As a consumer living in a society where anything you want can be bought, spending your money is a normal natural thing. I have wondered for a long time why we don't understand money even though we use it every day. Why do some people fail to get rich over and over again, no matter how much they make? They refuse to cut back on the expenses they have, and certainly this past year we have had to one way or the other. I was watching a video today and he made a really important point.

Just spend less. Watch this now or after, its up to you.

That is the thing. How can I spend less? I need to make more! Yes but if you cannot curb your spending habit when you have a little, those habits will ruin you when you have a lot. For this example we will say that most people generally need to earn at least $2000 a month to survive.

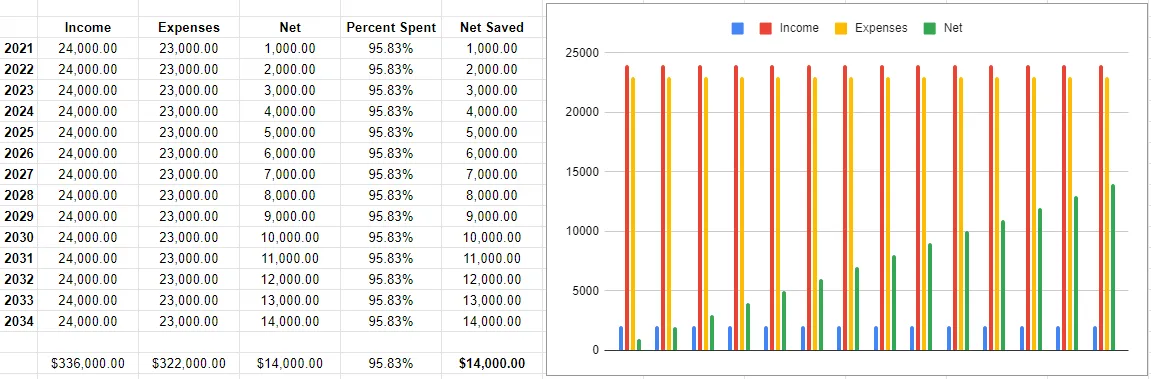

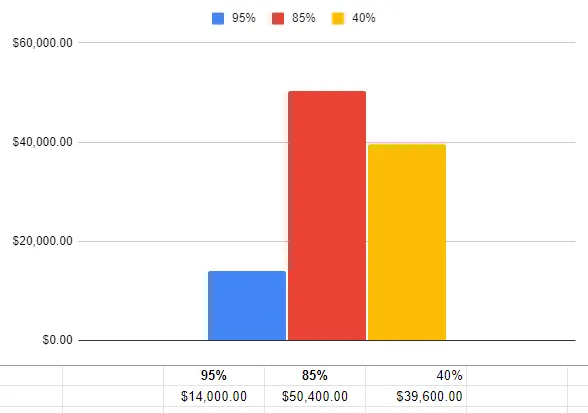

It is hard to make money but easy to spend, especially on the comforts of modern living. At the end of the month most people don't have any money left, so they go back to work chasing that next paycheck. Here in this example over the next 10 years this person saves $1000 a year out of their total income. That means they are spending 95.83% of the money they earn. At the end of a decade, 13 years here actually, instead of having $300,000 saved, they have less than $15,000 which is not even enough to pay for a year of rent. There must be a better way, how do some win and others lose?

"10% of all I earn is mine to keep"

This is the first lesson from the book The Richest Man In Babylon,

""This, my students, was the first cure I did discover for my lean purse: 'For

each ten coins I put in, to spend but nine.' Debate this amongst yourselves. If

any man proves it untrue, tell me upon the morrow when we shall meet again.""

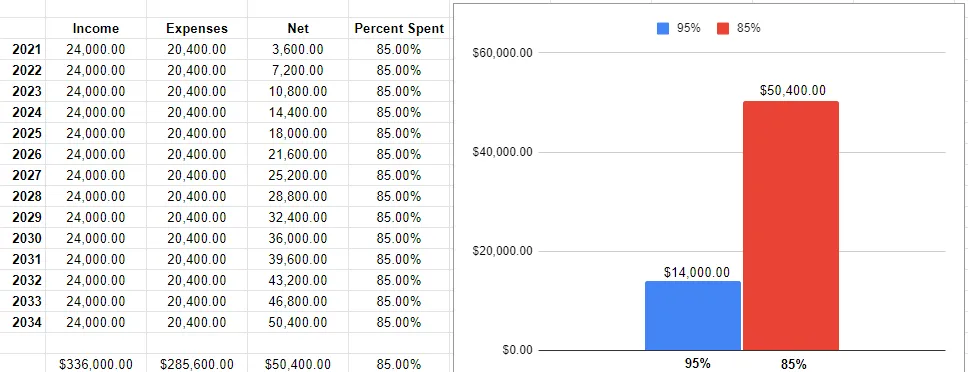

This is a staggering difference, by reducing your expenses just 10% and making due with what is left over, this example shows that by spending only 85% of your income vs 95% of your income, you can save 360% more over 13 years. Life will always throw you curveballs, so there are infinite reasons to have some money set aside even if you think you'll be able to earn more next year.

Without increasing your income, you can still save by spending less of the money you earn.

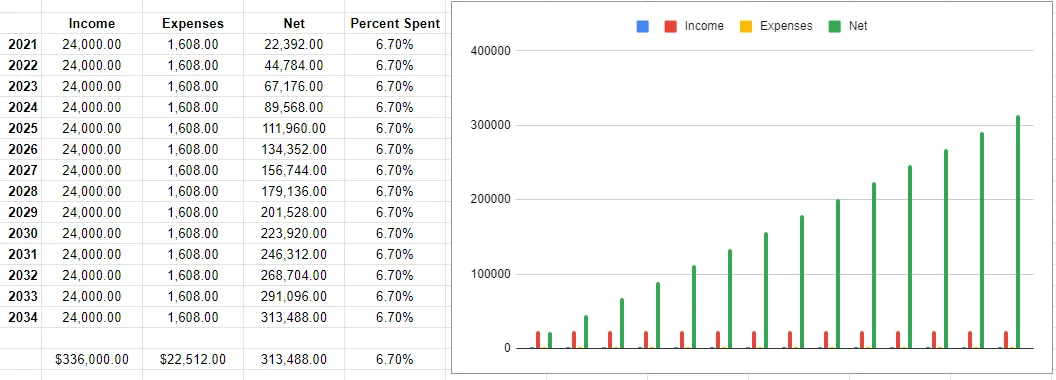

In this example, as the video recommended, you live in 5% of your income. Here its actually 6.7% so a little more than 5% but if all you had to pay for was a Phone and you don't eat. Then you could save close to $313,488 over 13 years. This might be a little unreasonable, so the other course of action is to increase your income. Another great saying is "I am so happy and grateful now that money comes to me in increasing amounts from multiple sources on a continuous basis".

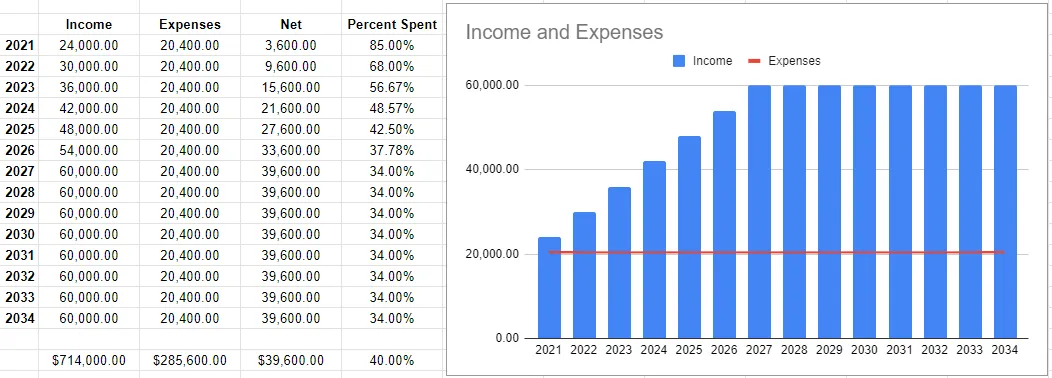

This could be wishful thinking, unless you like to acquire streams of income in the form of stocks that pay dividends, rental properties, oil wells, or small businesses that generate cash. Some people start home based businesses and others write books. Find another way to generate $500/month and you can add a new source of income. Add a new source of part time income every year for 6 years, then you are making $5000 a month and your expense are reduced to 34% of your income.

Notice even in this scenario building the extra income, you still end up with less spending 34% of $714k than saving 85% of $366k. How much do you want to work? Would you rather work or have money that works for you? What percentage of your total income you spend. Can you cut your expenses by 10%? Can you live off 5% of your income? Make a budget and see if you stick with it.

"It doesn't matter how much you make, only how much you keep."