Today I’m going to teach you how to improve your credit score and remove those derogatory marks from your credit report.

In my last post, I mentioned I was an expert when it came to credit. Many people claim to know about credit and 90% of the time they're wrong.

Right out of high school, I was a bill collector. I collected on bad credit card debt, and I was good at it. I made a lot of money, but it came with a high soul tax.

I did this for 8 years and in that time I was sent to courses on credit and credit law. I even went out of state for a month long training. The sad part was that I wasn’t going to these classes to be taught how not to break the law, I was sent there to learn how to dance around the law. They taught me how to walk the gray line and say the things I wasn't allowed to say in a legal way.

2 months into my 8th year and on the month of one of my biggest commission checks, I quit. I called an old lady whose husband had died and argued with her, I cried afterward.

I was done.

After that, I got a job at a credit consolidation company. I learned even more there but I also learned it was a scam and they cared nothing for the people.

From there, I worked for a credit repair attorney. I was trying to pay back and help the people I once collected from. He was a good guy and fought for the people who were struggling and in hard times.

Now before this post gets away from me, we’re going to get down to business.

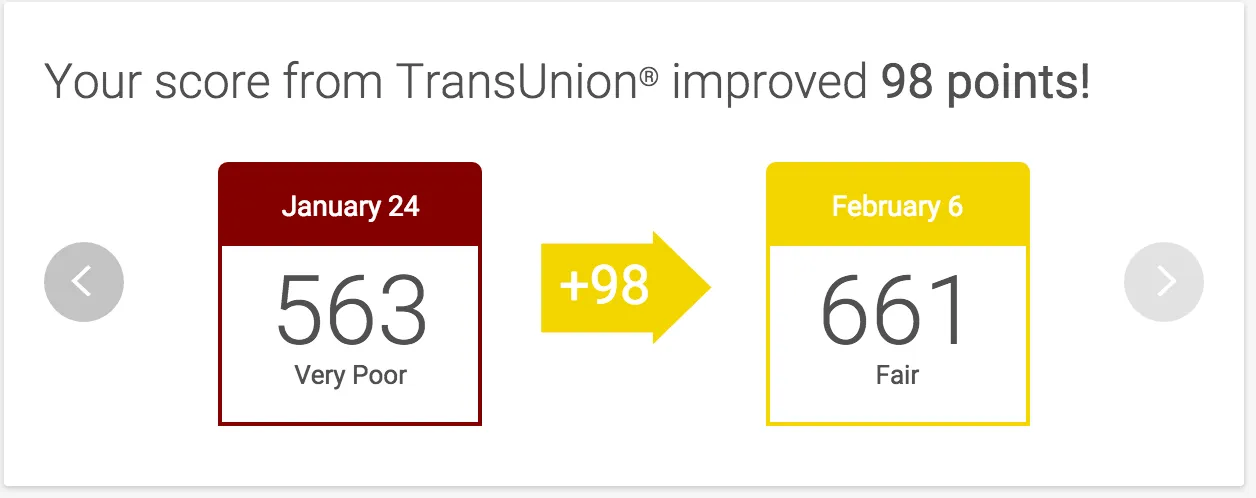

If you read my first post, I mentioned how I used this method to help a friend with their credit. This was his results after 33 days.

What we are going to do is dispute any bad debt with all three credit bureaus, but there is more to it than just that... I will get to in just a minute.

________________________________________________________________________

Now some people will tell you that you can’t dispute something you know is your debt, and that is true.

But how sure are you that any of those accounts are truly yours? I knew a friend that paid off a 3k debt thinking it was an account he opened 5 years ago only to find out it wasn’t really his account and someone committed fraud.

He later found out that the account he thought it was had already been closed and off his credit. How sure are you about your accounts?

It’s your right to ask for the validity of any negative mark.

________________________________________________________________________

We are going to write a simple letter asking that the credit bureaus to verify the negative marks on your credit.

Now, I want you to go over every derogatory mark on your report and make a note of it. Every late payment, bad debt, closed account or collection account, everything. List it all in the letter.

There are templates online (search "30-day dispute template" in Google) that you can use to plug your information in.

Here is where the loophole is, they have 30 days to prove the validity of any debt, and we are not going to make it easy for them.

We are going to send this letter certified mail return receipt to each of the three credit bureaus. In this letter, don’t put your email or phone number, just your address. Also, include a photocopy of your ID. You want them to have to mail the results back to you.

When they receive your letter, someone will sign for it, and you will get a receipt of when they got the letter.

From that day, they have 30 days to respond and usually they can’t get the information back to you within that time. And some creditors don't even want to go through the hassle and just fix your report.

After those 30 days have passed, you will mail another letter with a copy of you certified mail receipt that shows the day they got your original message. In this letter, you say they have failed to prove the validity of these derogatory marks, and you want them removed.

You can search for this template for this one also; look for “30 Day Dispute Period Has Passed” in Google.

Once they receive this letter, they will remove the derogatory marks, and your score will skyrocket. They can be fined up to 1k a day for continuing to report it on your credit.

The credit bureaus don't care about your credit, they want to make money off you and won't lose a night of sleep removing these from your report.

I have helped a ton of people using this method, and they have all had some increase in their score. I look forward to hearing your success stories and if you have any questions let me know.