I. What is Hard Protocol?

Hard Protocol is a decentralized and permissionless cross-chain money market build on KAVA, which will perform cross-chain asset lending and borrowing. Chainlink oracles are integrated in the chain and the Tendermint security consensus mechanism will design the platform as a foundation for DeFi applications and other services. Hard Protocol will allow over-collateralized borrowing and liquidity providers will be able to supply Bitcoin, Ripple (XRP), Binance Coin, Binance USD and USDX. The leading and borrowing of cross-chain assets will be powered by KAVA and HARD token will be issued as liquidity mining reward and for governance voting. All this looked so familiar and suddenly I remember writing a post abot Kava's Harvest - a Binance backed DeFi. This is the same project as Kava's Harvest but was re-branded as Hard Protocol. To be honest, there were millions of better names to chose from.

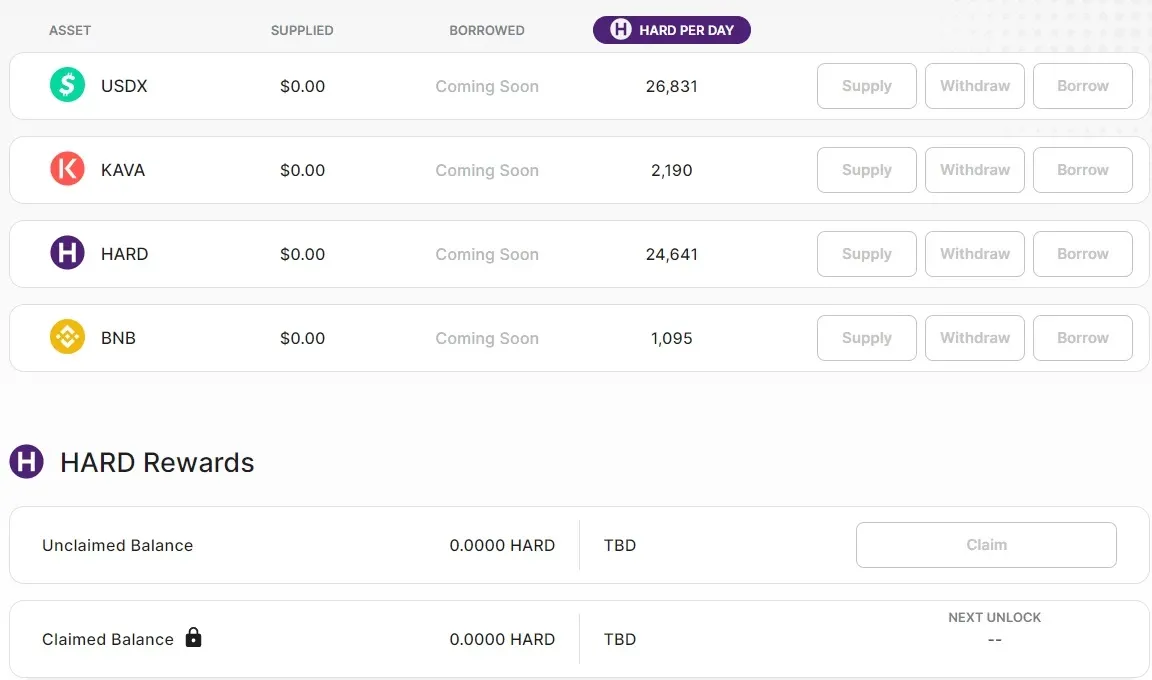

To access the HARD protocol pools, users must connect with an wallet (Metamask, etc) and at the moment USDX, KAVA, HARD and Binance Coin (BNB) can be supplied in the pools. The "HARD PER DAY" shows the total daily reward available for liquidity providers. The borrowing option is not available, but will probably follow soon. Unclaimed balance and claimed balance will be tracked in the HARD Rewards tab.

HARD Protocol will focus on building strong communities in Asia, North America, and Europe. New markets will the added as part of the growth strategy and new assets will be gradually added for lending and borrowing. Offering HARD tokens as KAVA staking rewards is the first step of a long term plan which aims to attract liquidity providers. This will be followed by partnerships with other block-chain communities. The project is backed by Binance, BitMax and OKEx. If Binance and BitMax are creating confidence, not the same can be said about OKEx, which still has all withdrawal suspended after a big fraud scandal involving one of the company top dogs.

II. HARD token ($HARD)

HARD token is the governance token of Hard Protocol, and will be used as reward for providing liquidity and borrowing cross-chain assets. It has a total token supply of 80,000,000 and the maximum token supply could reach 200,000,000 from farming, staking and rewards for Liquidity Providers.

The majority of HARD token will be allocated as rewards, 20% of the total supply for KAVA staking and 40% of the total supply for Liquidity Mining. The Treasury will hold 25.4% of the supply and the team kept 10%. The remaining supply will be shared in the ecosystem (1.6%) and through Binance Launchpool (3%).

III. Binance Launchpool

HARD was the 3rd project added on Binance Launchpool, and tokens were shared as it follows: Binance Coin holders - 60% (3,600,000 HARD). The remaining bounty was shared 30% (1,800,000 HARD) for KAVA holders and 10% (600,000 HARD) for Binance USD holders. The HARD joke was one of the trending ones in November!

Links and resources:

The fountains: PipeFlare ZCash, GlobalHive ZCash & Get.ZEN

Publishing bundle: Publish0x, ReadCash, LBRY & Presearch

- This article may have been published on ReadCash or Publish0X