What is money? What is it to you?

Many of us go through phases in our understanding of money. Some of us grow up in churches and schools where money is demonized. Others grow up in shops and entrepreneurial families, where money skills are taught and become second nature.

Money is like water in a fertile field. Too much and everything drowns, too little and nothing grows, just enough and you get the optimum growth.

The topic of money is fascinating and it is very challenging writing just a short article about it. I would encourage you to read as much as you can - without getting discouraged! There are more technical terms about money, that most people would care to understand, and I think it's very important that we explain it simply.

Enough with the abstract concepts!

"Supply and demand?" You won't believe how abstract even this is to most people. These words can not make you understand, unless you understood it first. (Isn't that a catch-22. Isn't it a small miracle, if you think about it, that we can learn anything!? But fear not... with some parables, your brain will figure it out on its own. Read something again in a week, or in a month, and you might be surprised by much your understanding of it had changed - how many connections your brain grew, all on its own. Your mind is a pattern seeker. Give it something it doesn't understand, and you will almost certainly figure it out - many times over, in surprising ways that you wouldn't have believed when you started.)

There is a money revolution underway in our world, today.

It is all underpinned by the fact that the internet has allowed us to introduce "toy money" into circulation, and a whole generation of even younger scientists and technicians can now, for the first time, play with this "toy money" to see how it works and come to understand how money became what it is today.

Websites like Coinmarketcap and Coingecko help blur the lines between "toy money" and "real money".

We can access "virtual stock exchanges", and now "real" ones like Poloniex and BTC-e and literally hundreds more, things that previously were only available to the rich and we can trade and invest in virtual assets with almost no barrier to entry other than that of being literate and having a smart phone or computer.

It's more than just knowledge, it's that the ability to gain experience at "playing with" something that was solely the domain of a few million people, that is now within the reach of billions of people through fantasy sports, computer games and virtual currencies. That is exciting.

The older generations: scarcity

Most of us learn about money from our parents and grandparents - most of whom grew up in times of poverty and scarcity. To most of them, and even today, to most of the world, money is a very scarce resource - something you preserve and don't spend or use unless absolutely necessary.

It is easy to see profit seeking, interest or rent as being downright wrong if you look at money coming from teachings of compassion and generosity. If you have a scarce resource that can help someone, isn't it bad to try to get more of it, and to withhold it if someone is in dire need?

The origins of- and shift in how religions have viewed money is enough for several fascinating articles on its own.

You only have to walk into a supermarket to realize that we now live in an age of abundance.

What really got me: Property ownership

Coming from the above upbringing, I almost had a heart attack when I learned how much money an estate agent can make just on commissions on selling a house! How is it fair that I have to work for years to make as much money as an estate agent can make in one single transaction?!

Clearly something was wrong. Either I didn't understand money at all, or estate agents were evil! Right? I did not know much about buying, selling and the expenses of running a legitimate business back then; but I think it's fair to say that you can "make more money" out of someone who doesn't understand money, than from someone who does.

(I do think it's fair to say that people who know less than others get taken advantage of every day - and this is not limited to property transactions - it doesn't benefit anyone in the long term, however - neither a poor education, or ripping someone off. If you deprive someone of the means they need to make a decent living, that person could become a burden on society and you will ultimately pay more tax, or lose a lot in a revolt.)

Why is free parking so rare and what can that teach us about money?

I really only started understanding economics when I got frustrated paying for unaffordable parking.. and had to justify to myself to obey the law.

Imagine a popular mall - but one that has limited parking. If the parking was free, wouldn't the staff and the first few shoppers perhaps just occupy all the parking spaces, and nobody else would be able to visit the shops?

Now, what if the parking cost too much? Only a handful of rich people would be able to visit the mall and the shops wouldn't make a lot of sales - or everyone would just disobey the rules and park there anyway.

Now, what if the parking price was just right, so that the average person could afford to park there for just enough time to do enough shopping. Would that not result in a constant flow of cars into- and out of the parking lot, and customers into- and out of the shops, and result in the optimum number of sales at the shops in the malls?

There is a limited resource: Parking space. Money is used to regulate its use.

Tax and Value Added Tax (VAT)

Similarly, a tax on something can discourage people from doing it - and so too tax exemptions can encourage people to do things.

For example: It is easy to make money if you are a banker or a lawyer. But to discourage everyone from becoming bankers and lawyers, the government imposes a lot of taxes on them. To ensure that there will always be people who produce food, governments often make the growing and supply of basic foods tax exempt.

So too, is Value Added Tax a tax on "soft jobs" and middlemen - so as to encourage people to build companies and manufacture things. If you buy things for your company's use, you effectively get it at a discount. The fear is that, without these taxes and incentives, it would become too easy for everyone to do just the easy, profitable things, and nobody would do the really necessary things.

Things get really interesting if you go into the history of market economics and how the world has moved from protecting the production of goods to protecting consumer rights and the consumption side of things - the thinking is that this will allow the needs of people to drive what is produced, rather than what the producers think people need - and money can act like a kind of central nervous system feedback-loop to measure what works and what doesn't. (But it's not that straightforward!)

Goal-oriented Earning, Saving & Investing

While these are just small bits of the story, I think a a good understanding of money is very important for a healthy society. So many of us are constrained by money our entire lives that we develop a warped sense of what money is.

We develop a tunnel vision to just make more and more money, without knowing exactly what we would like to spend it on - or we develop fantasies about what we would spend it on - because we think that we'll never be able to save that much, or because we think that it will be a good place to be in life.

For some, only when those prospects become real, do they realize that their fantasies were a hell they wanted to avoid, instead. You only have to read a few sob stories about how lottery winners lost everything, and retired to poverty, much less happy, to realize this.

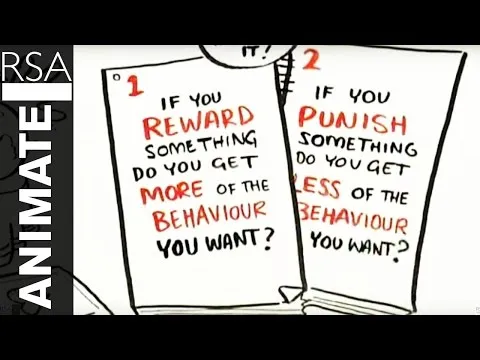

You might have seen this video:

The morale of the story is, that - most people only need enough money. Too little, and money becomes a problem; too much, and money becomes a problem.

History? Politics? Value?

You probably have heard about "the gold standard" or "the petro dollar"; the notion that something real and tangible with real value, has to underpin what the paper money represents. More about this in another article... just know that the understanding of money is core in political ideology and that wars are fought over this thing that people can't come to see eye to eye about.

Backed by something? Inflation?

If there are no checks and balances in place, nothing prevents all the countries and all the banks from just printing more and more money and in so doing devaluing the money that people keep under their beds. That means that your money will be worth more if you spend it on things.

Money doesn't disappear when you spend it, it goes to someone else who can do something else with it, and so on and so forth. It can be like oil in an engine that keeps the gears grinding together smoothly.

If a country prints a lot of new money, it devalues their money and makes that of neighboring countries more valuable. Governments do this so that people are incentivised to do things with their money, and it's called inflation. This means that it's cheaper for neighboring countries to buy things from your country, so it becomes more profitable for the companies in your country to export to those countries.

If there is deflation, ie. money is destroyed, then there is no incentive for people to spend money, because their money becomes worth more and more. If you keep all your money in a shoebox, under your bed, it will actually be worth more in a few months time, than it is today, if there is deflation. If everyone does this, economists fear, commerce will grind to a halt and companies will go bankrupt. People will go back to being super conservative with their money.

So how do countries keep each other in check, and make sure they don't just print more money than the others can find out about? They used a precious, limited resource to back it with: Gold. Plus constant audits.

Moreover, underpinning the value of currency with gold worked, because societies needed to reach a certain level of maturity in order to be able to mine gold - and if they could mine gold, it would mean that they could also build houses and make tools.

Similarly, oil is very important in our current economies - if we run out of oil, everything we know will grind to a halt within months if not weeks - and this has indeeed happened in a handful of countries just in this decade - you should read up about what happens when a country experiences long blackouts.

Cryptocurrencies, or virtual currency, or smart money gets very interesting. Most run on ledgers that require electricity, connectivity and computing power - curiously all things that serve a similar function that oil and roads does in the normal economy. These things are all necessary in- and can accelerate our modern economy greatly.

Money is just a means to an end. What is your end?

If you really start thinking about money and realize that it is always just a means to an end and that if you have a clear goal about the kind of life you want, and research and pretend to- or try to live that life for a short while - to see if it really is what you want, then you can either realize that it's not at all what you wanted - or you can find the means and reach for it and make it happen.

Not all of us want the worries of wondering if our company will be able to provide employment to hundreds of employees, or be in charge of a government that will be blamed if things don't go well for millions of citizens... and be able to care for them into old age. Not all of us want yachts and islands and the headaches of dealing with the staff we'll need to keep everything the way we want.

"Can't buy me love"

Not all of us are happy with our station in life.

I think if we understood money better, then we could be- and the first steps toward that is to start thinking, reading and talking about it more.

Also, to not feel bad, judgmental or envious when you read these little numbers at the bottom of each post and comment on this platform. Sounds easy right? Try it! No envy. No judgement.

Yes, it means that "this person got some toy money"; it also means that this person will be the one deciding how, what- and who to pay that toy money forward to, and what to grow with it - all money makes something grow - let it not be your ego, but rather the inclusivity of your community!