I am blessed with the natural demeanor of the HODLer. You might not be so lucky.

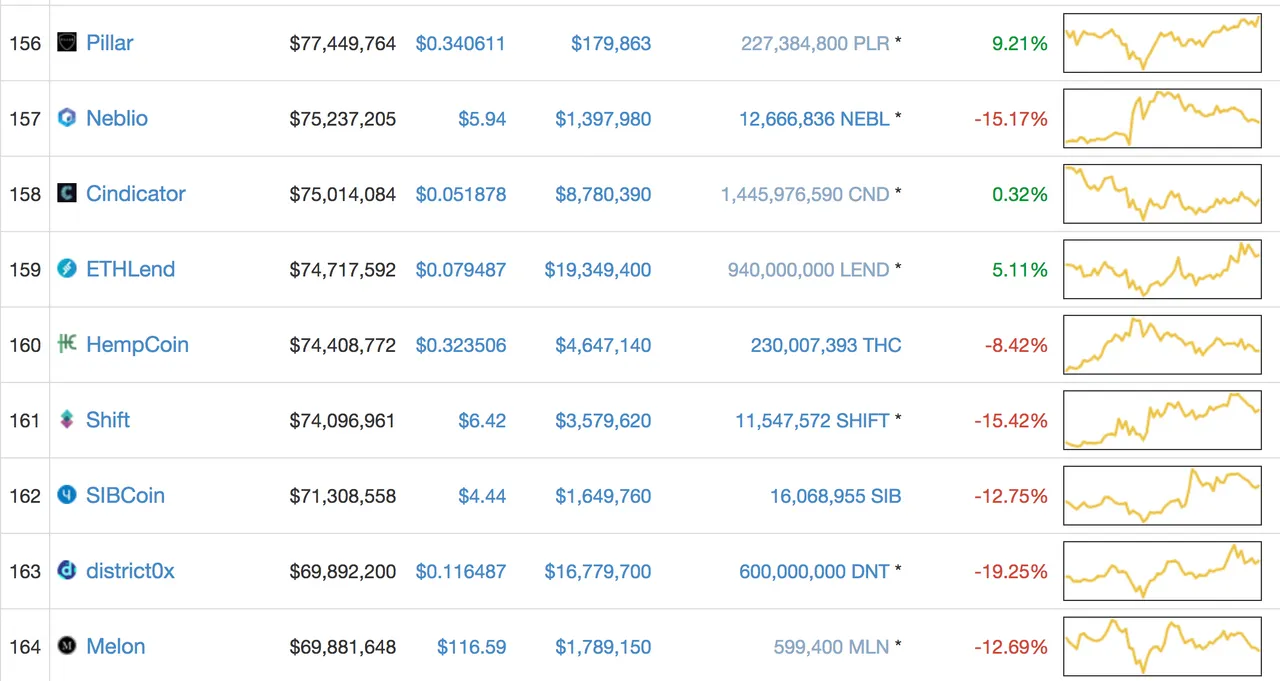

Do you spend your days starting at the CoinMarketCap charts, trying to spot the trends? You might know all the different names for different price trends/patterns and constantly question your previous trades.

One of these tokens is going to moon… maybe?!

Did you maintain that short position too long? Did you grab the wrong bag of altcoins? Is the crypto train leaving the station without you, heading straight to the moon?

A Harsh Truth: You Aren’t Earning More Money by Trading

There is a lot of literature about financial trading in the stock and bond markets from the last century. My favorite take on it comes from William J. Bernstein’s The Four Pillars of Investing.

William explains it in no uncertain terms: “Odds are good that the person on the other side has an I.Q. of 160 and has better access to information and systems than you do. It’s like playing tennis with someone you can’t see, and that person is Venus Williams.” (source)

A good question to ask is this: “What value am I adding to the system?”

If you succeed at day trading, do you add value to others? Let’s say that you put $1,000 into Steem at a price of $0.80, on a lark. Your friend said it was a good idea, so you just do it. Two weeks later, you sell it all for $3.20 and make a few thousand bucks.

That’s awesome. What comes next though?

?????? source: pixabay

Do you spend a year studying financial charts to learn how to buy lower and sell higher? If so, what is the point? Are you trying to add value to others through these studies? No - clearly not, your only goal is to learn to trade better than others and win for yourself.

If your only goal is to trade better than others, you are playing poker. There’s nothing wrong with poker - but you wouldn’t try to become a full time poker player off of a thousand dollars and a few months of practice, even if you had one really lucky week at the casino.

Asking: “What value am I adding to the system?” can change everything.

The same person in this story, after earning her first few thousand dollars, could decide that she wants to learn a lot more about “steem.” She starts reading - the bitcoin white paper, some Nick Szabo essays, a few Matt Sokol Token Investigations, the Dan Larimer essays…

For example - this essay was a game changer for me in 2017.

Now, this person may not do a single trade. They might not even hold any cryptocurrency. But after a few months of learning, they’ll be valuable. They have some domain knowledge now and can participate on Steem in a valuable way thanks to that education.

Perhaps they go on to work with a community group here - MSP, Curie, Open Mic, being a Witness, growing the Poker League, sponsoring the Sandwich Competition, helping facilitate more cool shit at Steemfest…

It doesn’t matter what they do. It only matters that they want to create real value for others and are working with that goal in mind.

Seeking short term value - i.e. trying to become a master at trading tokens back and forth - is mostly about enriching yourself. Look, if you are truly talented there, I don’t fault you for doing it. It is strictly rational to earn a shitload of money trading if you really can.

But you probably aren’t the Tiger Woods of trading - you’re probably just a shmuck holding a golf club the wrong way. I know I am.

In conclusion,

What You Think You Look Like While Day Trading Dank Tokens

vs.

What You Actually Look Like While Day Trading Shitcoins

The HODL and Learn Strategy

You can always HODL. Put away that thousand bucks into a few tokens that you believe in.

Don’t touch it for a year. Let it do what it does. Educate yourself. Build long term value.

I suspect that this simple “HODL and Learn” strategy will earn you more than you will earn from trading.

You may be happier working towards tangible goals focused on people and knowledge, rather than trying to obsess over the daily price fluctuations of the cryptocurrency market.

Furthermore, - and perhaps most importantly - you will get good at resisting bullshit and hype. One day, a lot of shitcoins will bite the dust. The traders will be the first to fall.

You dig?

All opinions in this article are offered as guidance only. I am a 26 year old musician & self-educated cryptocurrency person… Bitcoin class of 2016. So take my opinion with a grain of salt. Do your own research and consult a professional before making any decisions that could impact your financial well-being.