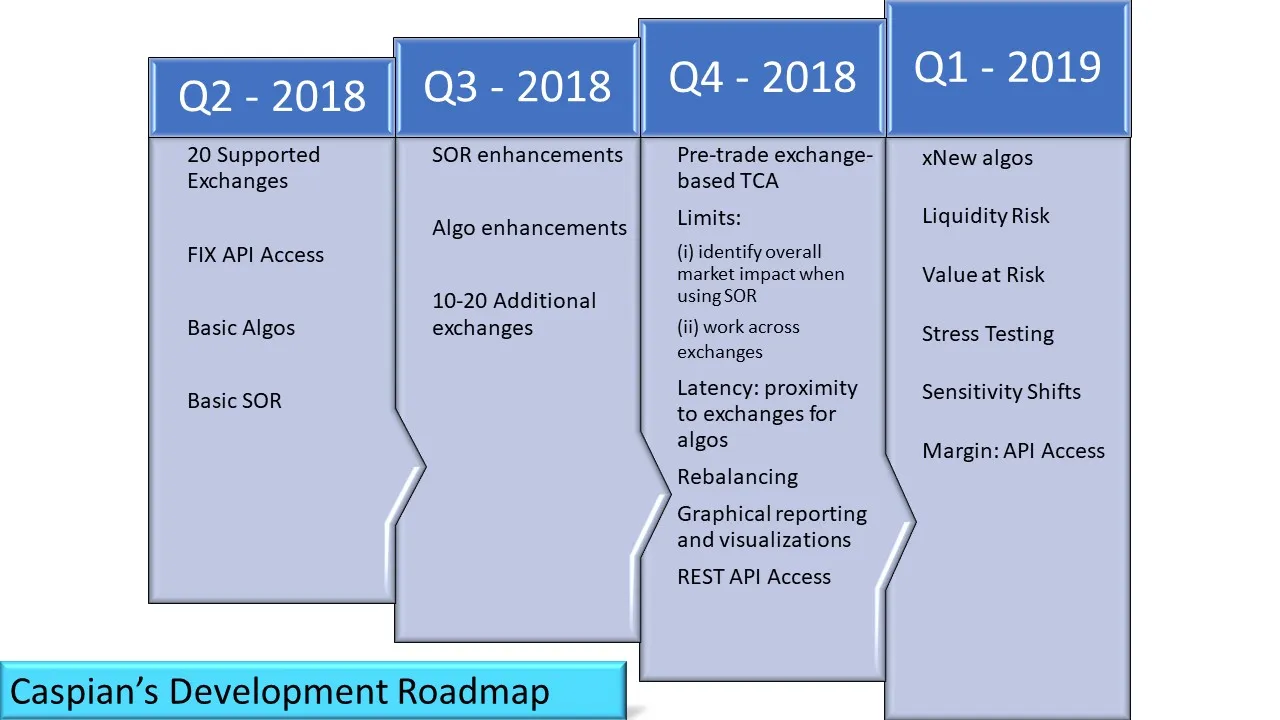

So, what next for Caspian?

Here is Caspian’s development Roadmap for the next 12 months:

-----------------------------------------------******--------------------------------------------------

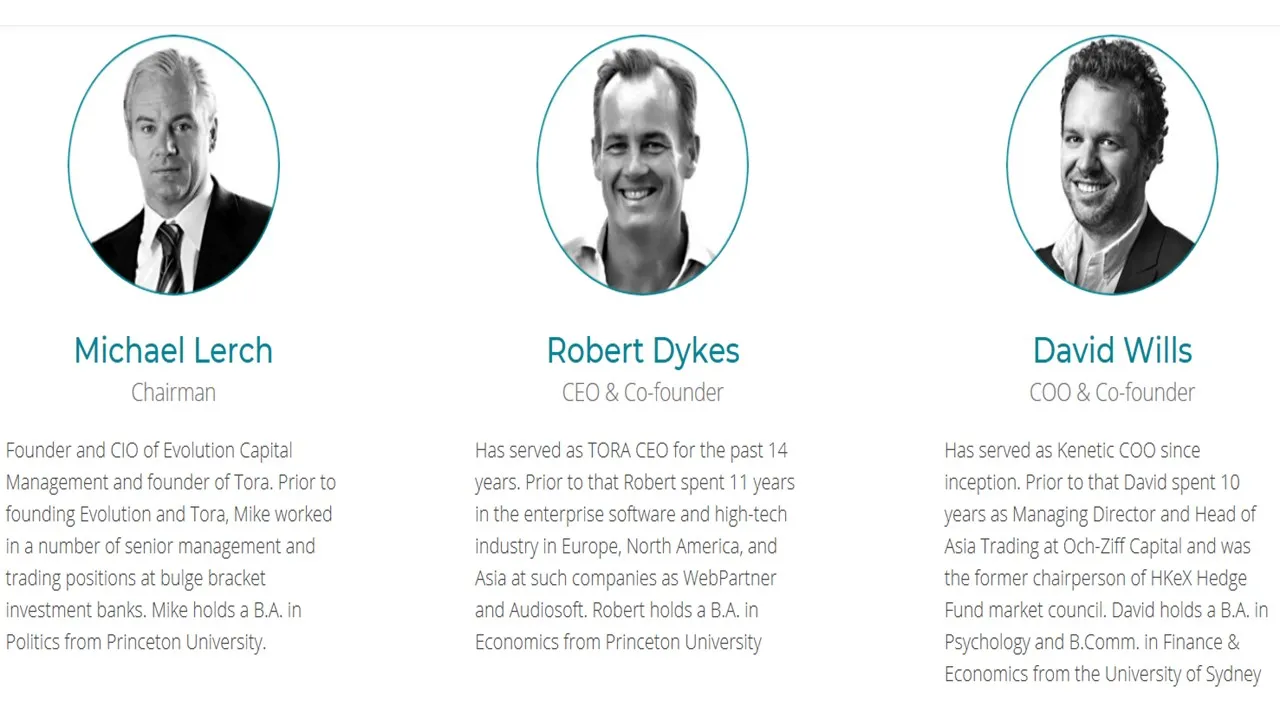

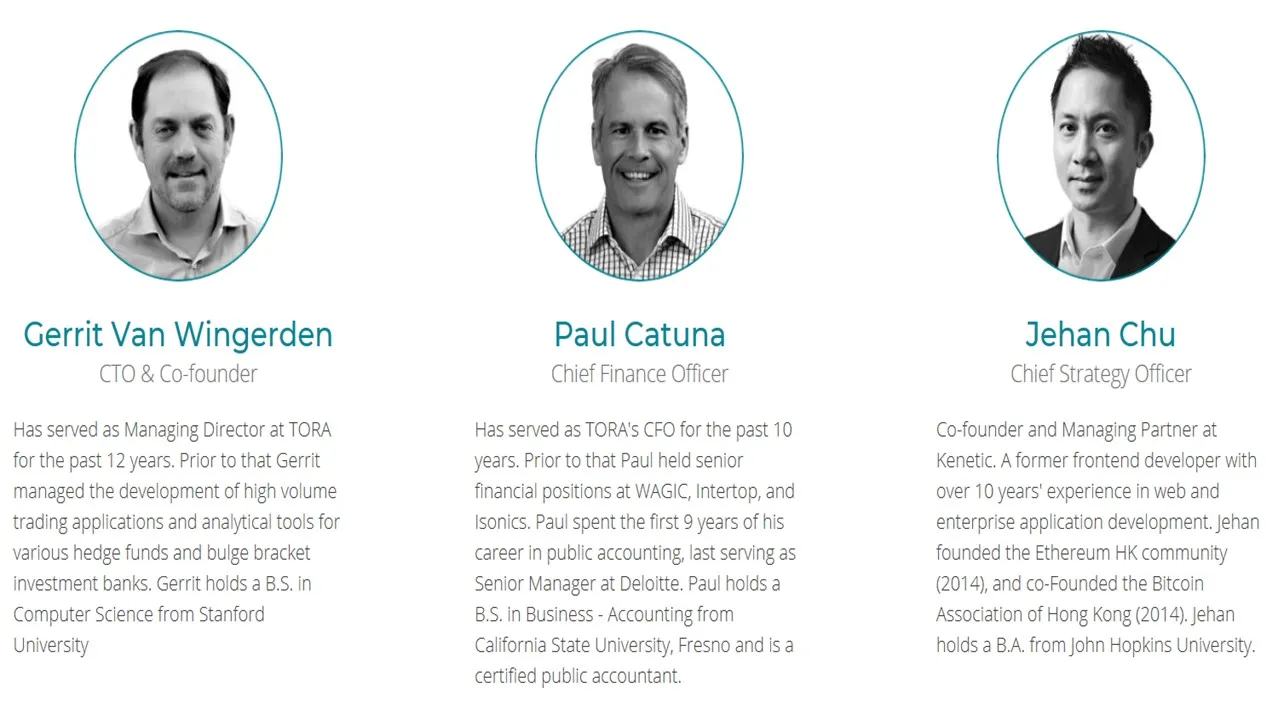

And the team behind Caspian?

The Team

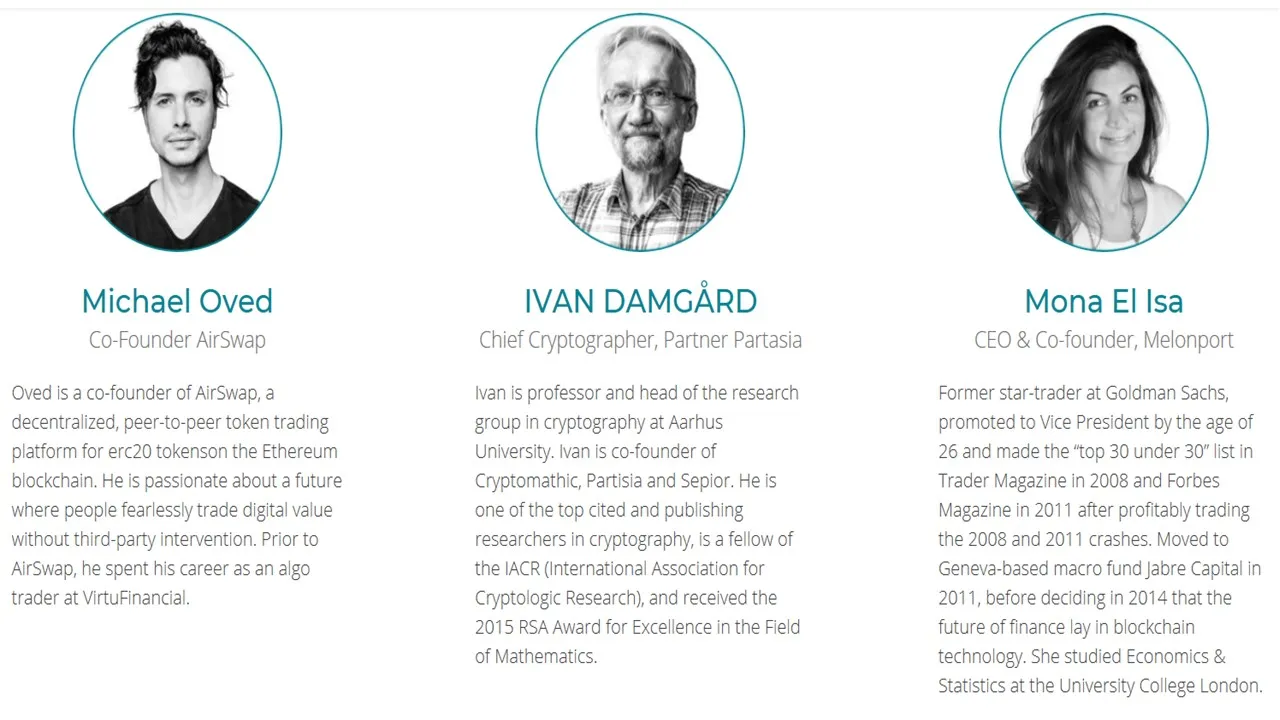

The Advisors

-----------------------------------------------******--------------------------------------------------

It is also recommended that readers understand more about Caspian through any of the following informative resources.

- Caspian Website

- Caspian WhitePaper

- Caspian Steemit

- Caspian YouTube

- Caspian Telegram

- Caspian Videos

- Caspian Blog

- Caspian Events

- Caspian News

- Caspian Linkedin

- Caspian Management

-----------------------------------------------******-------------------------------------------------

This article is written in response to originalworks’ call on authors’ thoughts on Caspian. It can be read here. https://steemit.com/crypto/@originalworks/910-steem-sponsored-writing-contest-caspian

Image Courtesy: Caspian Resources

caspian2018