Price discovery is a beautiful thing.

Back in the day, many people learned about bitcoin because they wanted some product they could only obtain safely and peacefully via the Silk Road which accepted bitcoin as payment. They were content to use a new currency as needed and didn’t really think about the long term value it represented. I’ve heard stories of people selling bitcoin at $1.00 after making 100x return! How can that be a bad trade? Well, it’s a terrible trade from the lens of a $66,000+ bitcoin.

Others understood. And held. And bought more via dollar cost averaging. They bought the dips.

I remember buying more bitcoin at $50 when it crashed from $120. I remember it going from $1,200 down to $250 with friends of mine who bought at $1k selling at $600 for a loss. They simply didn’t understand the long term value of what they were dealing with.

The $MOR chart reminds me of those bitcoin charts I started watching in early 2013. It’s the natural process of price discovery. Some people are undoubtably staking ETH to earn MOR which they dump for more ETH. If you’re long ETH and don’t care about MOR, that’s a logical thing to do. If that was the only force driving the Morpheus tokenomics, eventually we’d reach parity with the yield Lido generates with staked ETH to earn a MOR token and the market cost to purchase a MOR token.

But that isn’t the only force. There are many, like me, who see the long term value of Morpheus. They use tools like Venice.ai, confident that many more like it will emerge in the future. They participate in MOR20 fair launches, like what started yesterday with Nounspace, confident of many MOR20 launches to come and the increase in value that will create for Morpheus.

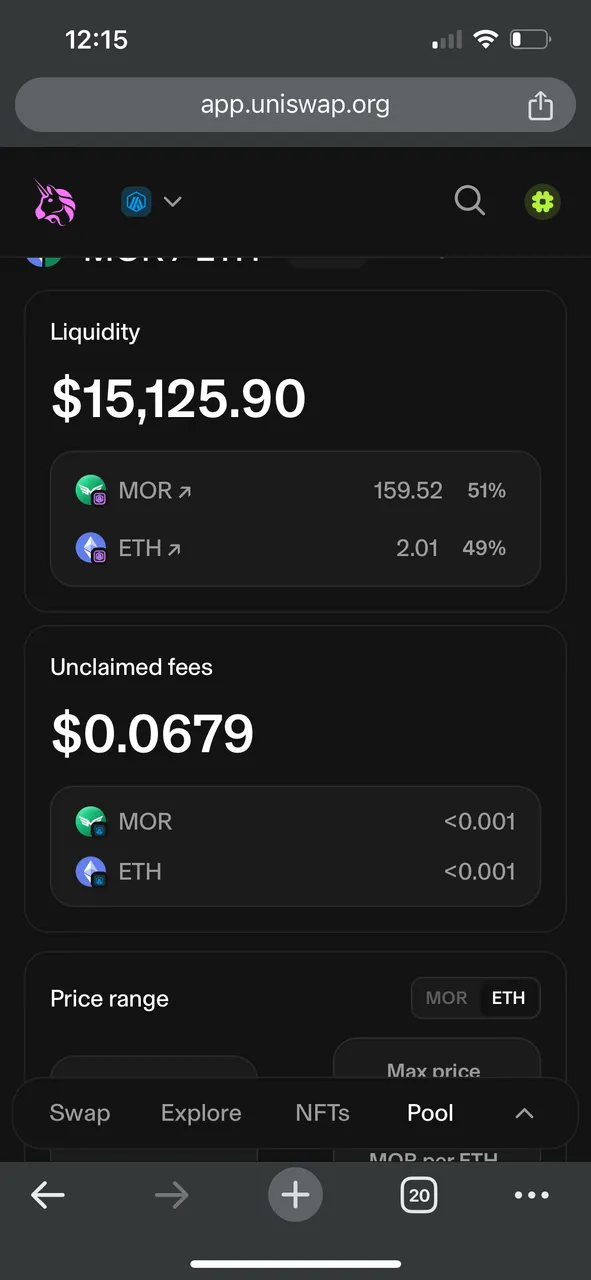

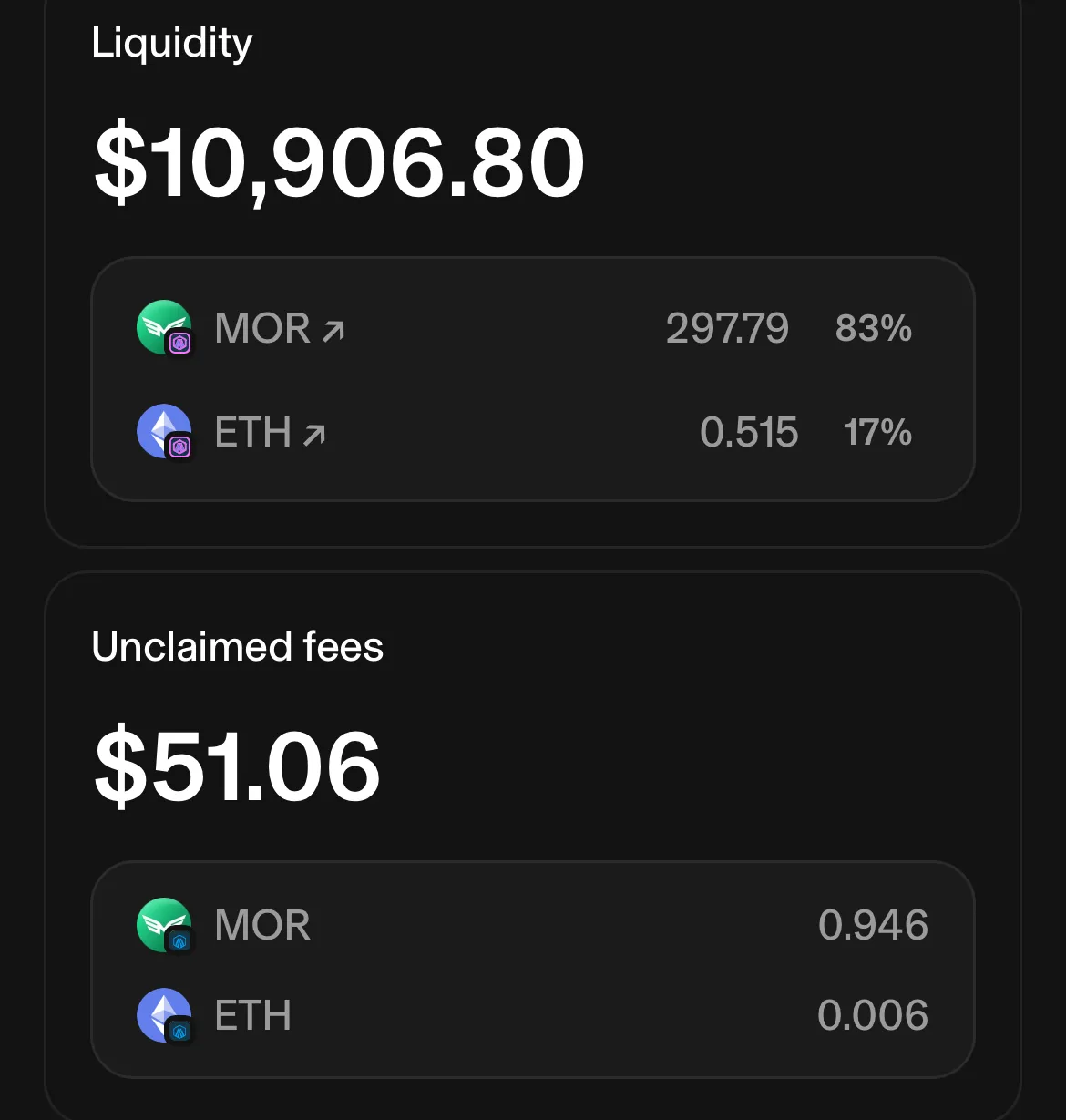

They are buying while others are selling. They are providing liquidity to the pool to make it even easier for weak hands to let go, essentially dollar cost averaging as their MOR balance goes up and their ETH balance goes down. They are betting on the future without caring about day to day fluctuations. Whether you bought bitcoin at $50, $100, $250, or $500 feels kind of irrelevant compared to those who have to buy at $66,000+ today.

And will people have to buy MOR in the future? With its 42M tokens and clearly defined emission curve, is it anything like bitcoin? Well, those who appreciate bitcoin know it’s required to escape the ponzinomic fiat system. Will we need a token in the future to access unrestricted intelligence, free AI, that keeps our personal information private and is open source to ensure there’s nothing nefarious taking place with our most intimate questions and private documents?

I think we will. I think there’s a huge pent up demand for exactly what Morpheus is building. 180M+ users signed up for ChatGPT. How many of them will get frustrated with it not answering questions accurately for political reasons? How many will understand the dangers of giving away such intimate information? How many ads will it take that are informed by private sessions with an AI before they demand a privacy maintaining alternative?

This isn’t financial advice, but I’m happy to be long the MOR token. When something really exciting comes along and OGs recognize it for the value it brings, the day to day price is irrelevant. Obtaining at any price significantly lower than its future potential is a win. Price discovery will continue and 5-10 years later, we get to see who made the best call.

This is my (Luke) personal view and doesn’t claim to represent the views of any other individual contributors to Morpheus or to suggested how you should view things. Do your own research and place your bets.

I’m providing liquidity in the uniswap pool adn an excited to this increase in MOR tokens from ~160:

To almost 300:

The currebt price is irrelevant. The future price is what matters.

I recently started a Morpheus AI Facebook group which you can follow here: https://www.facebook.com/morpheusfreeai

See my Facebook pinned post for more information https://www.facebook.com/bestoked