What is Moon Defi:

MoonDeFi is a protocol on Ethereum for swapping ERC20 tokens without the need for buyers and sellers to create demand. It does this via an equation that automatically sets and balances the value depending on how much demand there is.Unlike most exchanges that charge fees, MoonDeFi was designed with a very low fee structure.

This is one of the first fully decentralized protocols for automated liquidity provision in the Defi.There’s no company involved, no KYC, and there’s no person involved that’s mediating things.

Liquidity Pool & Liquidity Provider:

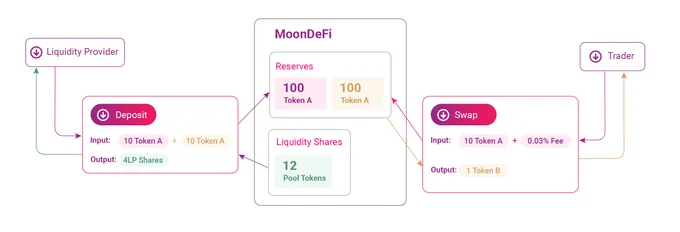

The way that MoonDeFi works is using liquidity pools. Basically, they are pools of tokens that are locked in smart contracts. There are enough tokens for you to be able to exchange any of them with one another using Ethereum as a conduit. There’re loads of Ethereum in there, and there’re loads of every kind of token that MoonDeFi currently supports. Moreover, anyone can create a new exchange pair in a new liquidity pool for any token, at any time. Who contribute to the liquidity pool are called Liquidity providers. Anyone can be a liquidity provider by depositing an equivalent value of two tokens in the pool.

MoonDeFi Liquidity Staking:

Innovative Defi platform MoonDeFi has recently made liquidity mining available to users. After the Liquidity providers contribute their coins to the pool, they will receive LP tokens. Those tokens represent their share of the entire liquidity pool. These liquidity tokens can be redeemed for the share they represent in the pool. Moreover, Liquidity Providers can use those tokens to participate in the Staking Program to gain MOON with a high profit rate.The reward will be distributed among users who deposit funds to the liquidity pool and join this program. Normally, they can earn APY of 30%-45% for staking LP tokens. The Staking program is also applied for holders of MOON & other tokens. Users can also stake other tokens with the same ERC-20 protocol, including MOON – the native token of MoonDeFi to get APY of 30 – 40%. With a limited number of tokens (total supply of 210 million tokens) and the quickly increasing demand of MOON, staking this token will give users drastic benefits in the future.

Moon Allocation:

210 million MOON have been minted at genesis and will become accessible over the course of 4 years. The initial four year allocation is as follows:

69.00% to MoonDeFi community members 144,900,000 MOON

18.25% to team members and future employees with 4-year vesting 38,325,000 MOON

12.50% to investors with 4-year vesting 26,250,000 MOON

0.25% to advisors with 4-year vesting 525,000 MOON

Moon Token Distrubition:

Year - Community Treasury - Distribution %

Year 1 - 57,960,000 MOON - 40%

Year 2 - 43,470,000 MOON - 30%

Year 3 - 28,980,000 MOON - 20%

Year 4 - 14,490,000 MOON - 10%

MoonDeFi contract & token addresses:

Token: https://etherscan.io/token/0x71924a8d733ae1bbc18d243e1deb56e767440eb6

Contract: https://etherscan.io/address/0x765b2d50dE69219A418383F79a4973568d537F90

Other Webside Link:

Written By :

•Bitcointalk username: rojnimesh

•Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=2860952

•ETH Address: 0x0d459dBa518FD4f0D69E29c5fC2B7712caAfc1A0