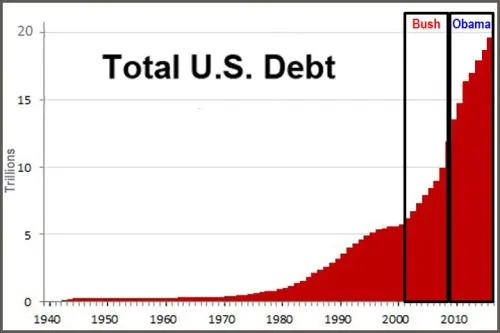

Back before I wrote regularly about cryptocurrency, I wrote regularly about government debt.

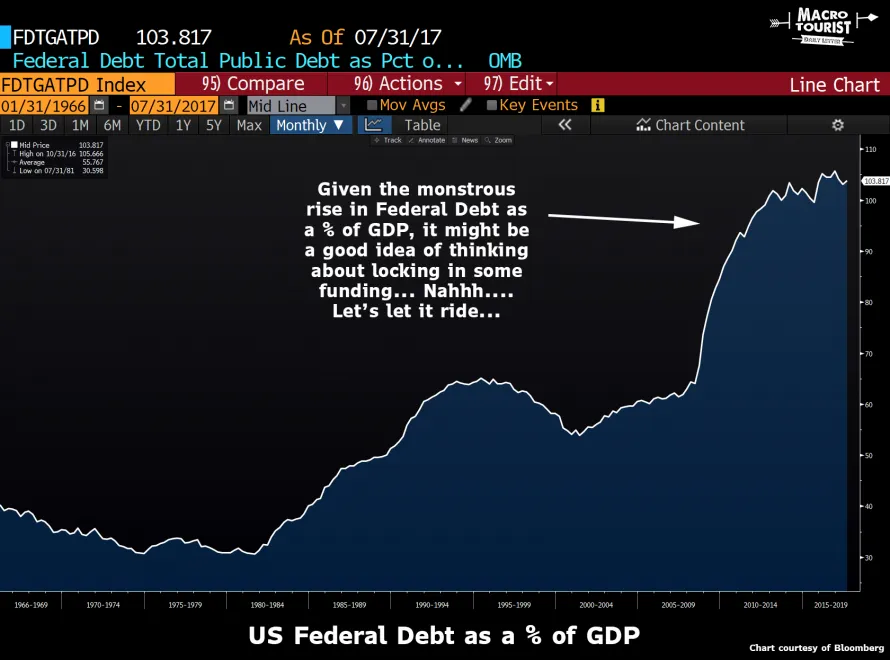

In between posting images like the one above, I'd post all sorts of scary charts with rather obvious, inevitable outcomes such as the following:

I've had to simply bide my time and wait, knowing that my calls for financial prudence and an end to money printing would fall almost entirely on deaf ears, but wanting to have my "I-told-you-sos" well established such that I can taunt everyone once the blood is running in the proverbial market streets.

Given Jamie Dimon just released another annual shareholder's letter chalk full of lies for his clients, directing them as usual to become bag-holders for his bank's future bad trades, I figured it was a good time to remind ourselves why he's openly lying to you when he says "“the Federal Reserve and other central banks may have to take more drastic action than they currently anticipate … reacting to markets, not guiding the markets,”"

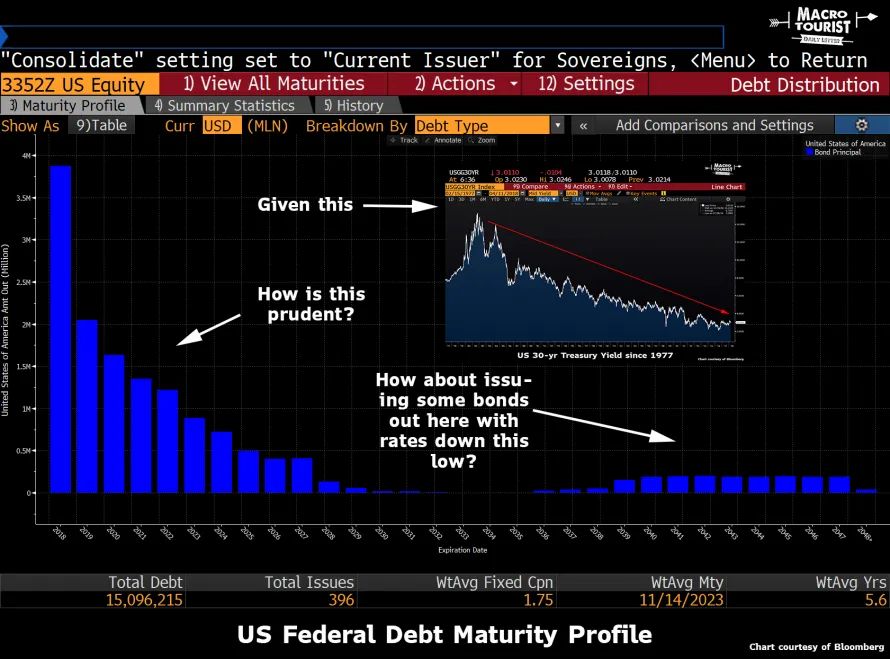

There's a clear reason why they are not selling more long dated treasuries (as you can see in the next chart below) - nobody is interested in buying the long-duration,sub-inflation-rate debt coupons of an openly bankrupt nation that has recently passed the Rubicon of 100% Debt-To-GDP and therefore has no mathematical chance of fiscal recovery without total currency collapse.

In fact, according to SGH Macro Advisors, this is already happening: "From what we understand, the Chinese government has halted its purchases of US Treasuries. Despite the direct encouragement, according to Chinese sources, by US Treasury Secretary Steve Mnuchin for China to "stay put,” Beijing has apparently discontinued purchases of US Treasuries “for the past few weeks.”"

Perhaps more interesting than why the CEO of an abusive multi-national bank would be lying, is why public officials are actively making the impending fiscal crisis worse by refusing to finance at longer durations while rates are obviously suppressed below the real market clearing rate.

More than half of the US debt is going to have to be rolled over within 6 years and refinanced, in what can mathematically only be a far more hostile future credit market with a far less solvent borrower (the US, 6 years from now.)

Heads should literally be rolling...from the guillotine...where they used to be attached to the heads of corrupt US politicians.

Instead, they try to distract you by launching more illegal wars in the Middle East.

Let's get on that, shall we?

PS - This is why we need immutable block-chain currencies with a ledger that can't be edited, in case you were wondering.

Sources: Google, Macro Tourist, Bloomberg, SGH Macro Advisers, Zero Hedge

Copyright: SmartSteem, PALNet, SPL, Macro Tourist, Bloomberg, LaDepeche.fr, Polination