There is no doubt the world has a debt problem. Ever since 2008 when banksters created debt saturation in many Real Estate markets around the US and Europe, everyone has thought we have been recovering. That is not true at all. Debt has risen to record levels, and we are now seeing debt like government, credit card, student loan and car loans and also including a new massive wave of mortgage debt as well.

I want to focus on the Auto debt that has been accumulated on a vast scale. In 2008 a Toyota Corolla base model cost about $14,405 new https://www.autoblog.com/2008/01/25/toyota-releases-prices-on-2009-corolla-and-matrix/

In 2018 the new base model of Corolla sits at $18,600. That is an increase of 29.12% an average rise in car prices of about 2.91%. If you look at commodity prices Aluminum was in 2007/2008 about 3271.25 a tonne today it sits at 2,288 a tonne.

!

!

Iron Ore increased from about $60 a tonne in 2008 to $69 a Tonne in 2018.

Rubber prices went from about 526.40 JPY to today lying around 177 JPY per kilo.

As you can see the commodity prices of the most significant components of a car is for the most less now so why is car prices up? Is it because of inflation? Taxation? Let's dig a little deeper before we go into the current auto debt crisis to give you an understanding of where we came from to where we are today.

The average tax rate on cars in the US is for state and local taxes around 5-7% it varies in some states they have as low as 0%. Approximately there is 25% of the car is the cost to manufacture and another 25% is the taxes and fees from the government. The last 50% goes towards marketing and developing newer models.

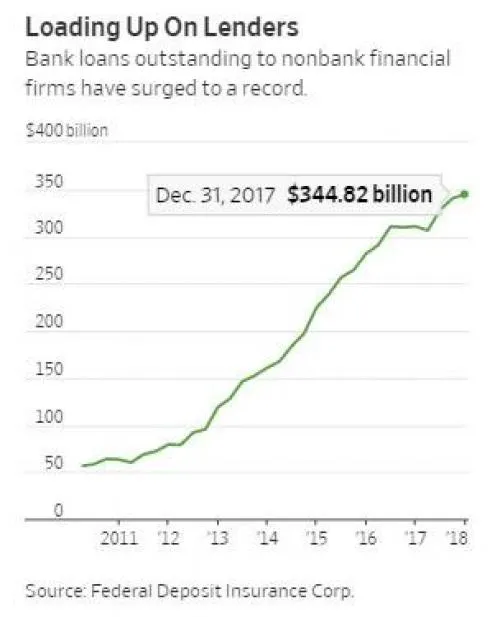

Let's get back to the carpocalypse. The current amount of debt held by non-bank financial institutions is $344.82 as of December 31st, 2017.

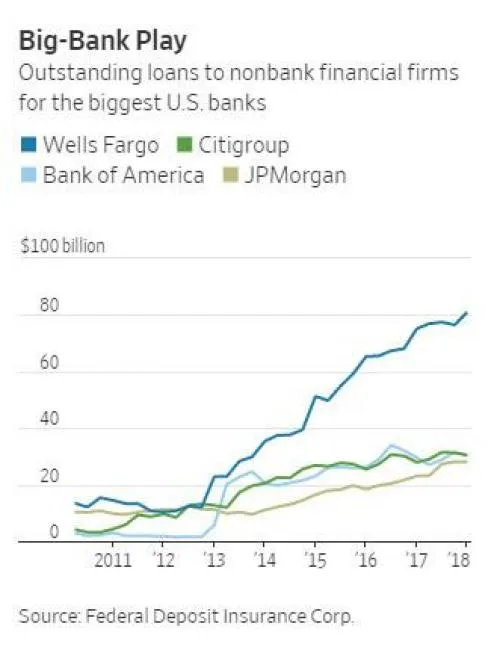

The biggest banks in auto lending are of course the corrupt Wells Fargo that issued insurance without asking customers and then REPOing the car as they didn't pay it.

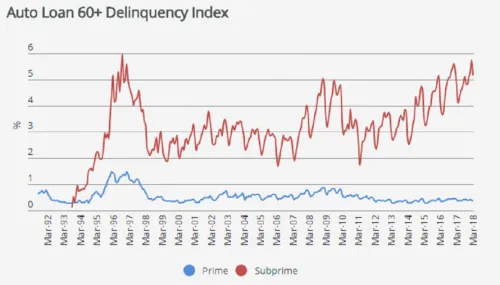

As auto loan delinquencies are almost at record highs no one is paying attention as we have passed the levels of 2008.

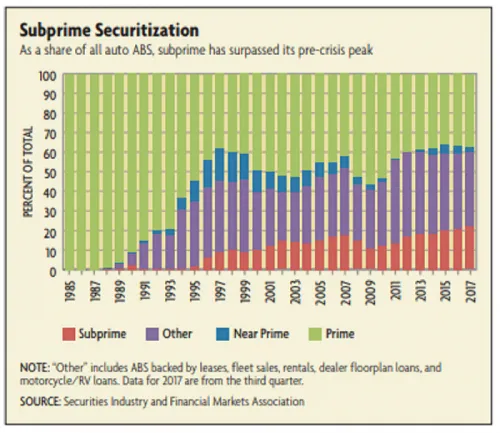

The banks have been looking for other derivative vehicles and found a perfect fit with ABS or Auto Backed Securities. Since people and investors find CDO a criminal enterprise by banksters, they have been looking for other products to invest in, and the bank derivative machine is on it again. It is great for the bank as they move their exposure to bad debt off the books and lets them still make money on it selling it to stupid and institutional investors as a significant investment!

As you can see the amount of ABS issued, being Subprime has skyrocketed. It is starting to smell like 2008, but there are more than just Auto loans that are the issue. We have mass amounts of corporate and private debts. Meanwhile, the banks are repeating the same Ponzi they did before luring willing idiots in yet again as they most likely will bet against these investments. It is like clockwork for the bankster combine. Rip off as many human beings as humanly possible and scalp everyone else for as much money they can and indebt you, so you become the slave to the banksters!

Subprime-auto asset-backed security sales are on pace with last year at about $9.5 billion compared to $9.6 billion a year ago, according to data compiled by Bloomberg. With new transactions from Santander, GM Financial, Flagship, and Credit Acceptance expected to hit the market this week, the volume may exceed 2017’s total of about $25 billion.

With constant low-interest rates and low gas prices, the auto industry is not willing to tap out yet. Much like the housing industry in the US in 2008. One thing that is developing is that car manufacturers like Ford will now be focusing more on the big gas guzzlers as gas is relatively cheap.

Auto debt and debt, in general, has become so bad that you can get a car title loan. https://www.cartitleloanscanada.ca/ A line of credit on your depreciating asset. The scams don't stop there. People are being sold cars that they will most likely lose money on and as cars are getting older the people who bought them cannot afford to fix them.

Peace, Love and Voluntaryism,

John